The #1 Seamless and Secure Mobile Banking App Built

for Community Banks

Empower your customers with access to real time transaction data and secure account management at any time, from anywhere.

Our cloud-hosted solution puts compliance and dependability first, giving your customers and your financial institution peace of mind when banking online.

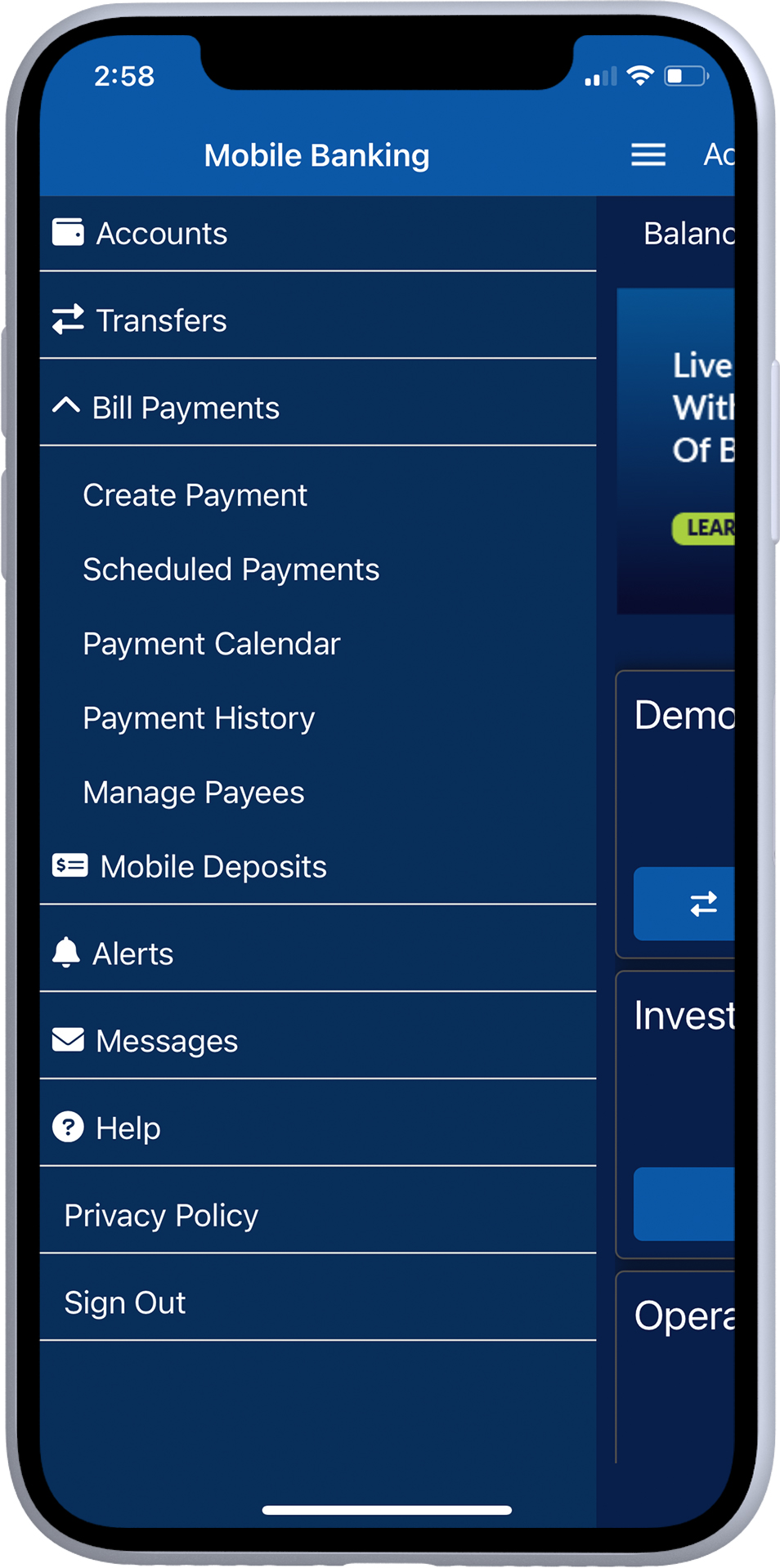

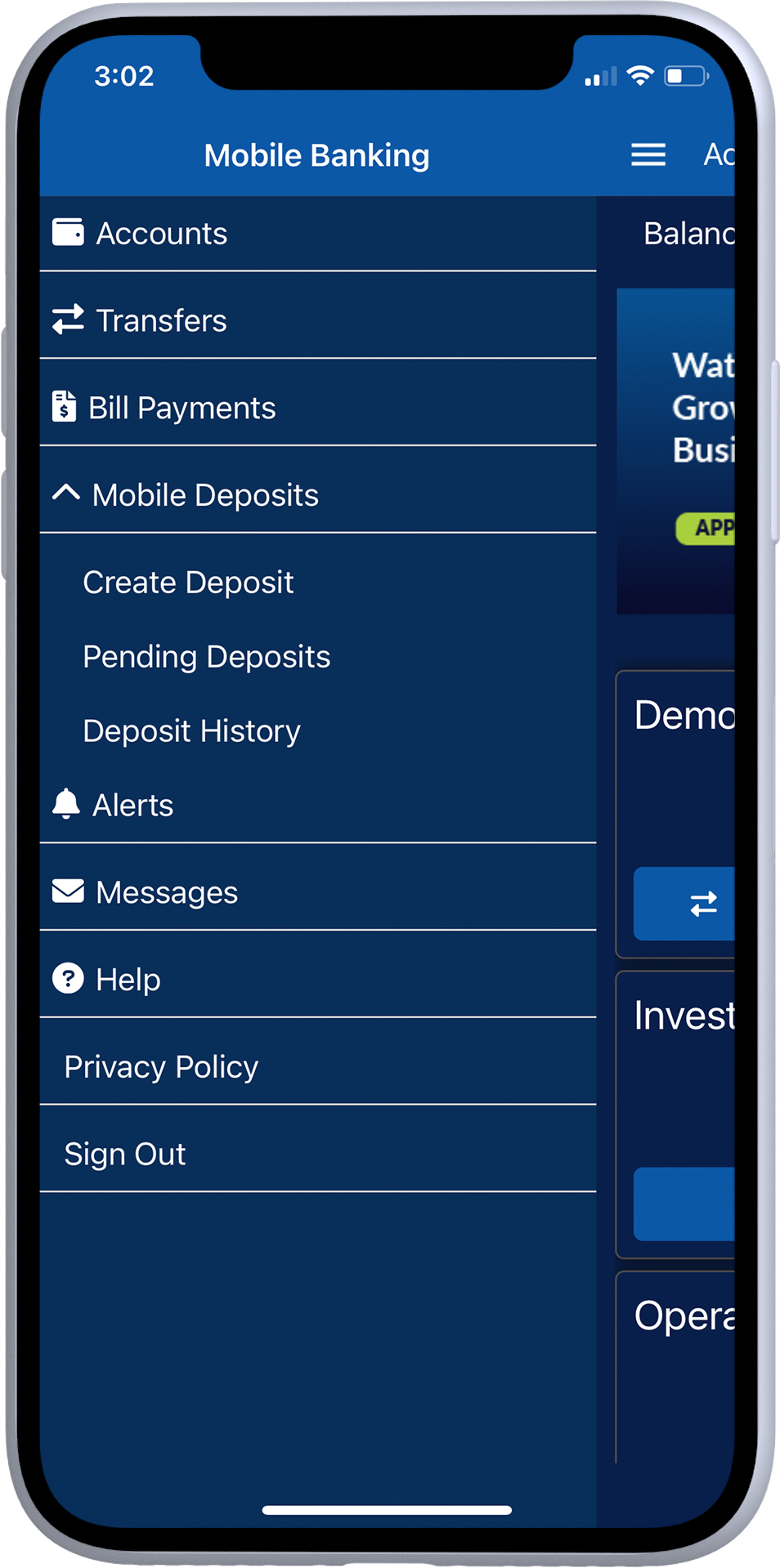

Take advantage of i2Mobile’s key features:

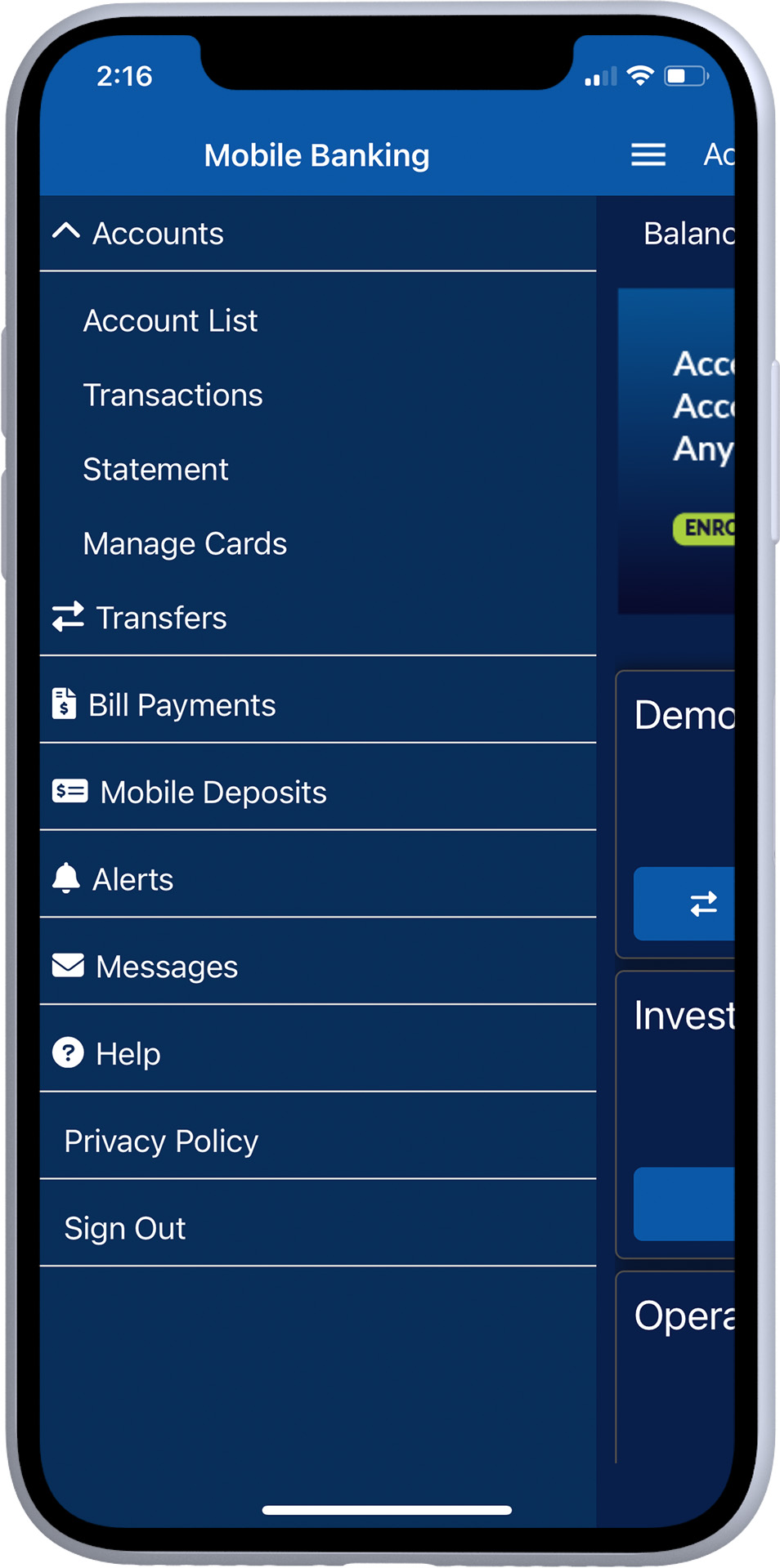

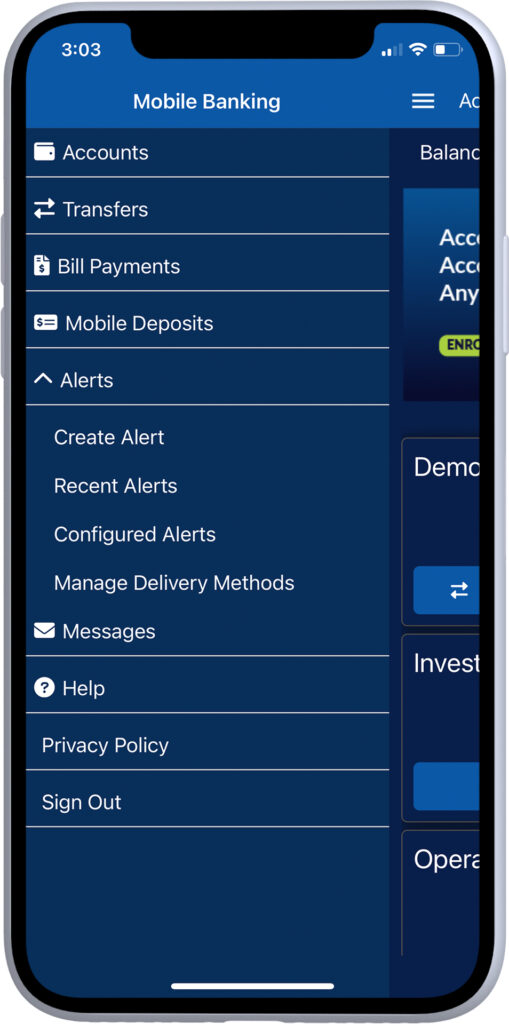

Enhanced User Experience

Providing a simplified, user-friendly experience, our app enables your customers to effortlessly navigate to their desired banking actions.

Tailored Ads for Key Offerings

In-app advertising allows you to engage with your customers and showcase tailored solutions based on their interests and needs.

Secure and Reliable Protection

Using the highest level of encryption, with two-factor and biometric authentication, i2Mobile provides a safe environment for all of your customers’ transactions.

A Seamless Banking Journey

Integrating i2Mobile with our i2OLB online banking platform ensures your customers’ banking information is current and accurate with real-time transaction updates.

Powered by forward-thinking technology, our mobile banking app offers a wide array of features that revolutionize the way your customers handle financial transactions.

See the possibilities of i2Mobile:

