Propel your community bank’s growth with our simplified deposit origination platform.

Today’s customers are looking for convenience. Offer them an effortless account opening experience using SecureOPEN’s intuitive, simplified platform, so they can easily open an account anytime from anywhere.

From checking and savings to certificates, SecureOPEN enables your bank to build and launch a variety of deposit products that increase customer satisfaction and boost sales opportunities without compromising security.

With SecureOPEN, your bank can:

Accelerate Application Processing

With a simplified and automated application process, your bank can improve the customer experience in record completion time.

Offer In-branch & Online Options

Extend your deposit origination from the branch to the web and offer customers a convenient channel to apply for accounts.

Create a Path for Auto Decisioning

Control rule setup for your workflows and products, and put fraud services and risk configuration at your fingertips.

Integrate With IBT Apps' Core

Save processing time, reduce human error, and decrease compliance risk. SecureOPEN has a direct interface with our core platform, i2Suite.

Choose to Customize Features

From the application to forms, emails, and notifications, you can decide to customize these for your bank or select from a template.

Explore Growth Opportunities

Personalize the customer experience by setting multiple product and cross-selling offers, running campaigns, and customizing product types.

Streamline Your Account Opening Process From the Application to Account Creation

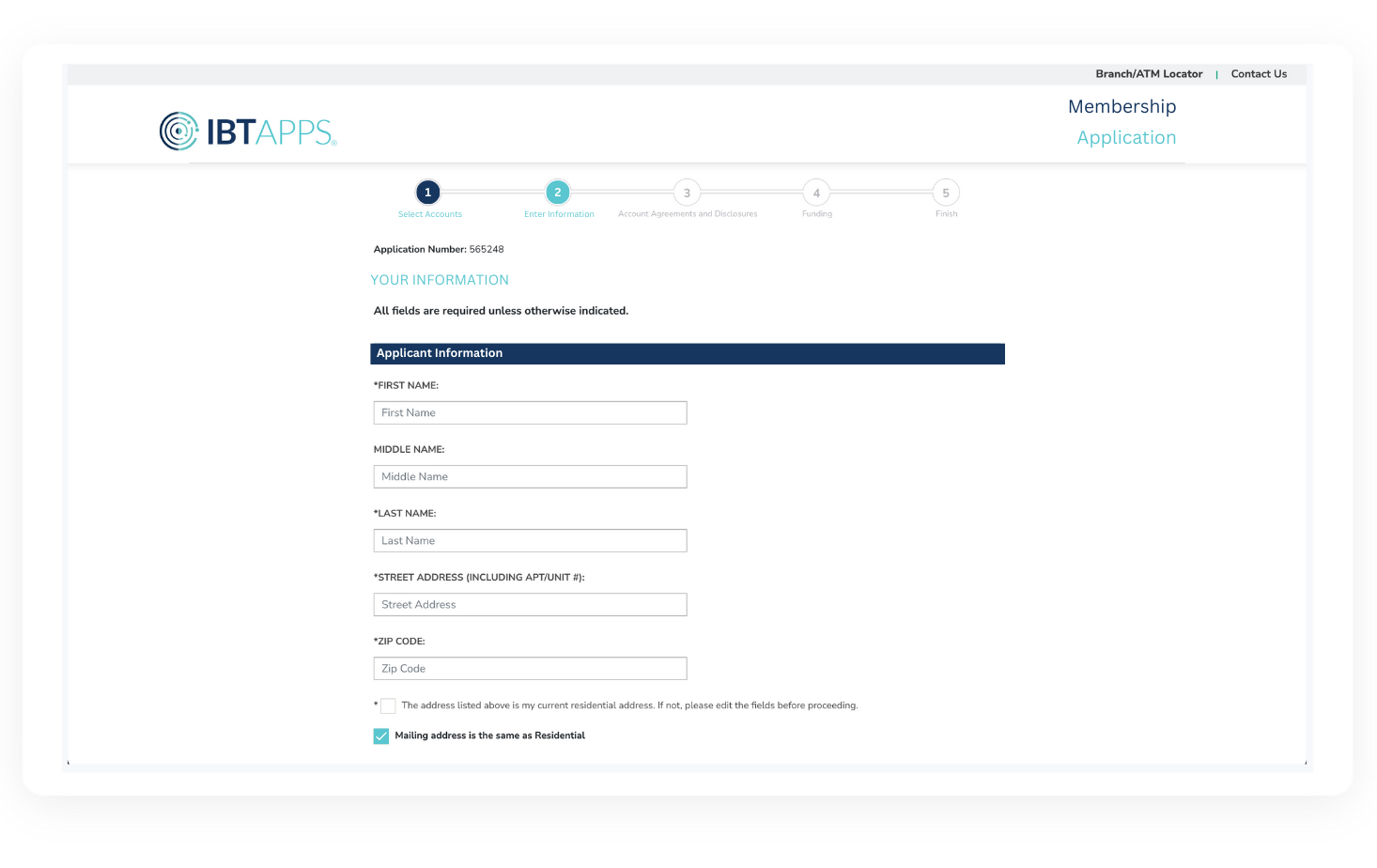

Open New Accounts In-Branch and Online

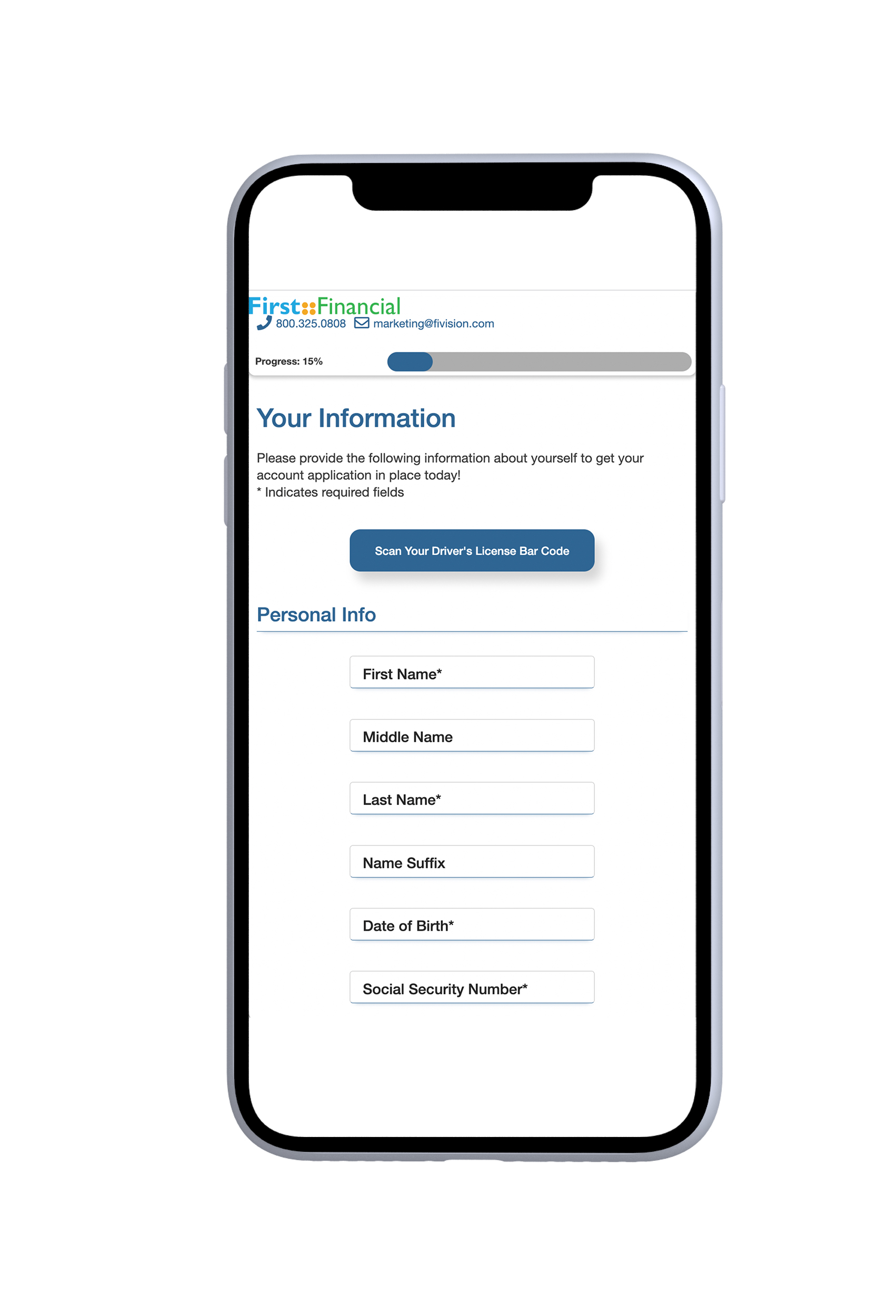