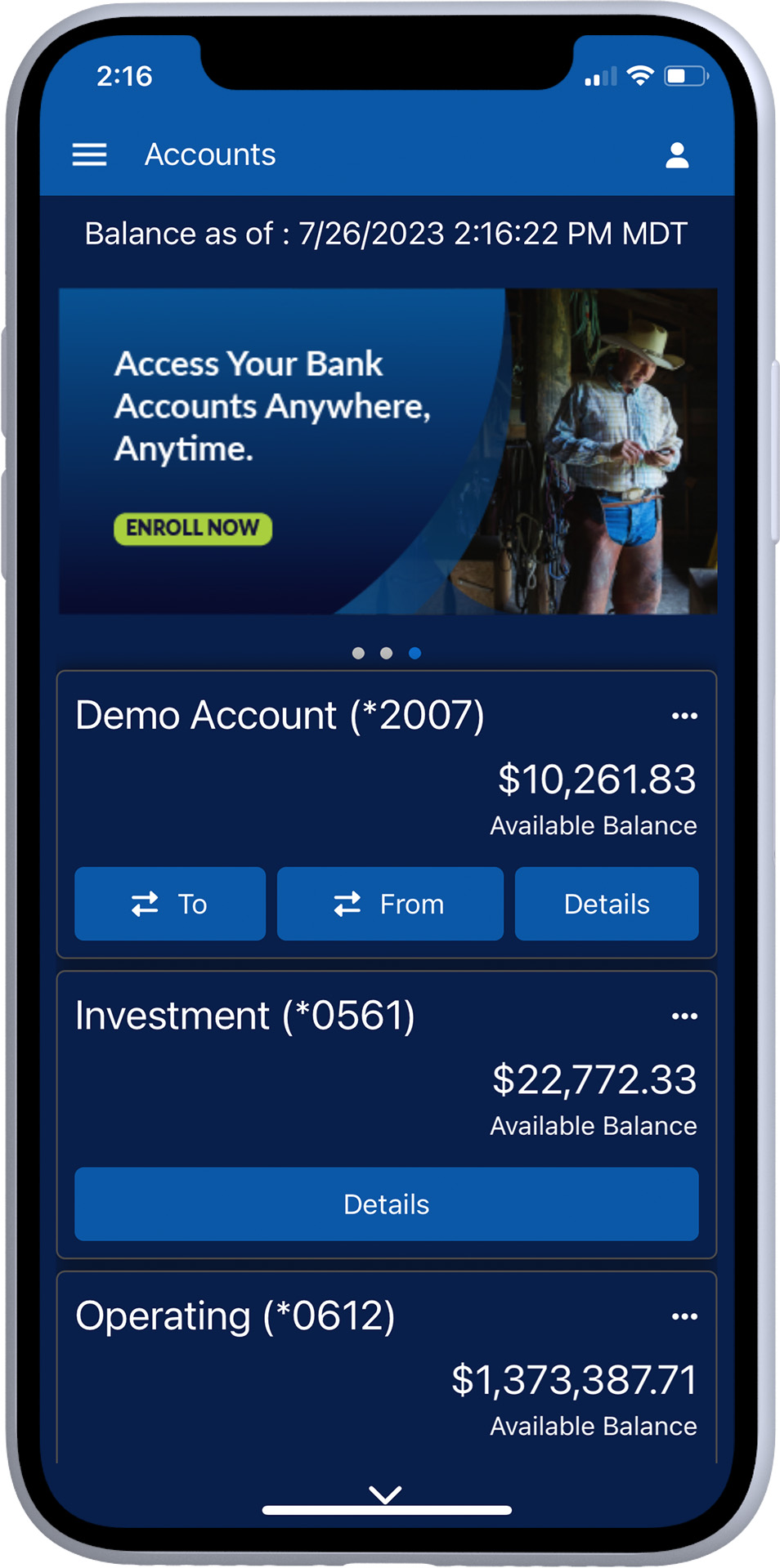

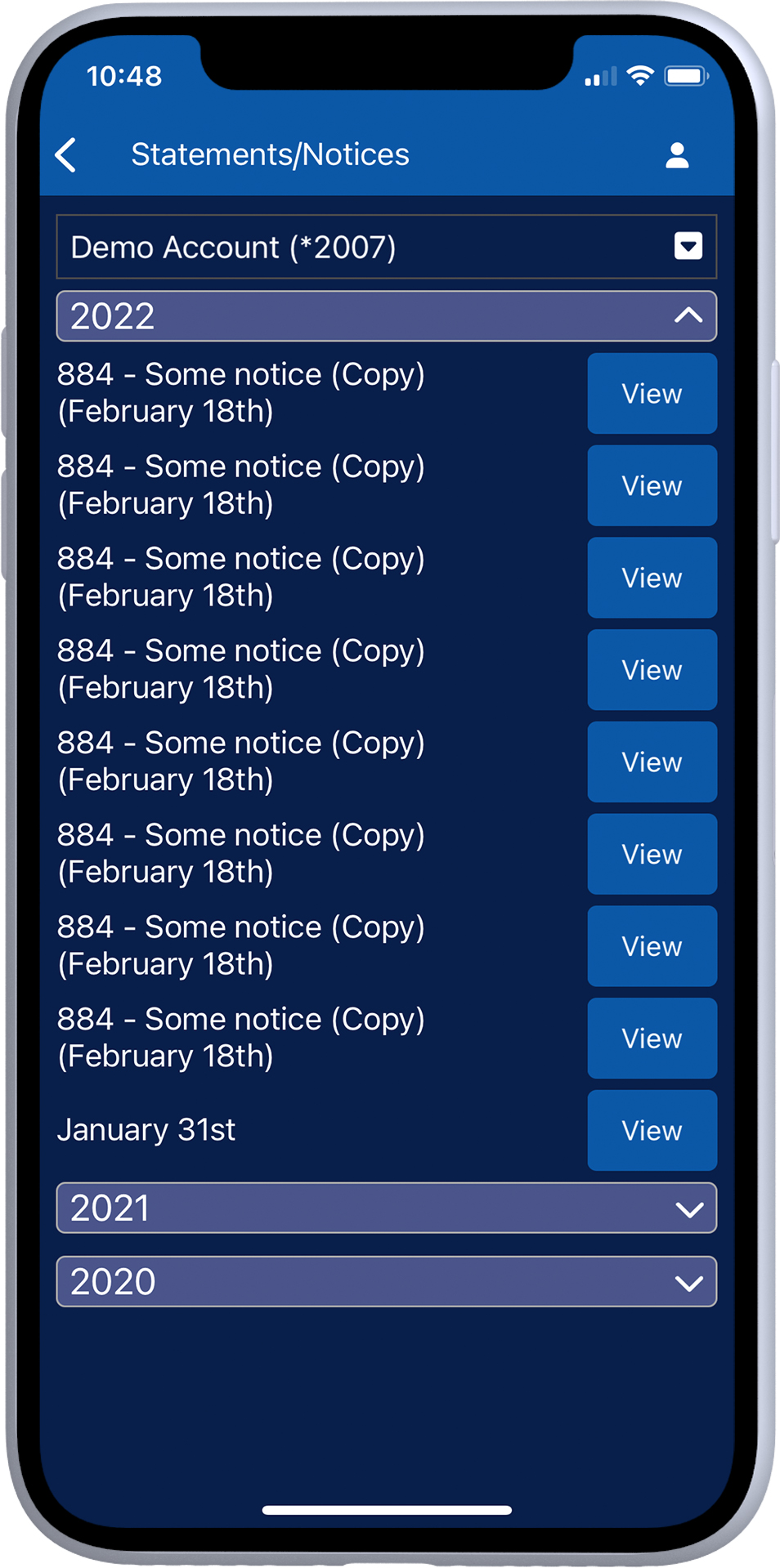

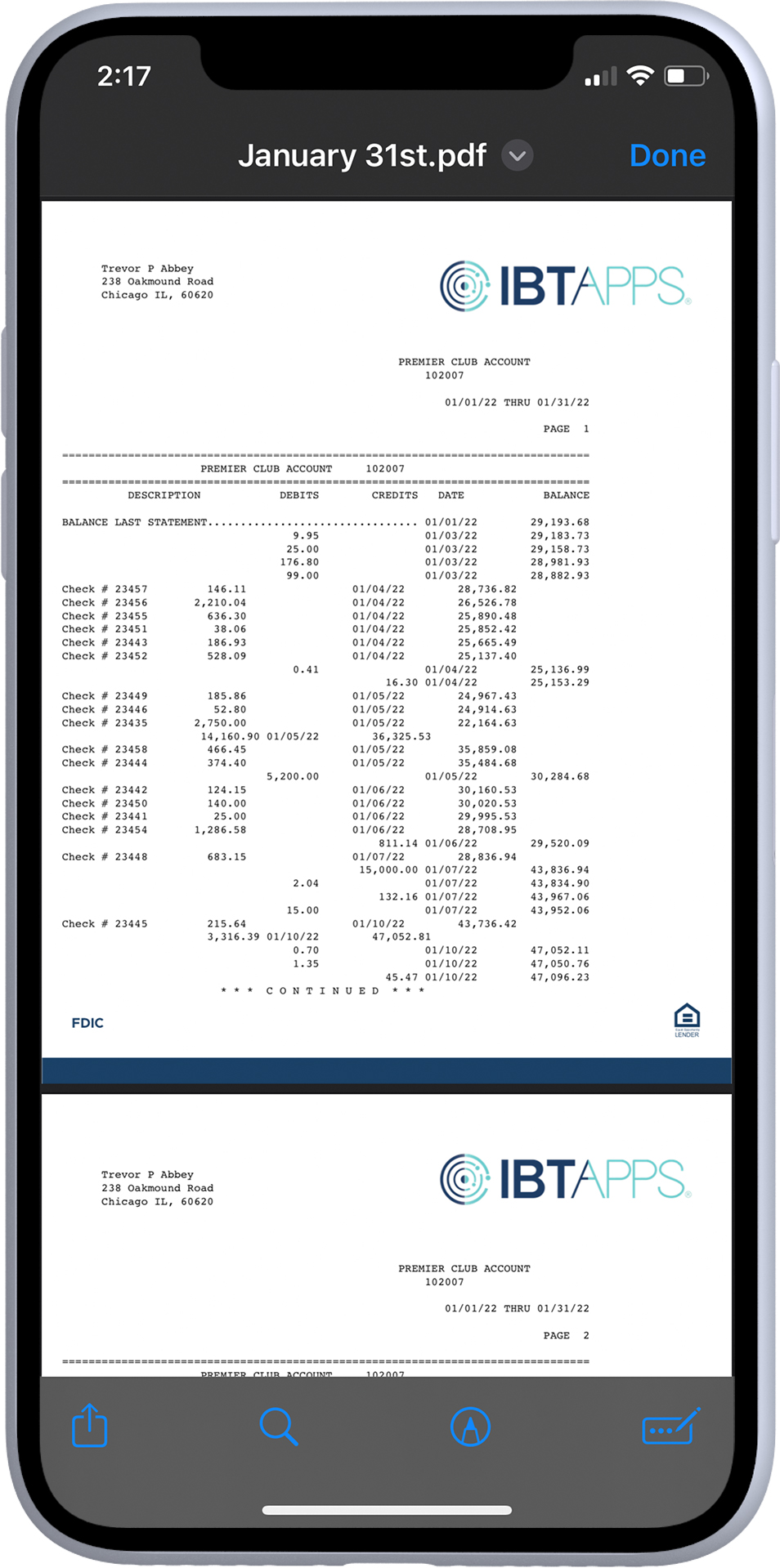

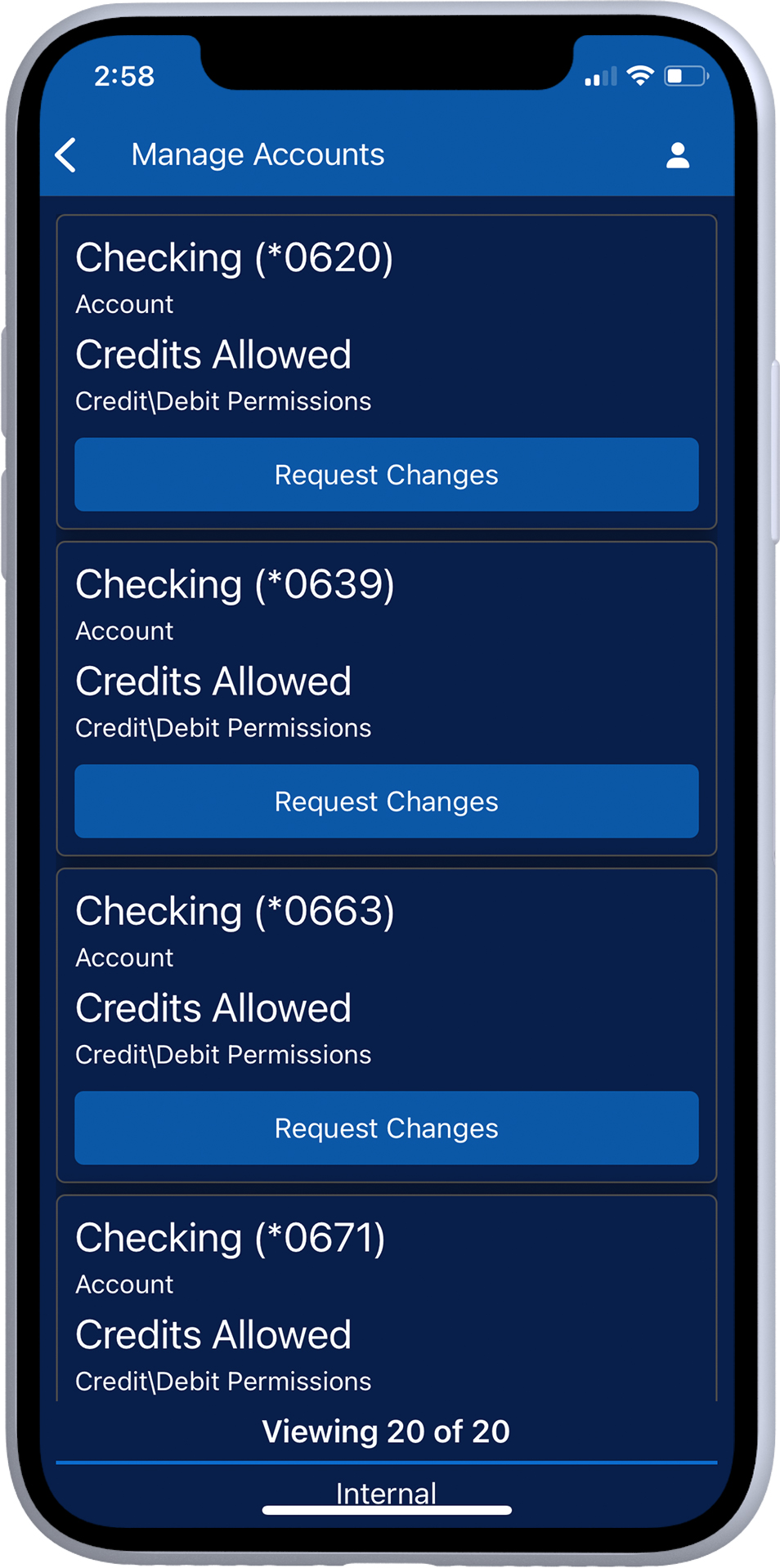

Accounts

With i2Mobile, you’re able to see all the activity in your account(s). From seeing all your transactions in real-time to viewing check images after making deposits, you’ll appreciate the timeliness and convenience of this banking app.

Features include:

- View all of your accounts and account details.

- View all transactions.

- See all check images.

- View, email, and print statements.

- Manage cards (dependent on card provider).

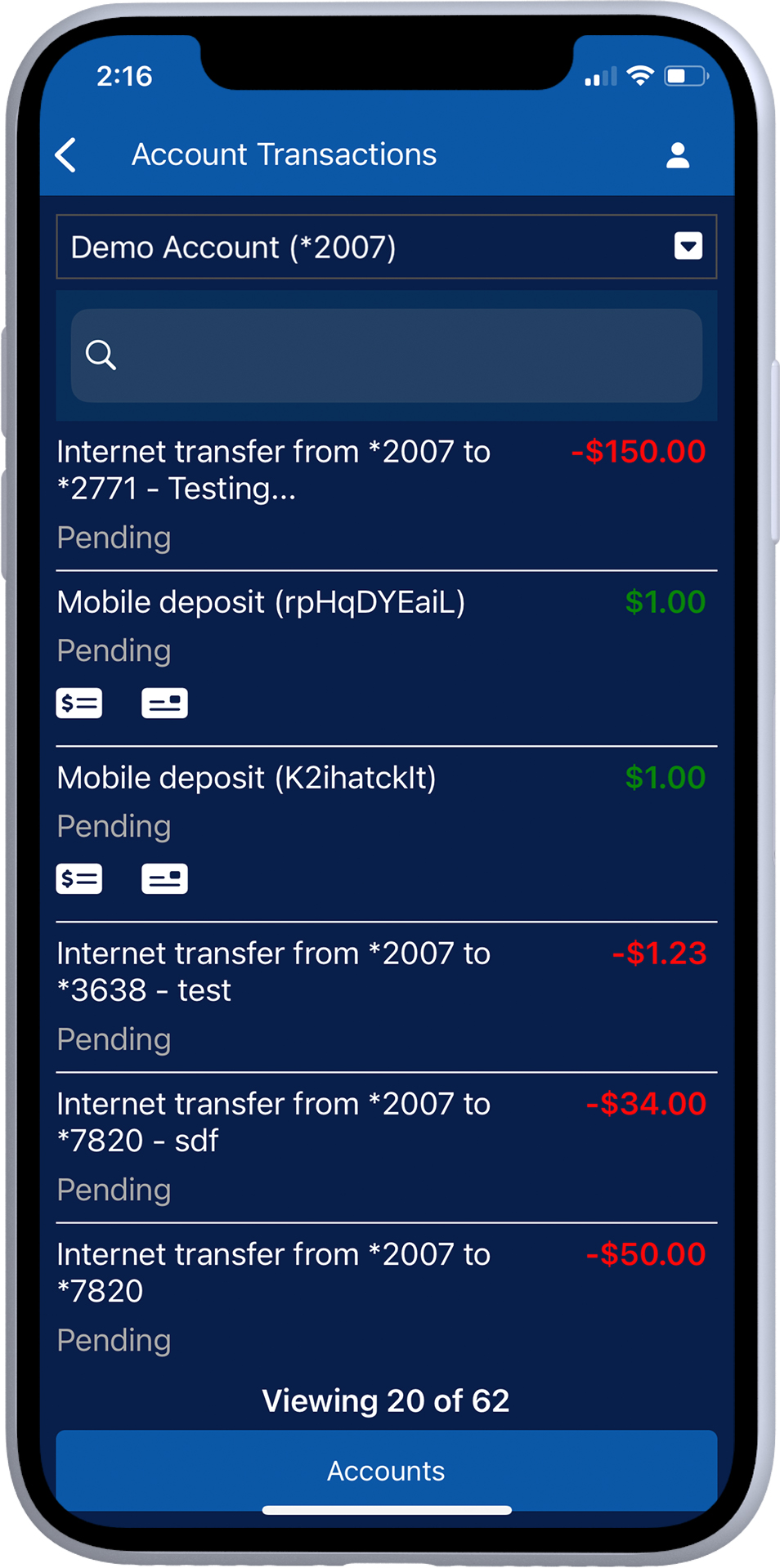

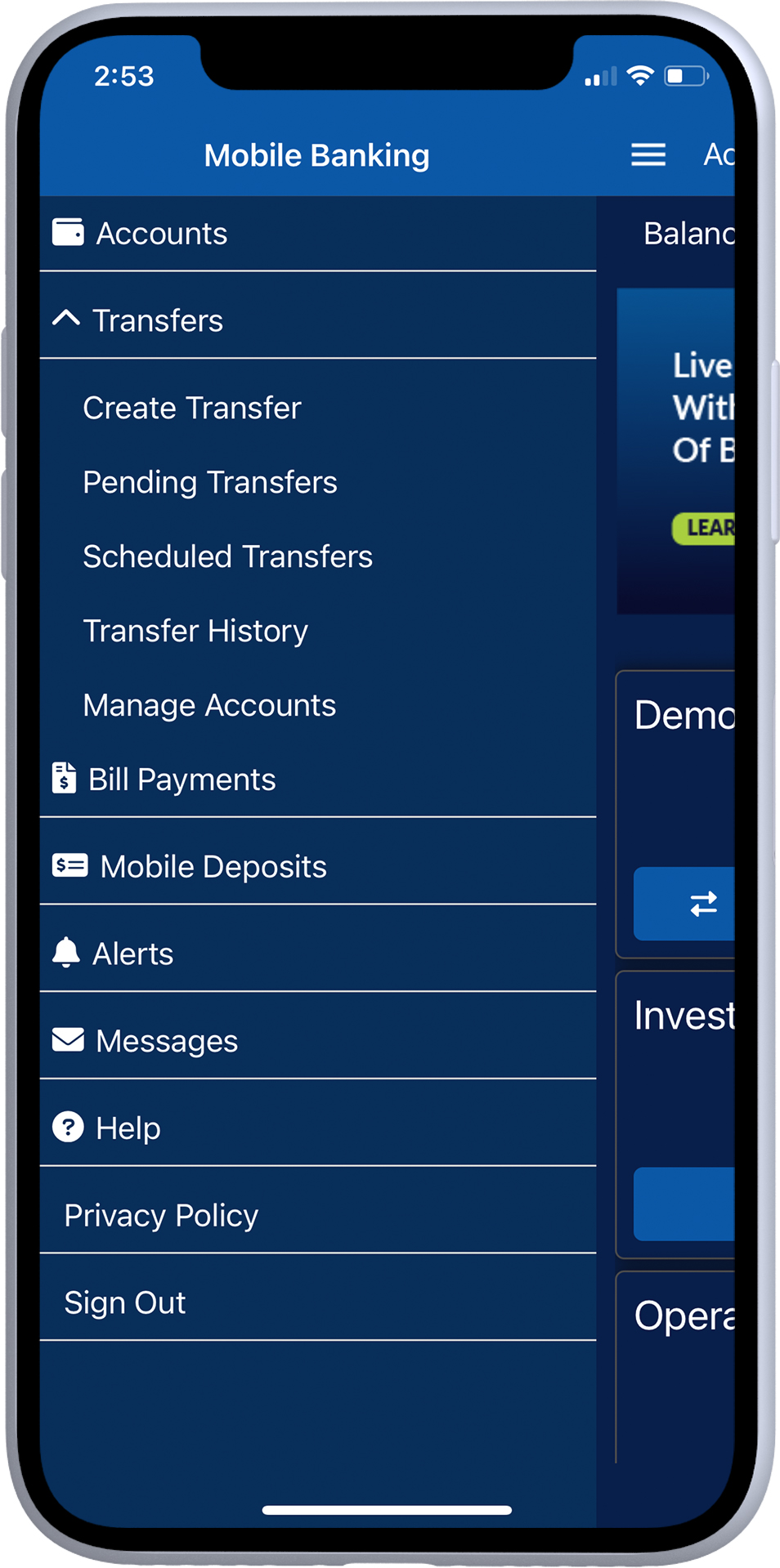

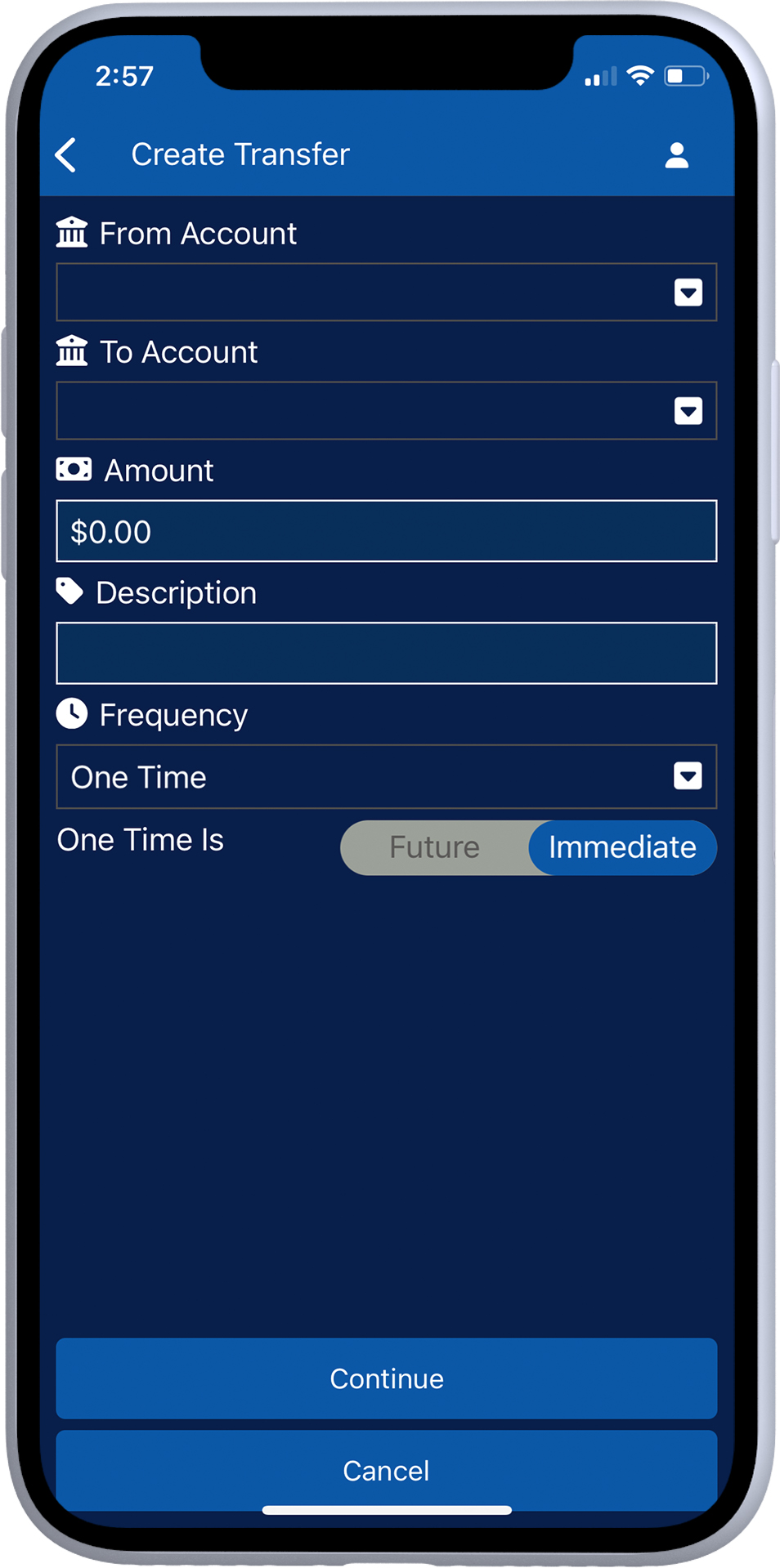

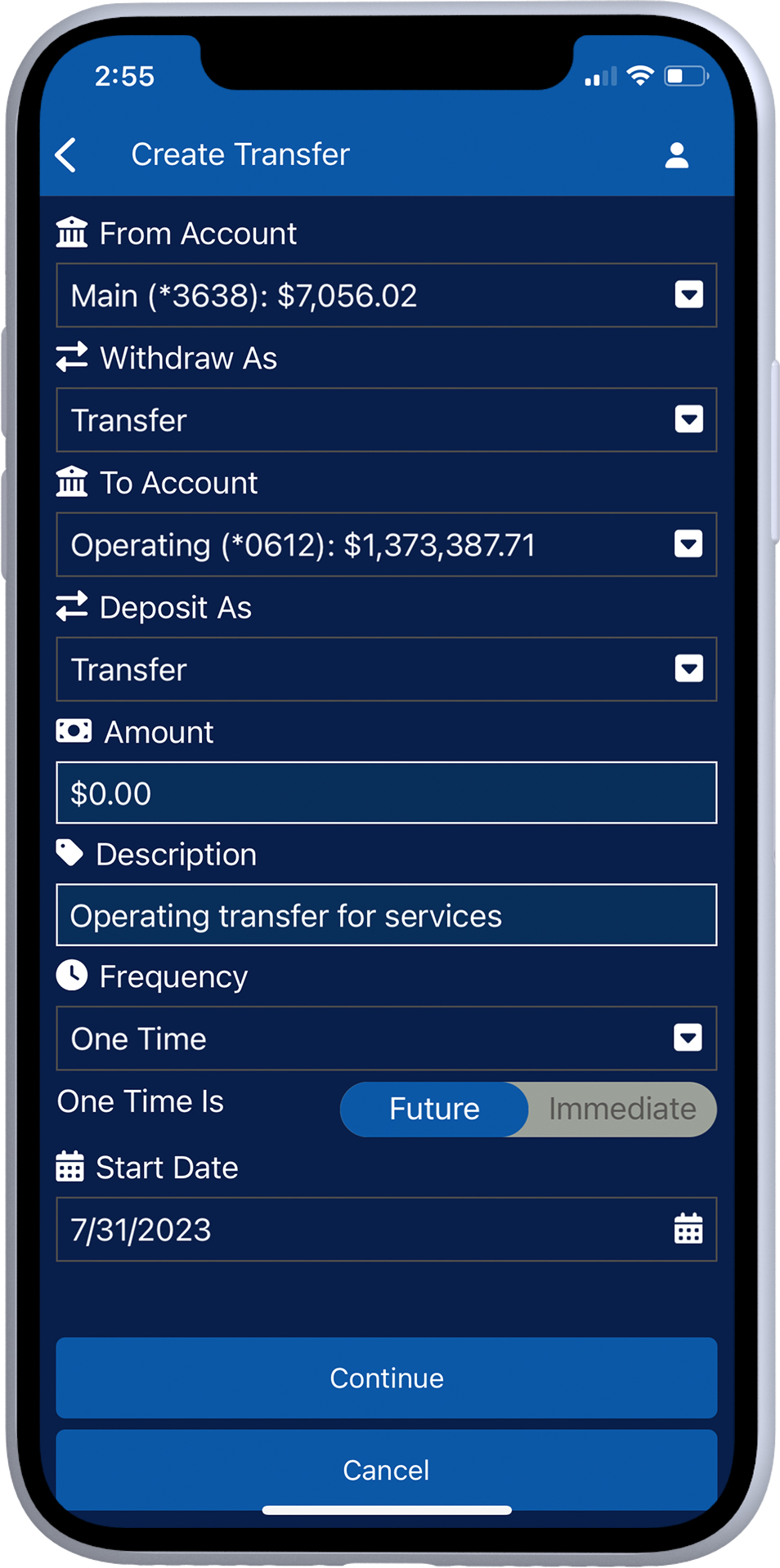

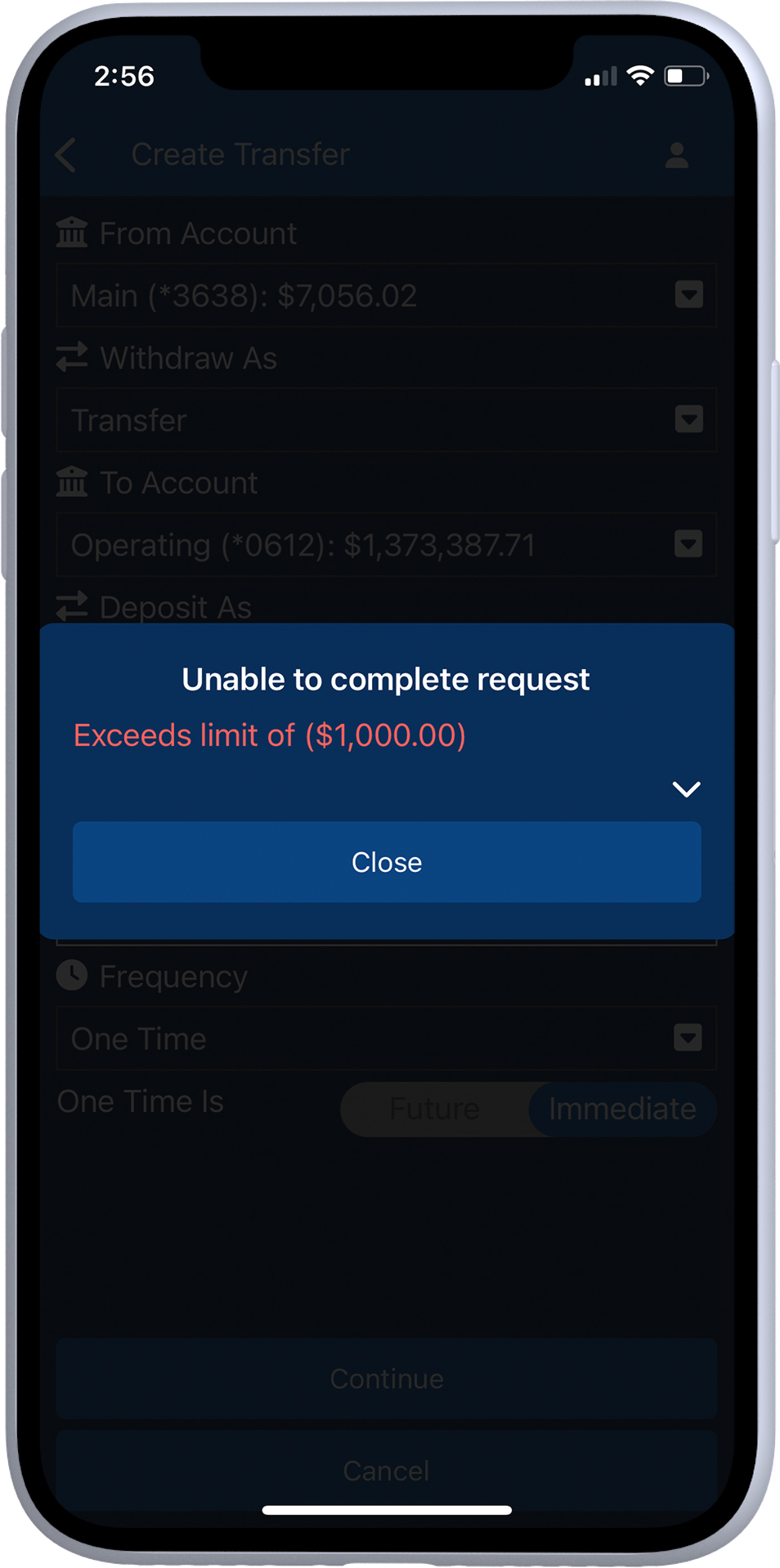

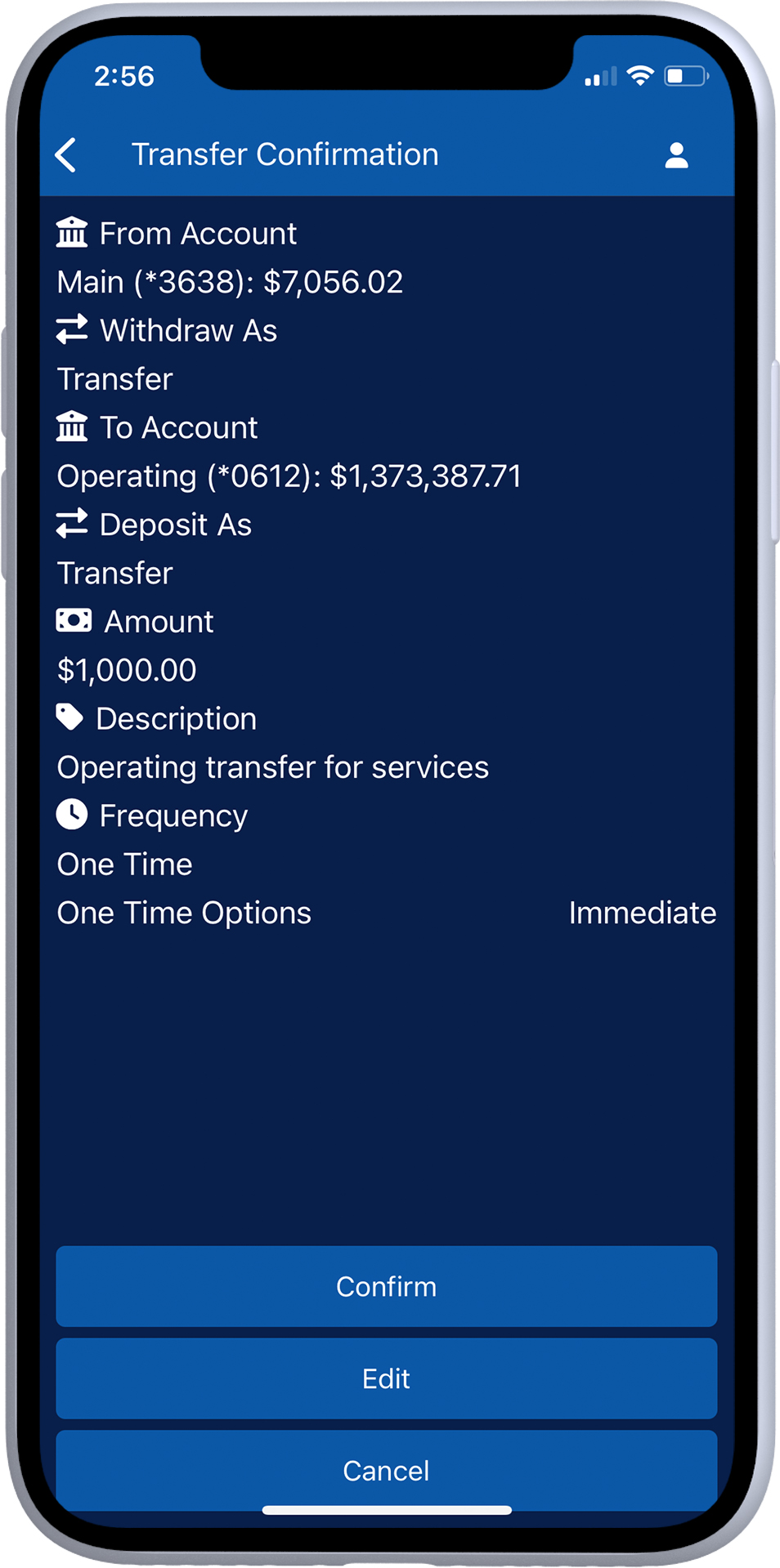

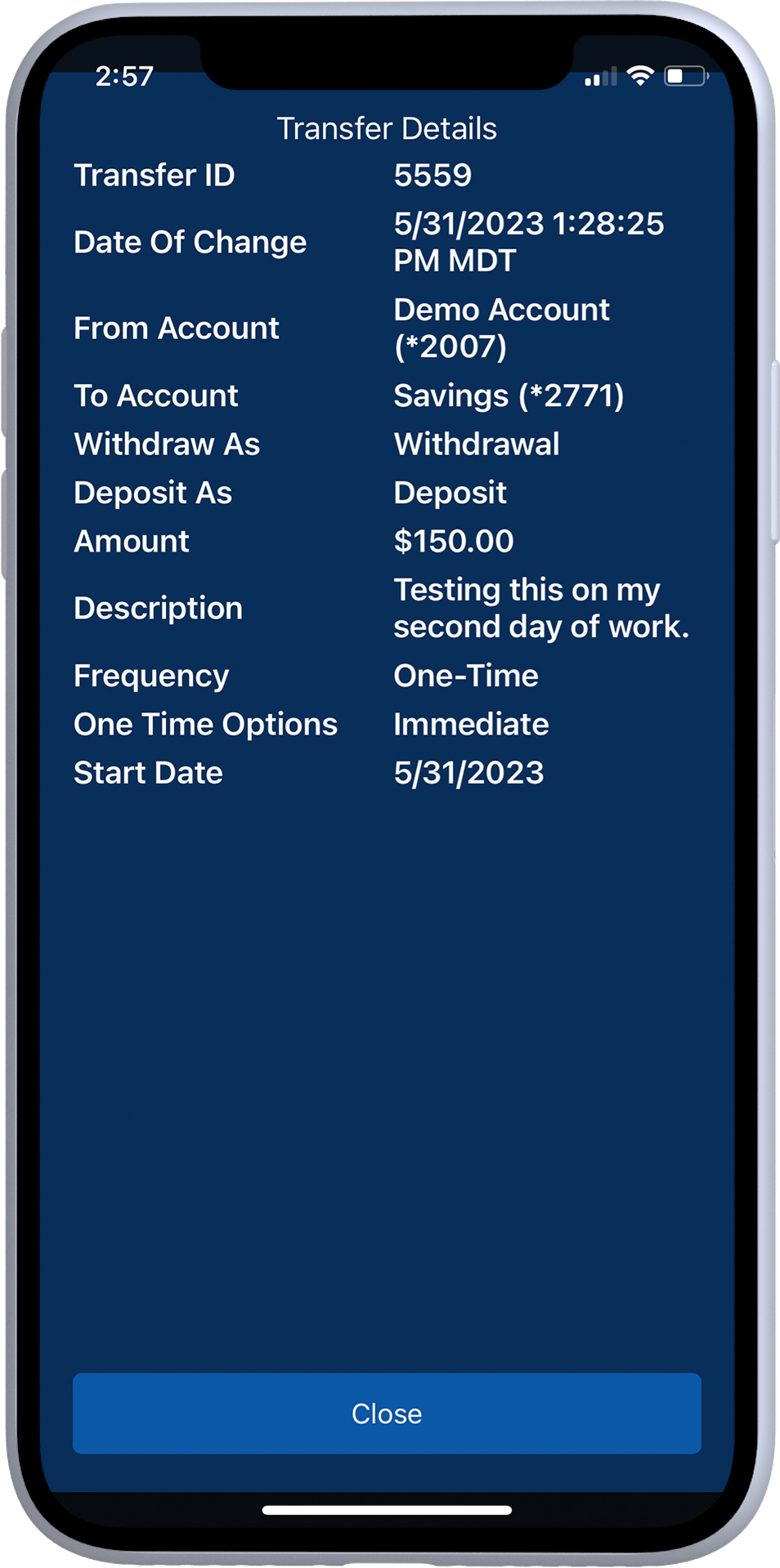

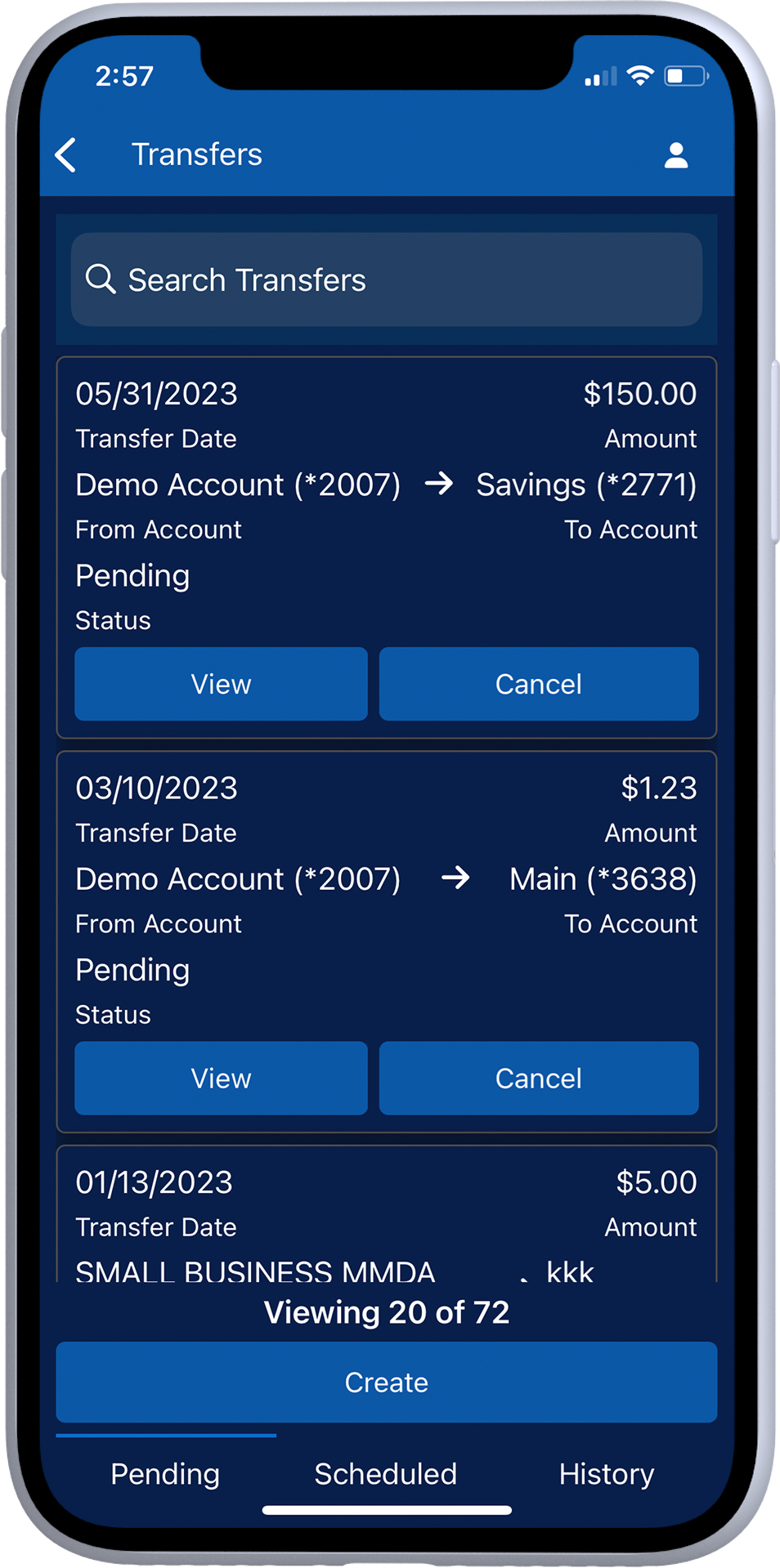

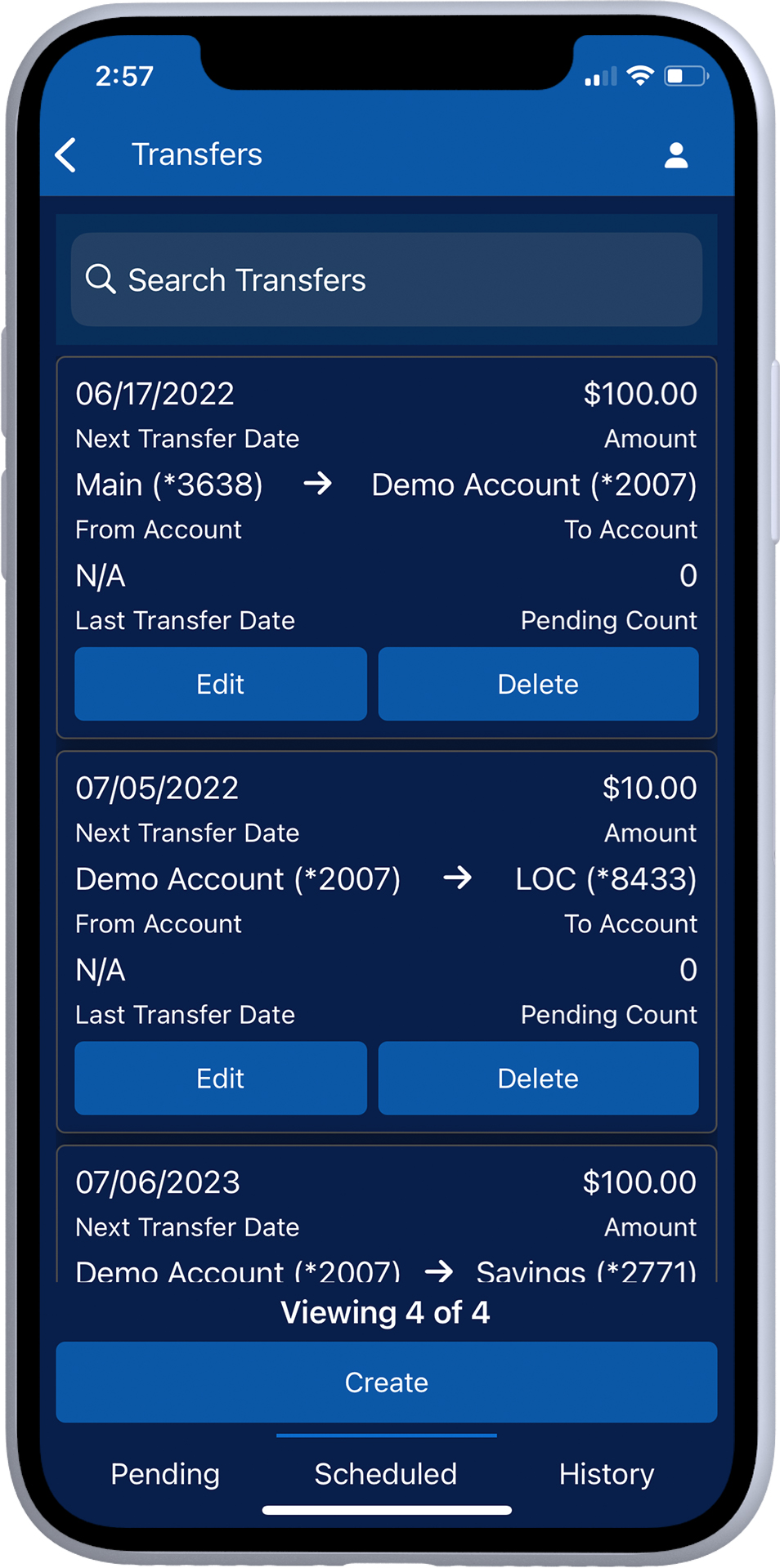

Transfers

Features include:

- Easily create transfers between accounts.

- Set a frequency for transfers (once, daily, weekly, monthly).

- Have the option to include a reason for transfers.

- Search and review pending and scheduled transfers.

- View transfer history.

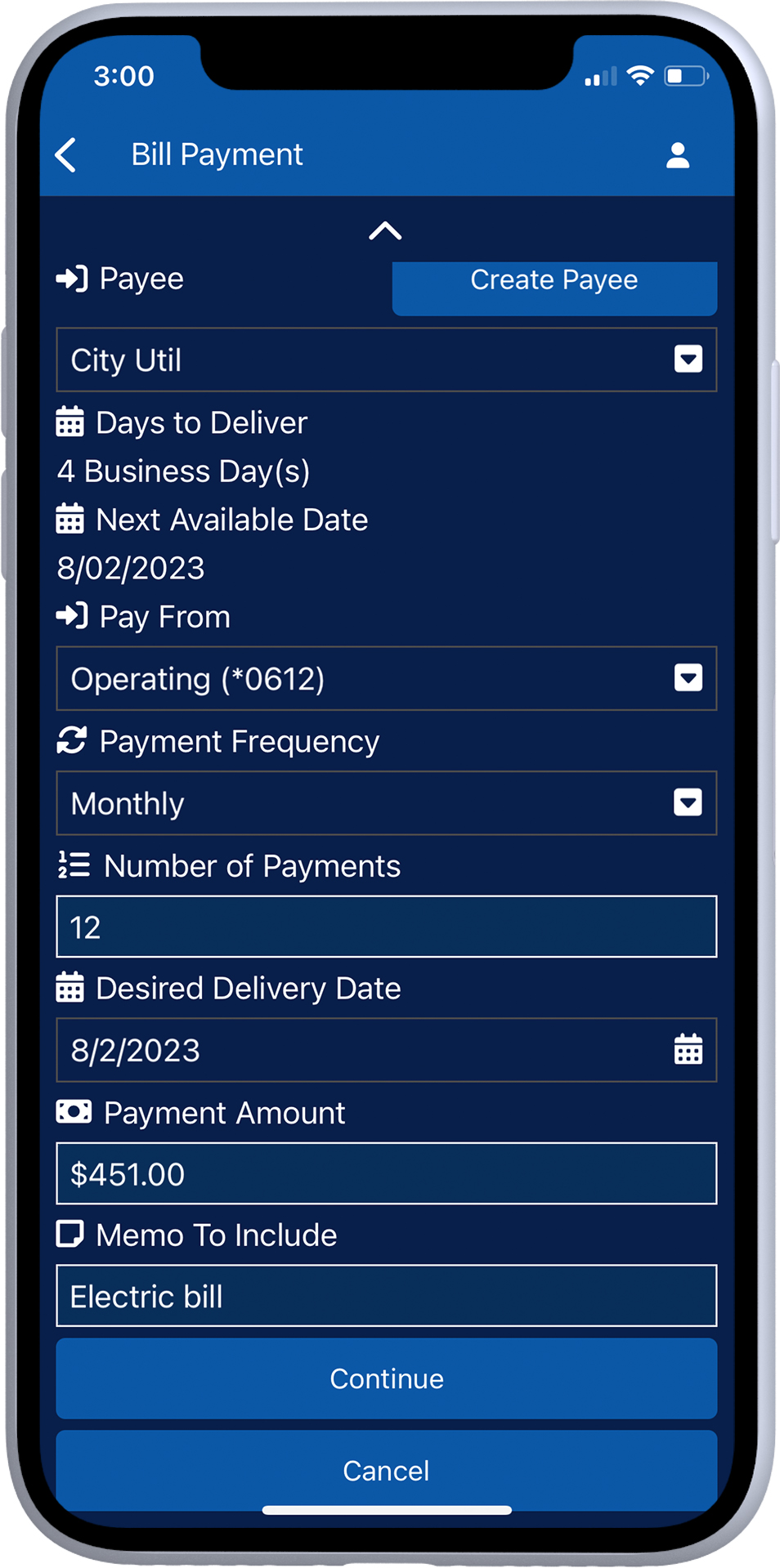

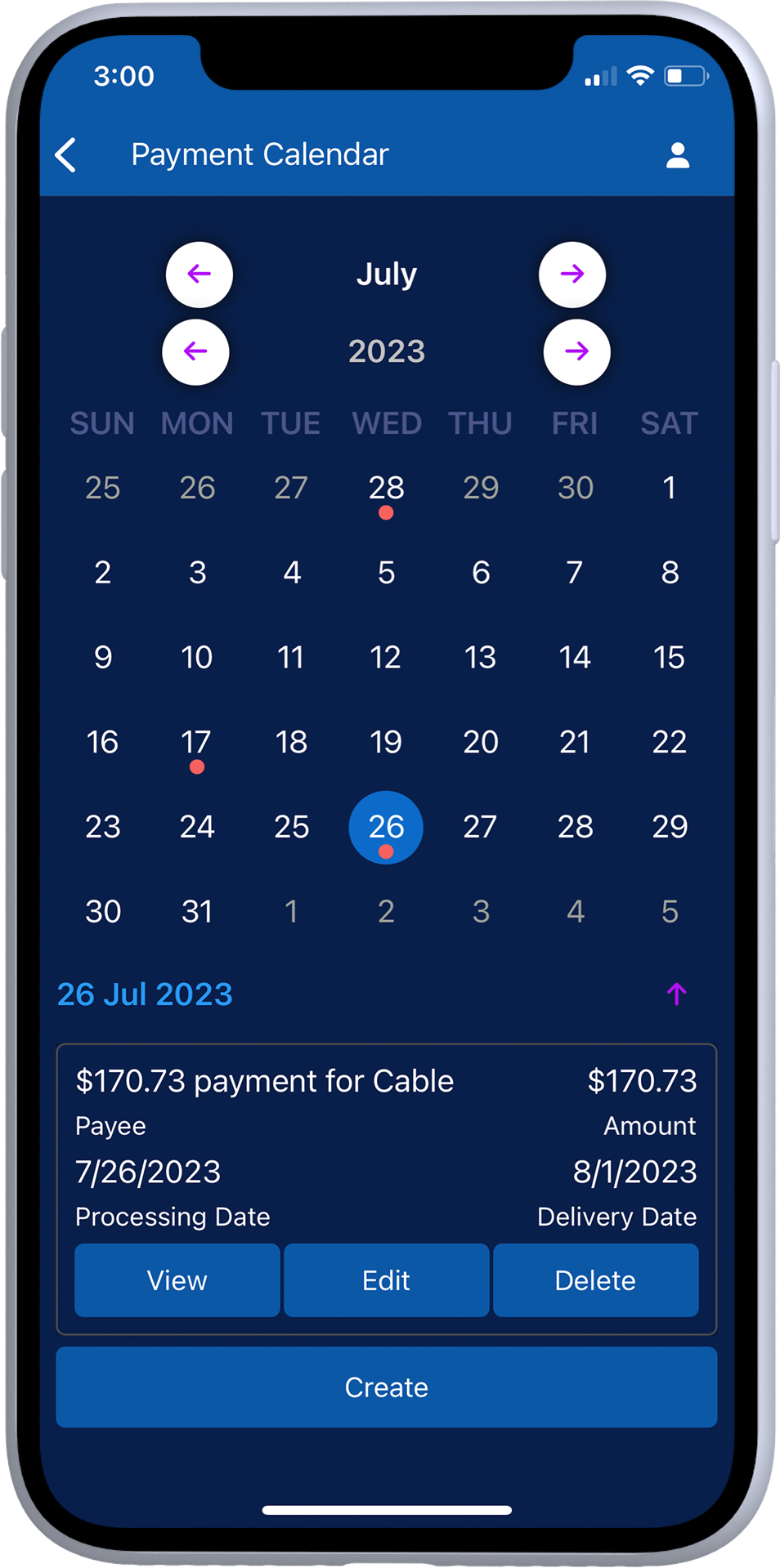

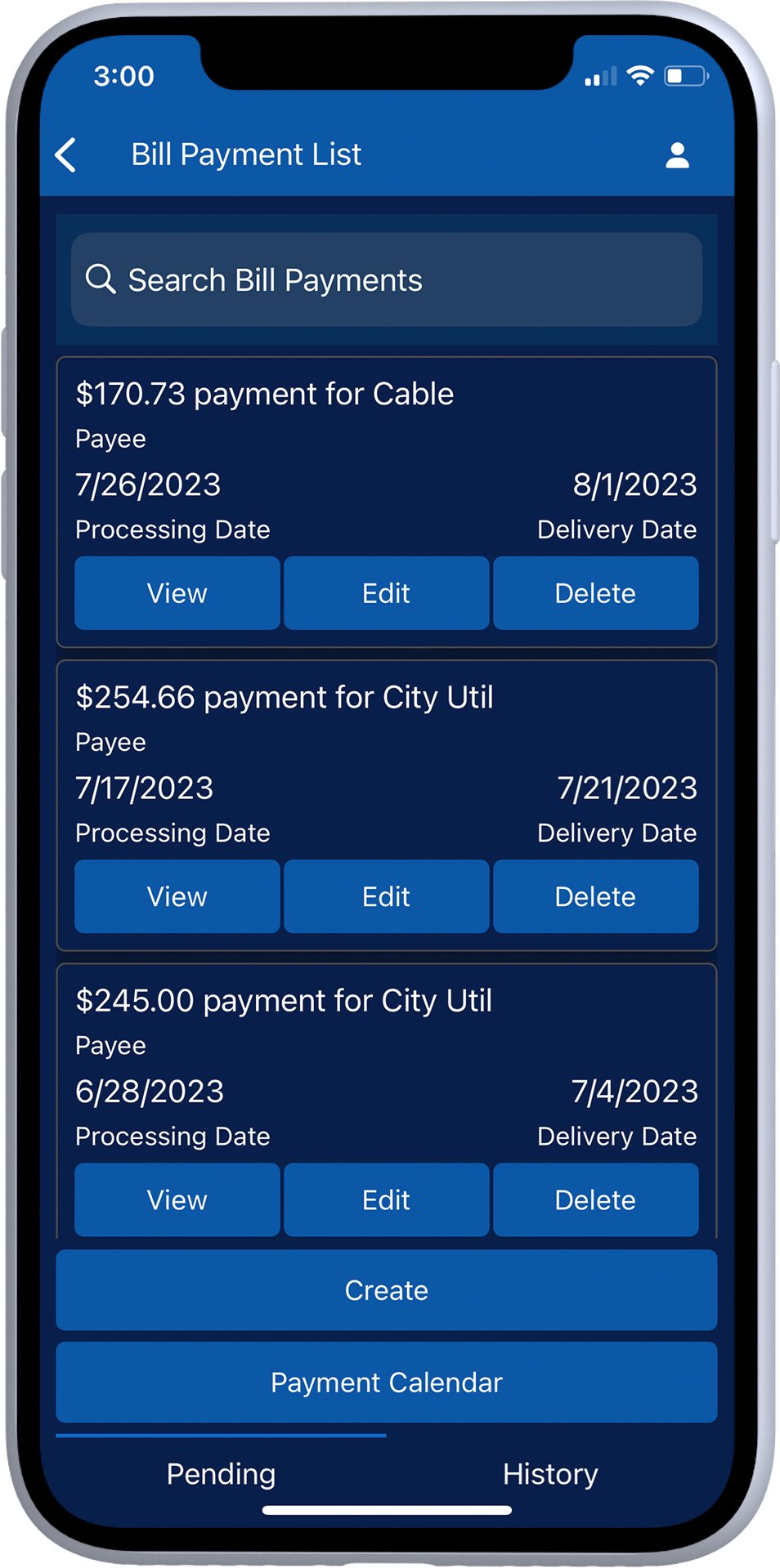

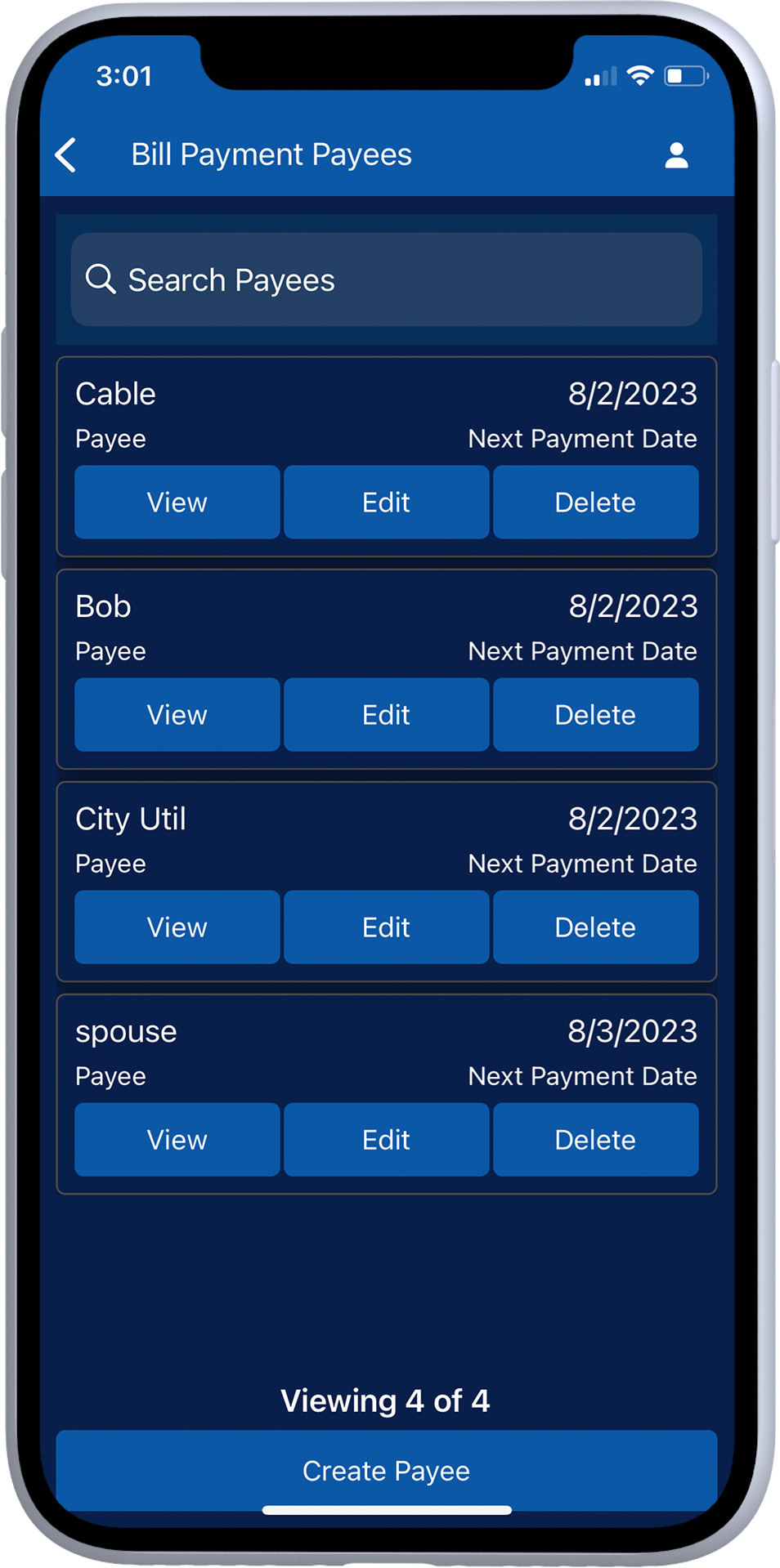

Bill Pay

Features include:

- Create and manage payments through the calendar view.

- Create payments and payees on one single screen.

- Set frequency for Bill Pay (once, daily, weekly, monthly).

- Navigate payment calendar by simply rotating month & year.

- Manage payees for easy payments.

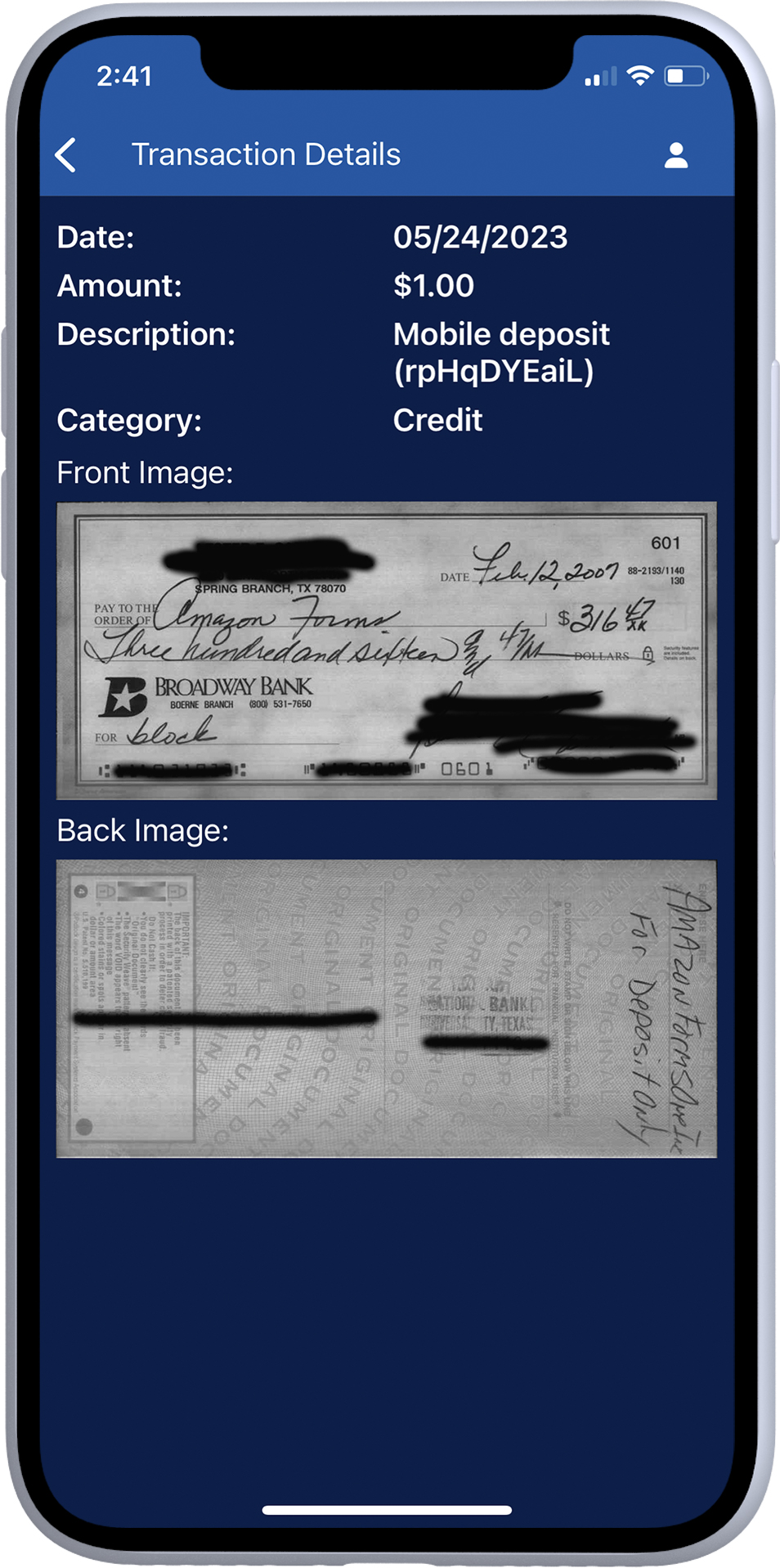

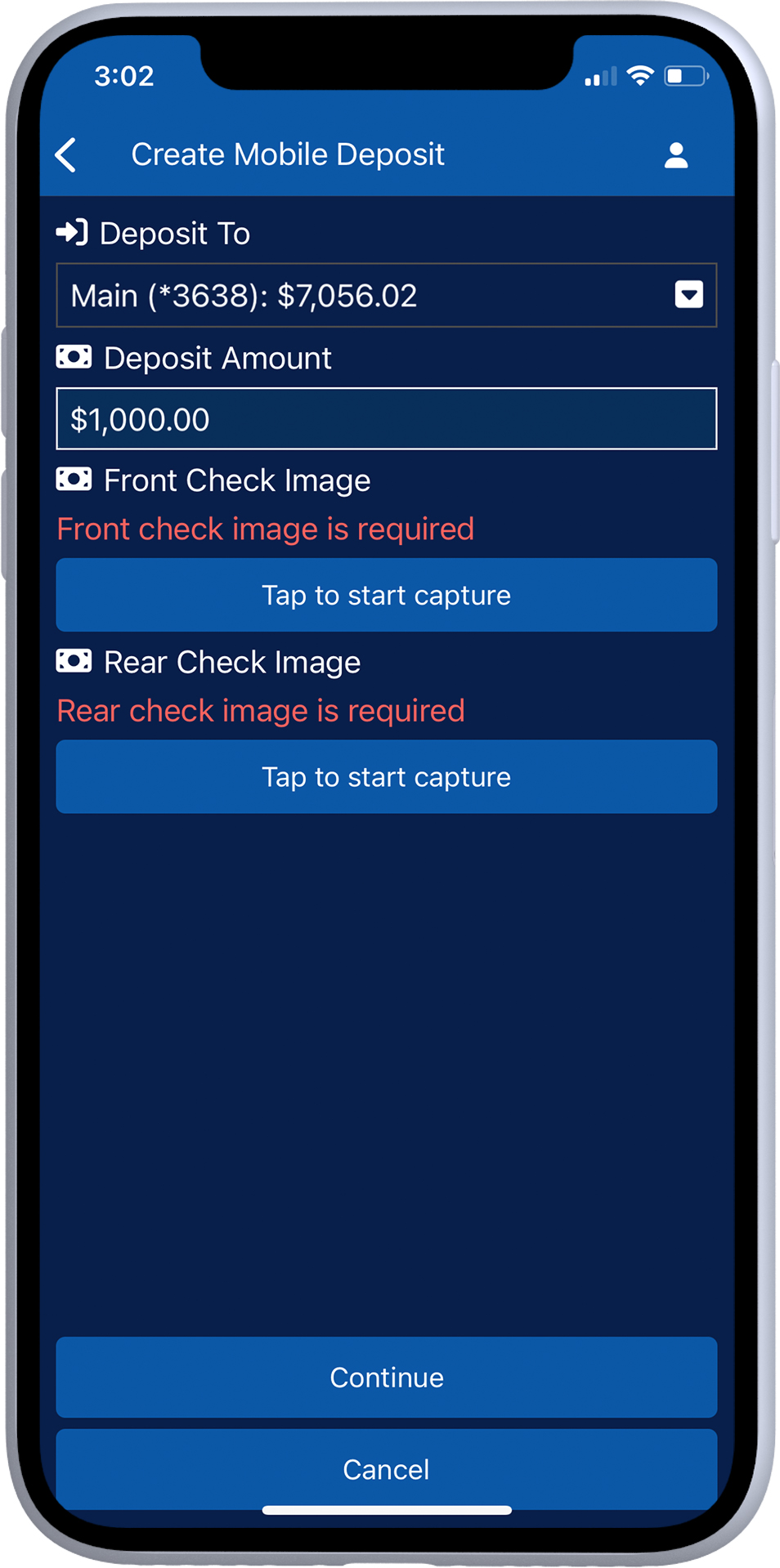

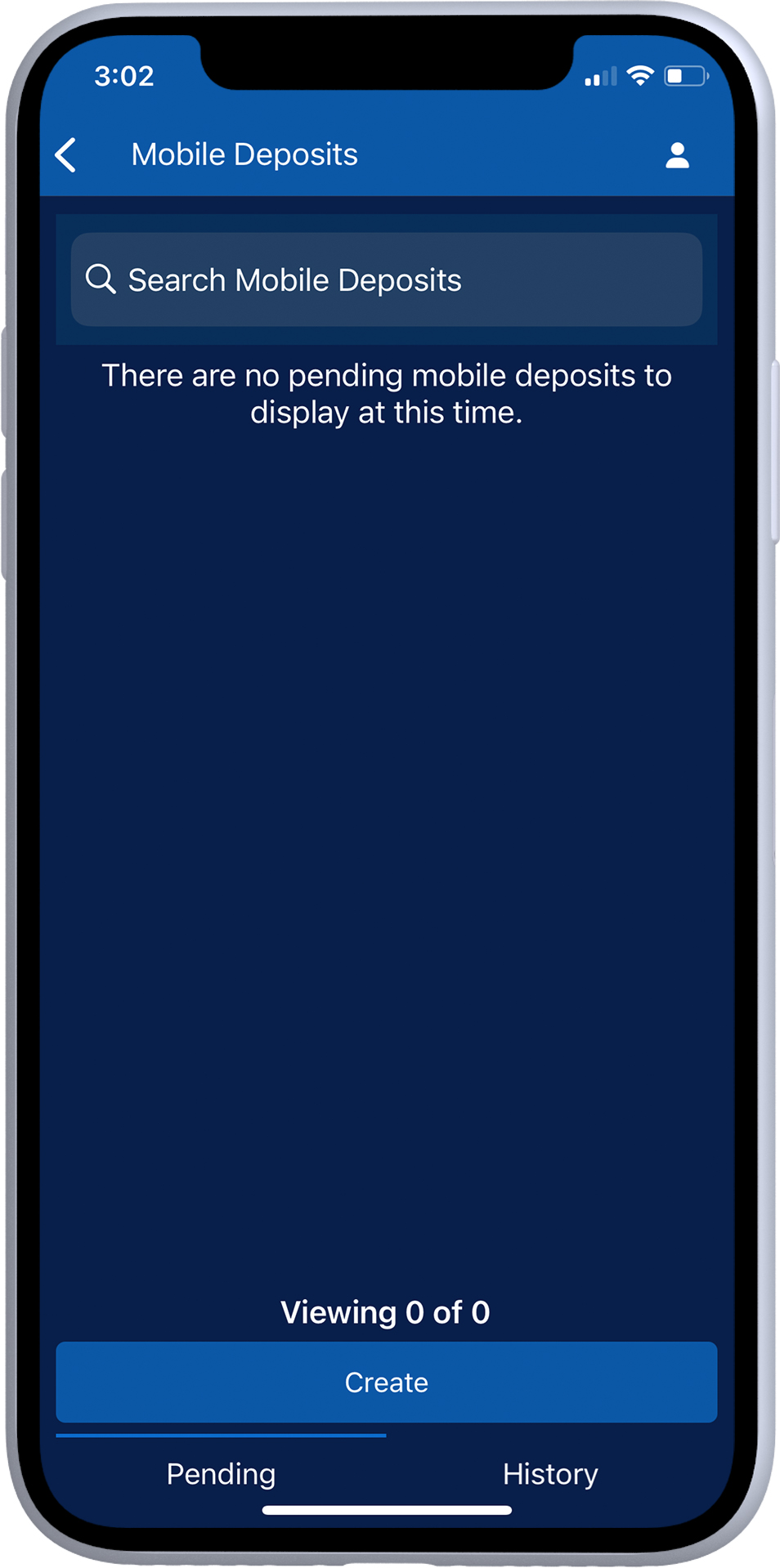

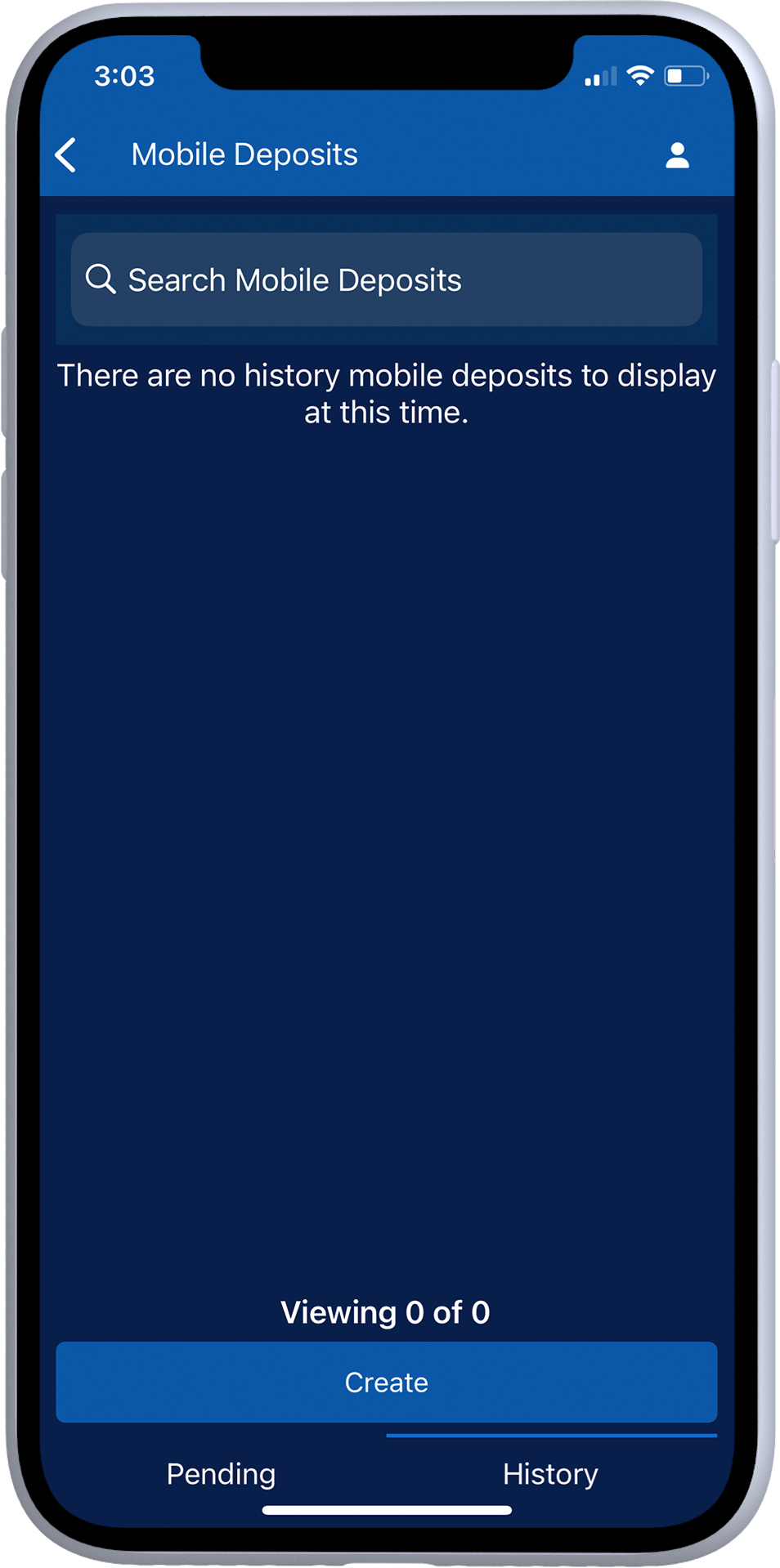

Mobile Deposits

Features include:

- Direct camera controls support mobile deposit images.

- Create deposits to any account.

- View pending deposits and deposit history.

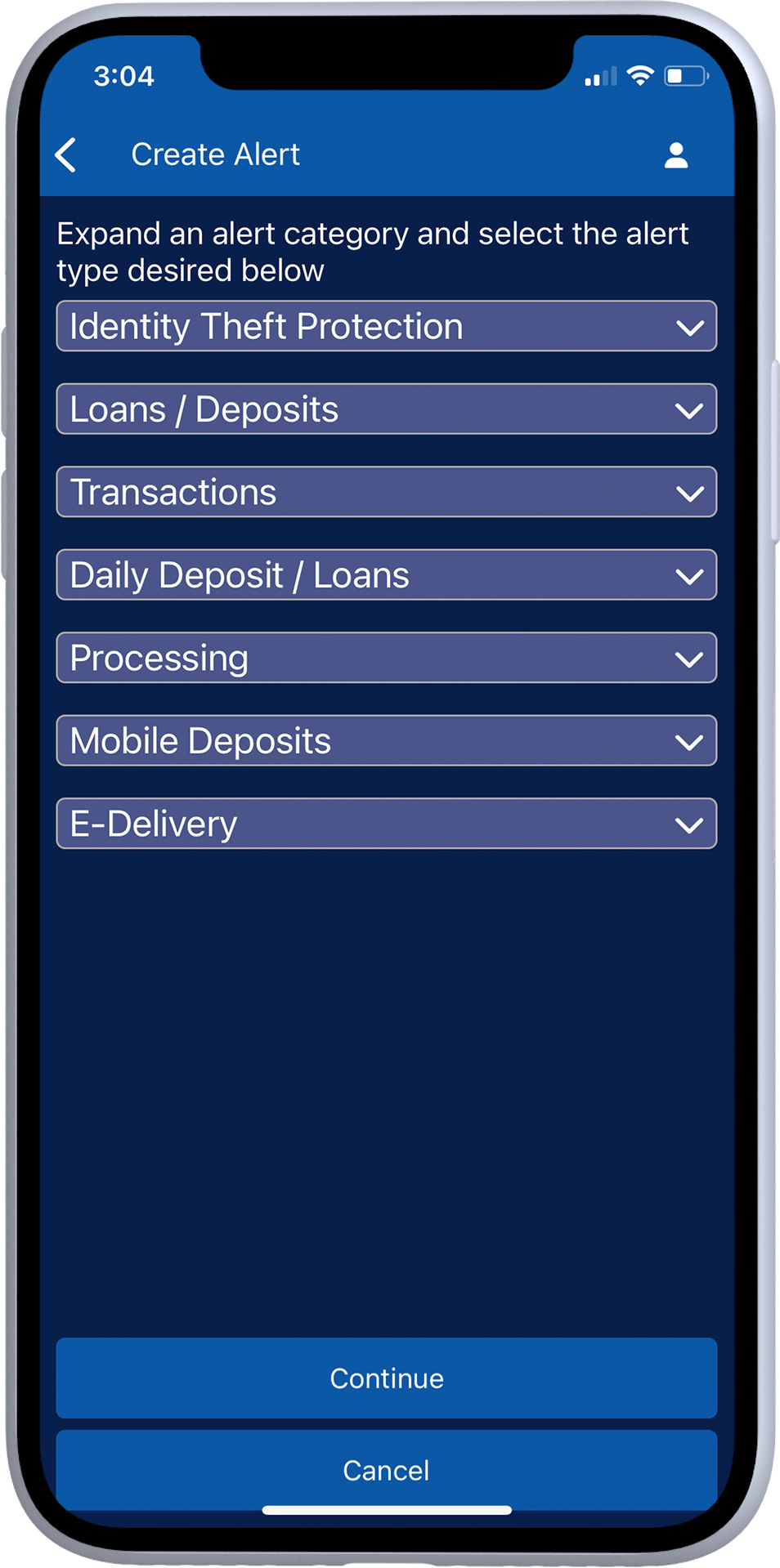

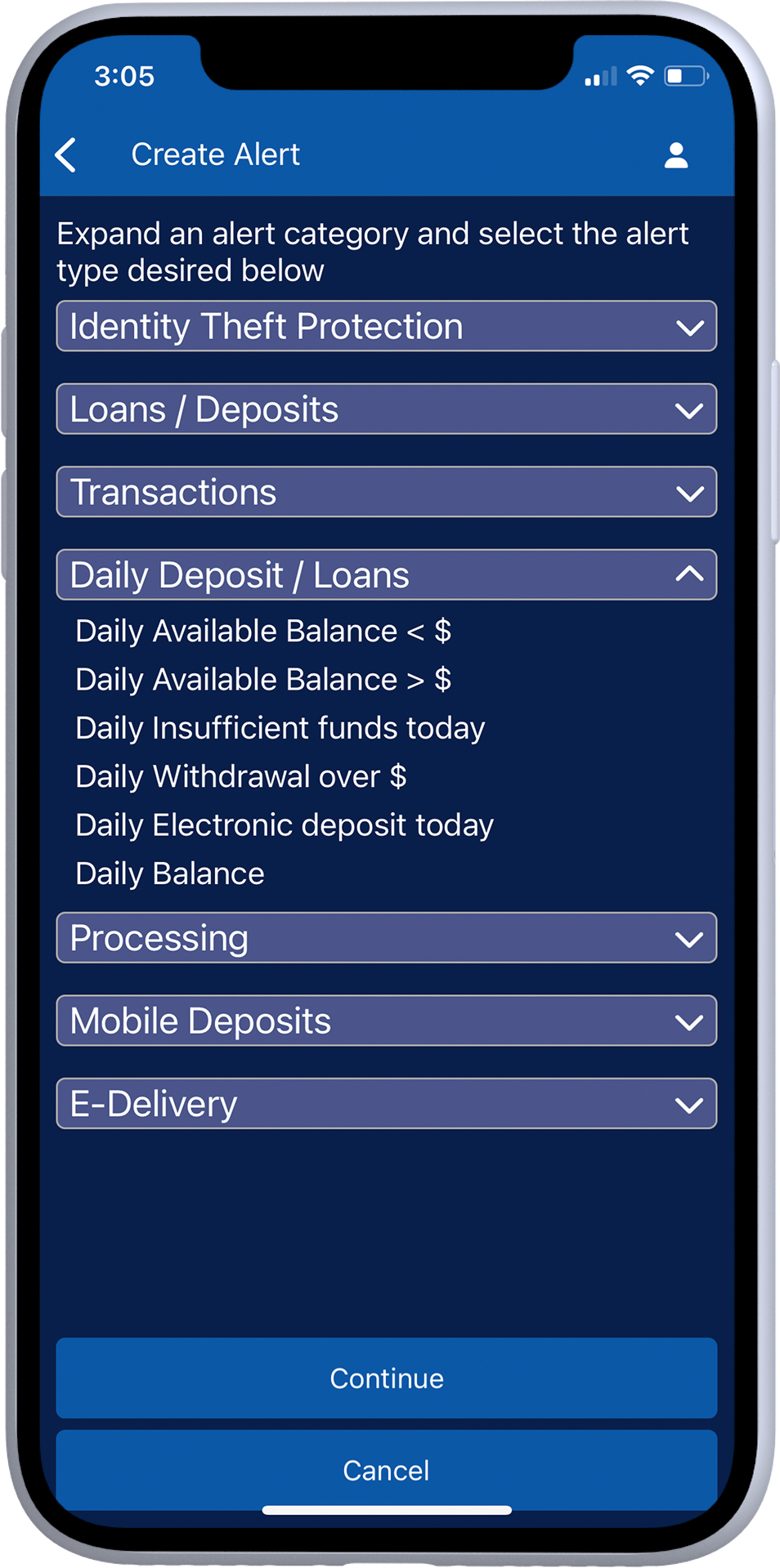

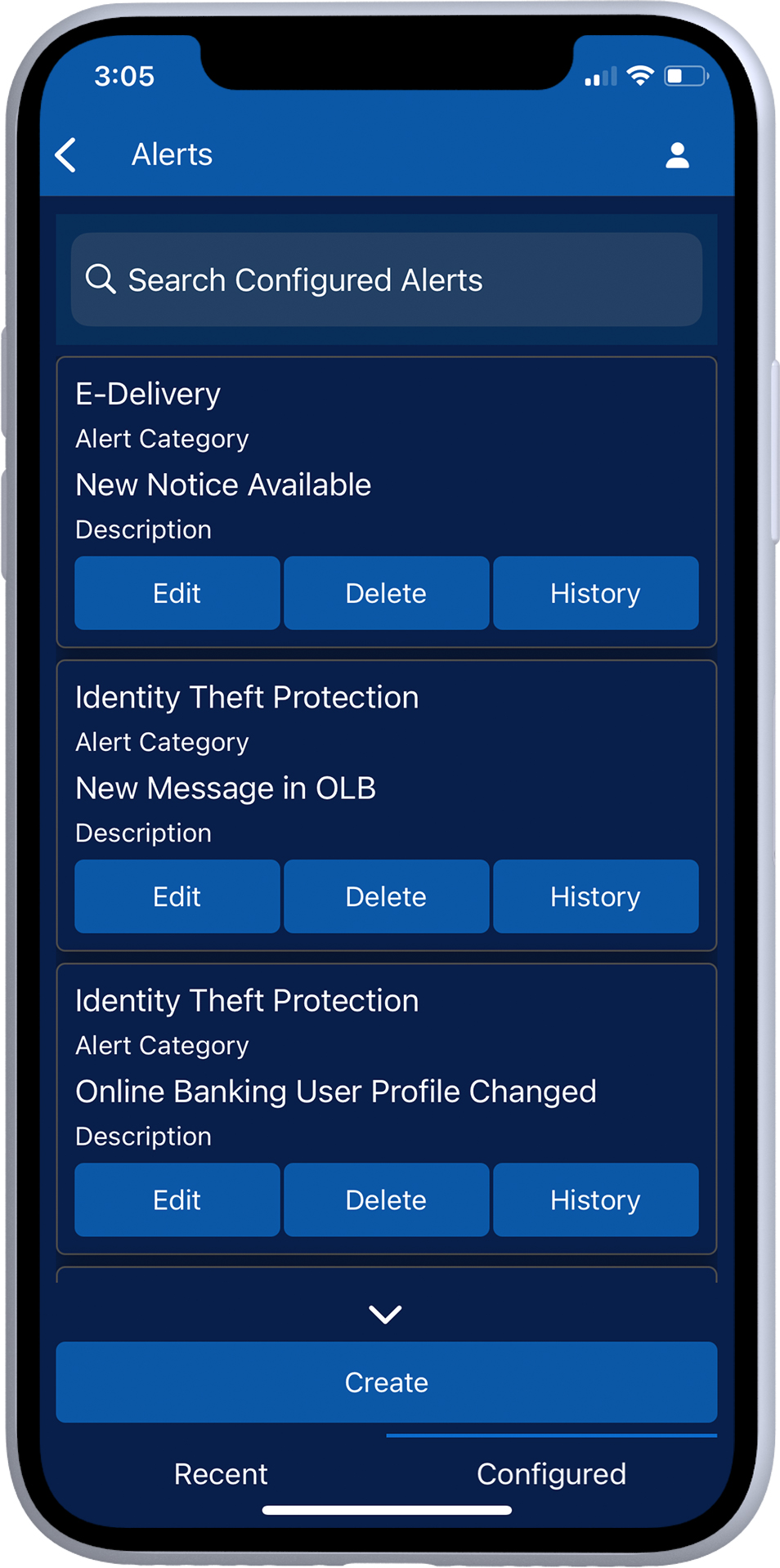

Alerts

Features include:

- Create and customize alerts to suit your preferences.

- Edit, delete, and view previously created alerts.

- Have the option to include a description for alerts.

- Choose one or multiple accounts for each alert category, all in the same view.

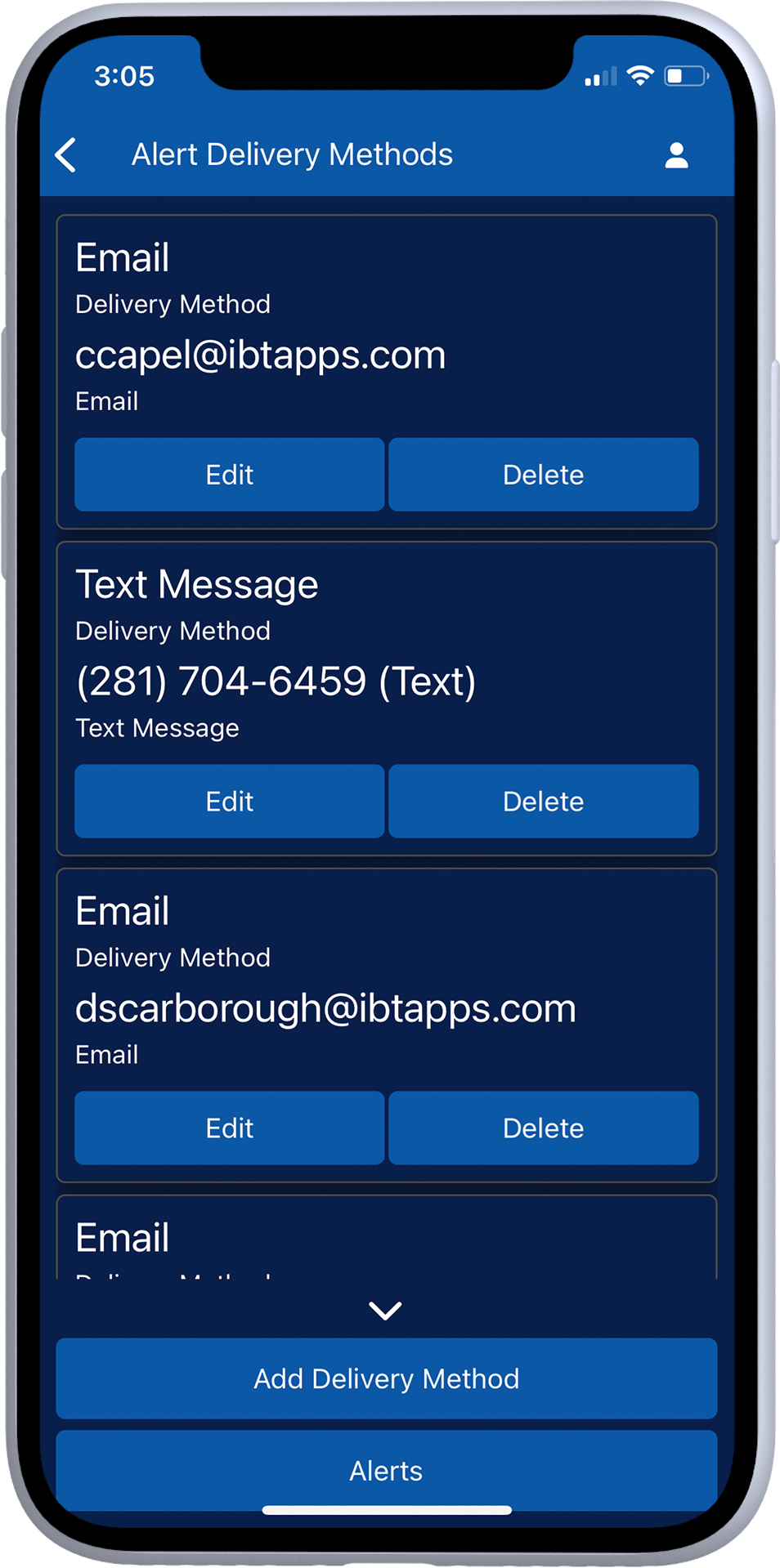

- Manage e-delivery methods (email or text message).

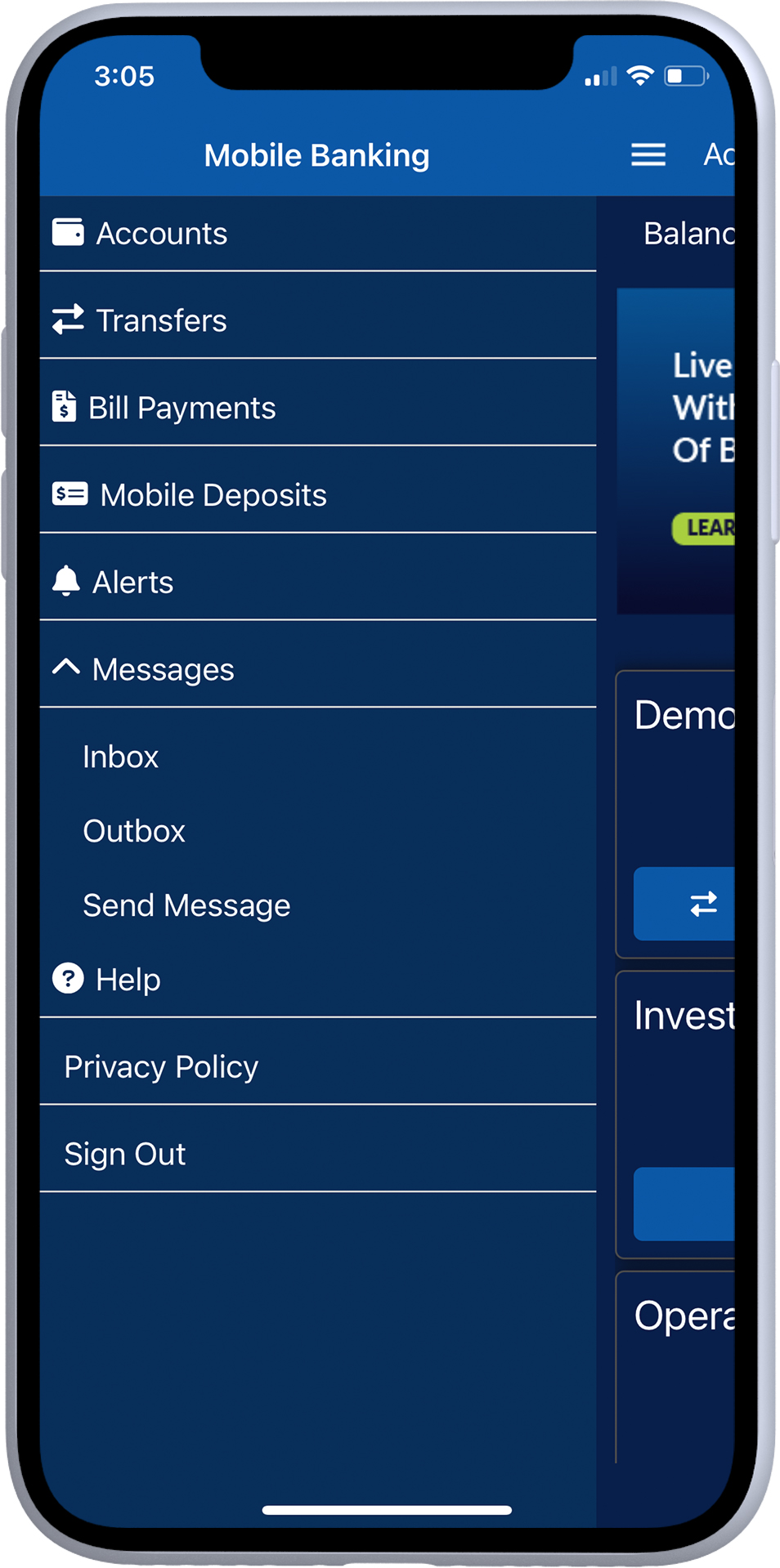

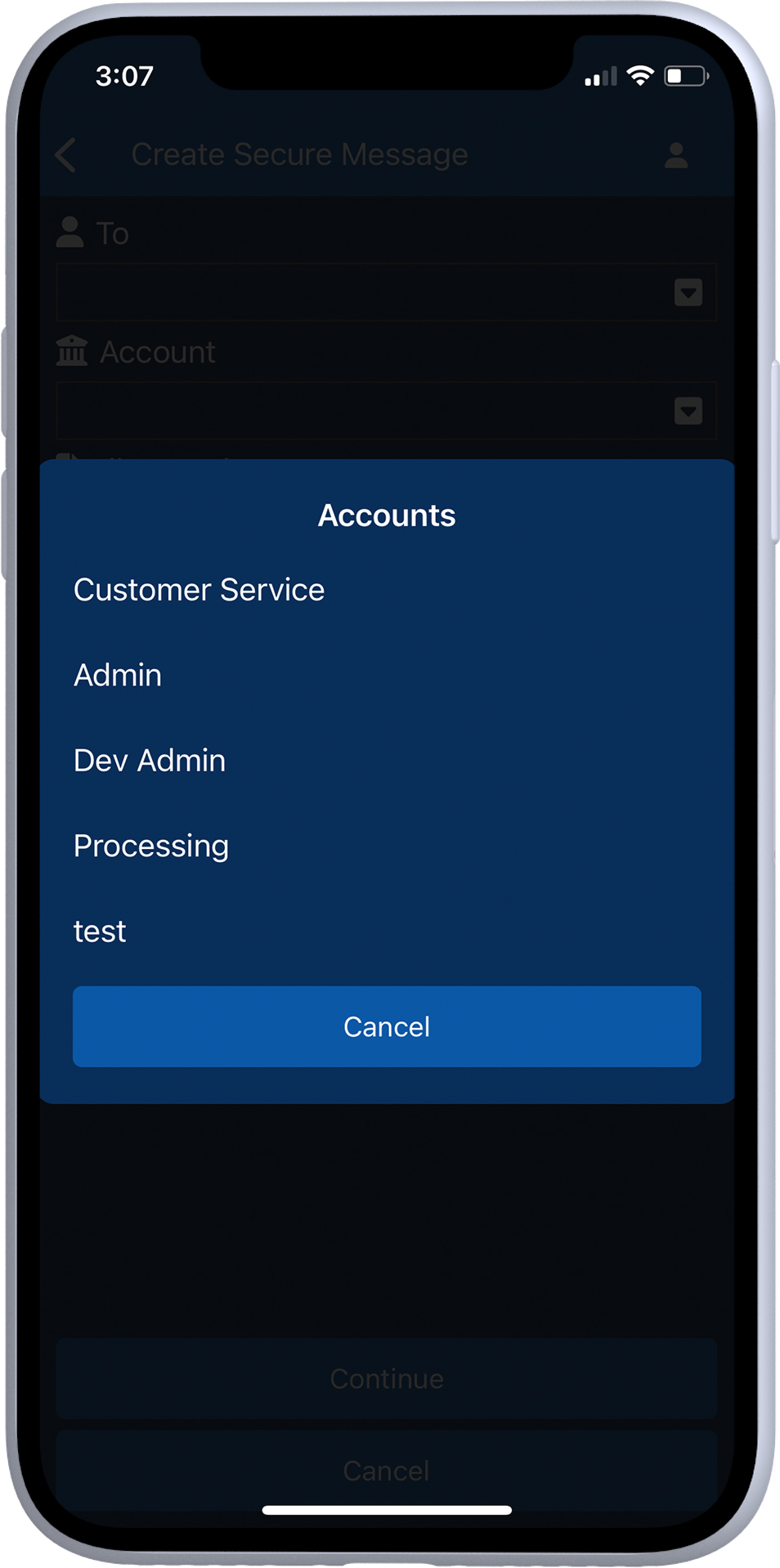

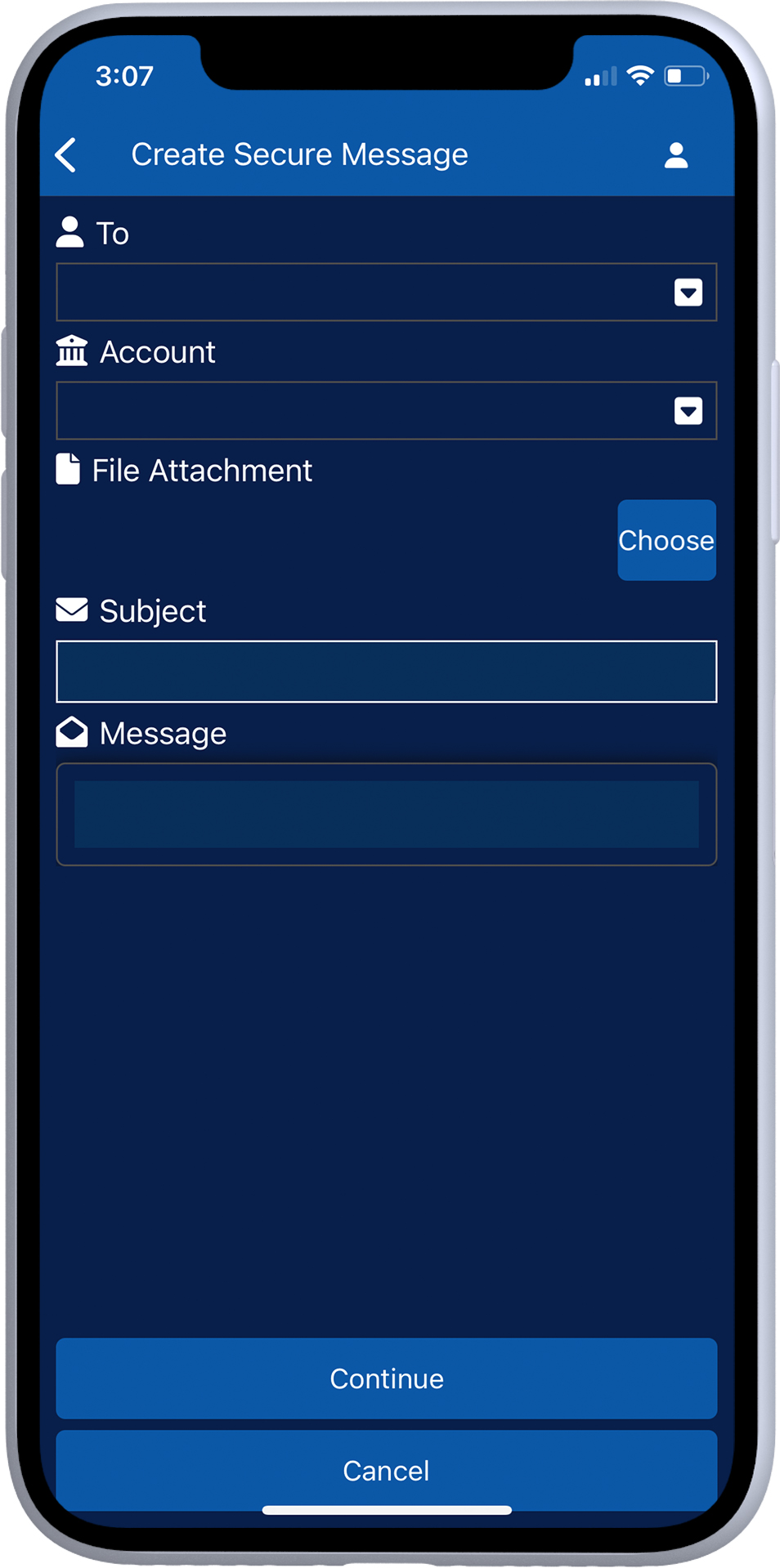

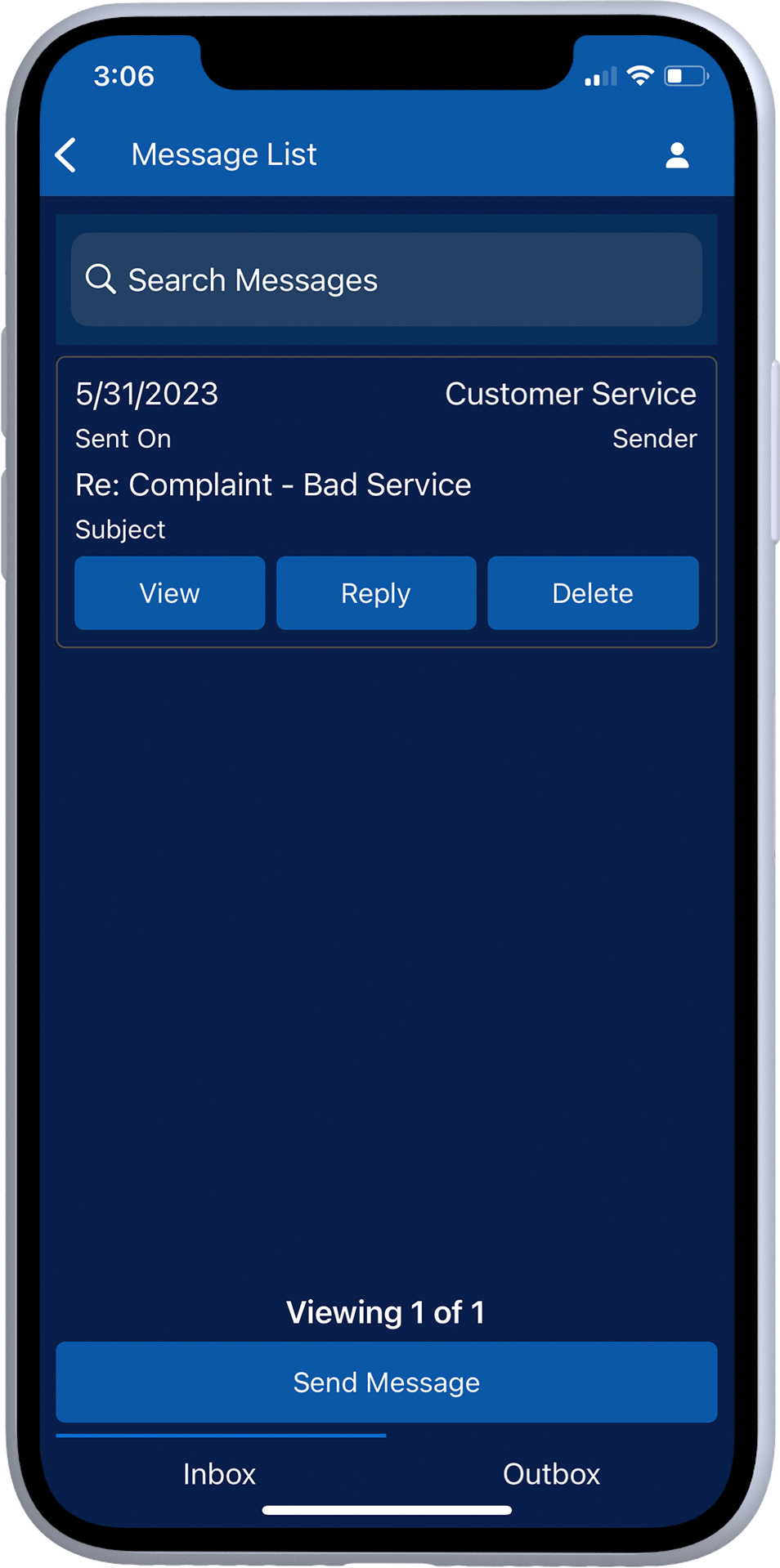

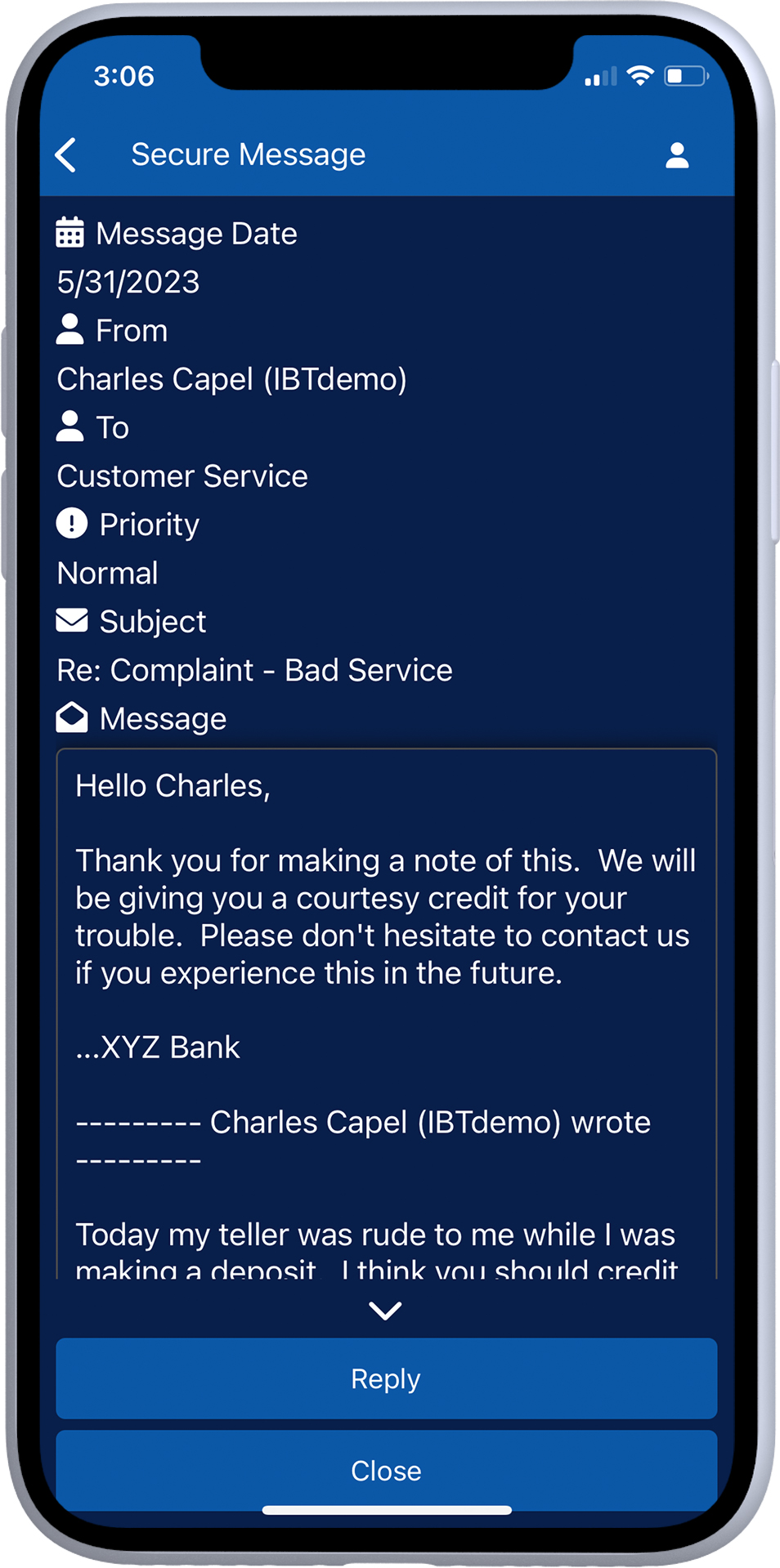

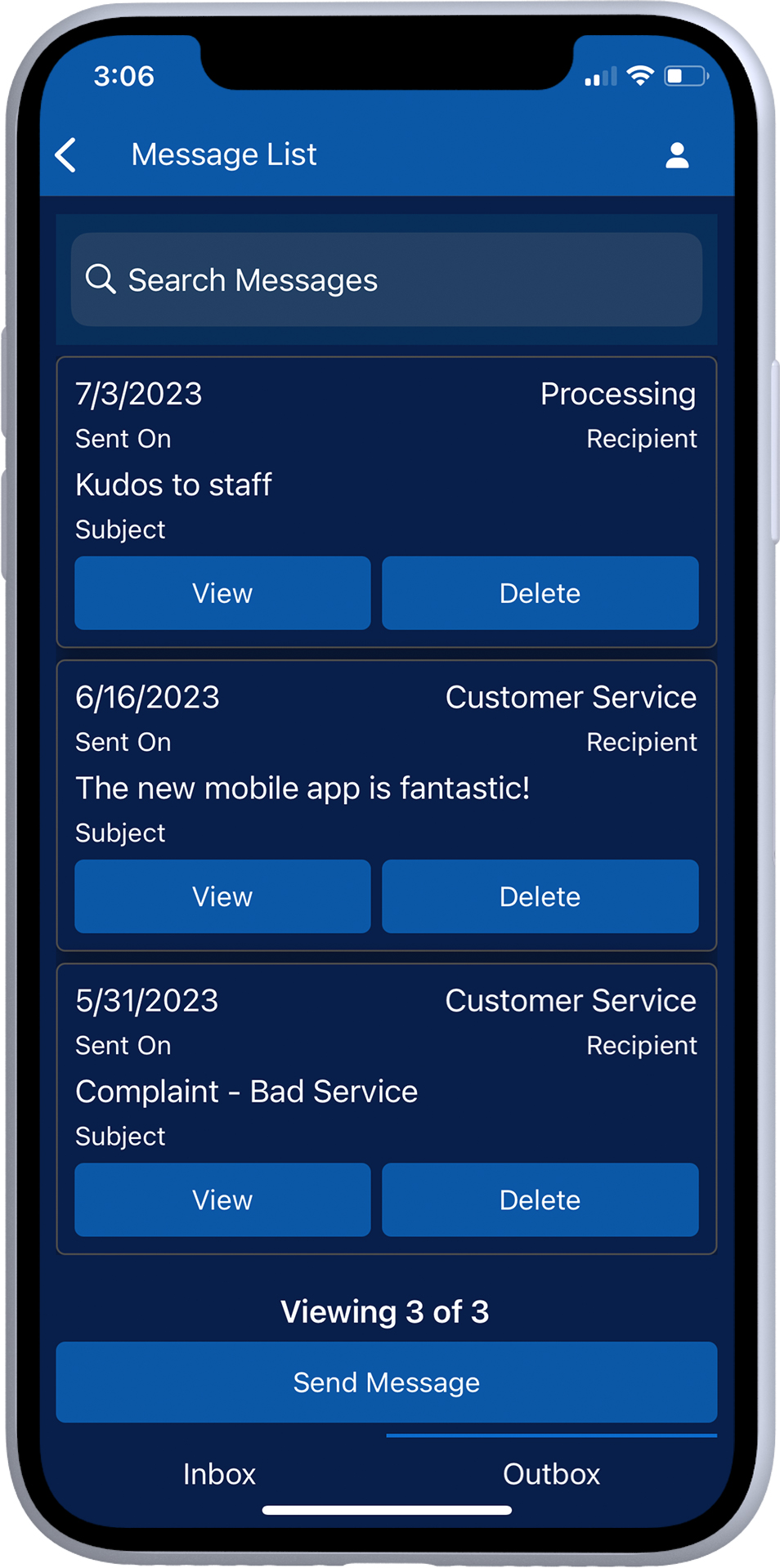

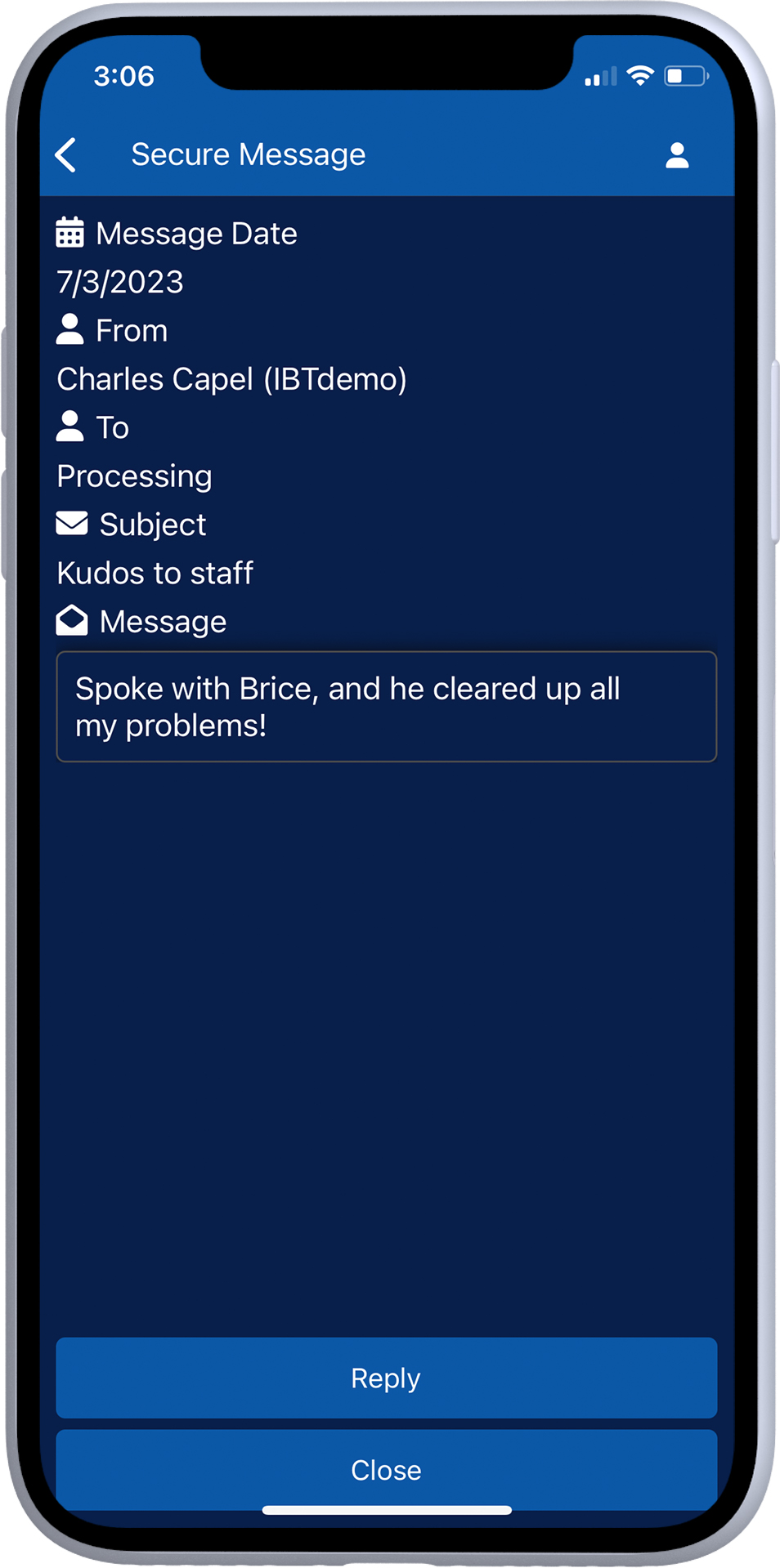

Messages

Features include:

- Provides employees the ability to securely send documents for review.

- Customers can send messages to preset departments on account changes and provide feedback to your bank.

- Customers can view previously sent messages in the inbox and outbox.

Provide your customers with security, control, and convenience, all in one mobile banking app. That’s i2Mobile.

“We’re often told that the products we’re offering are as good, if not better, than their previous [big] bank experience.”

Mike Sale, CEO

The Commercial Bank

Online mobile banking available anytime, anywhere

Connect with us to discuss i2Mobile, the mobile banking solution for community banks.

Related Content

FEATURED PRODUCT

IBT Apps i2OLB – Digital Banking

Attract and retain customers with secure account access and management, anytime, from anywhere. The i2OLB platform offers your customers a range of deposit accounts to suit their needs.

FEATURED ARTICLE

A Short Guide to API Banking, BaaS, and Open Banking with Fintechs

Community banks can (and should) start considering API-based banking solutions. Read this short guide to learn the benefits and how to get started. No downloaded needed!

CASE STUDY

First National Bank – Eagle Lake, TX

Learn how this community bank provided a one-stop shop experience using integrated technology and responsive service.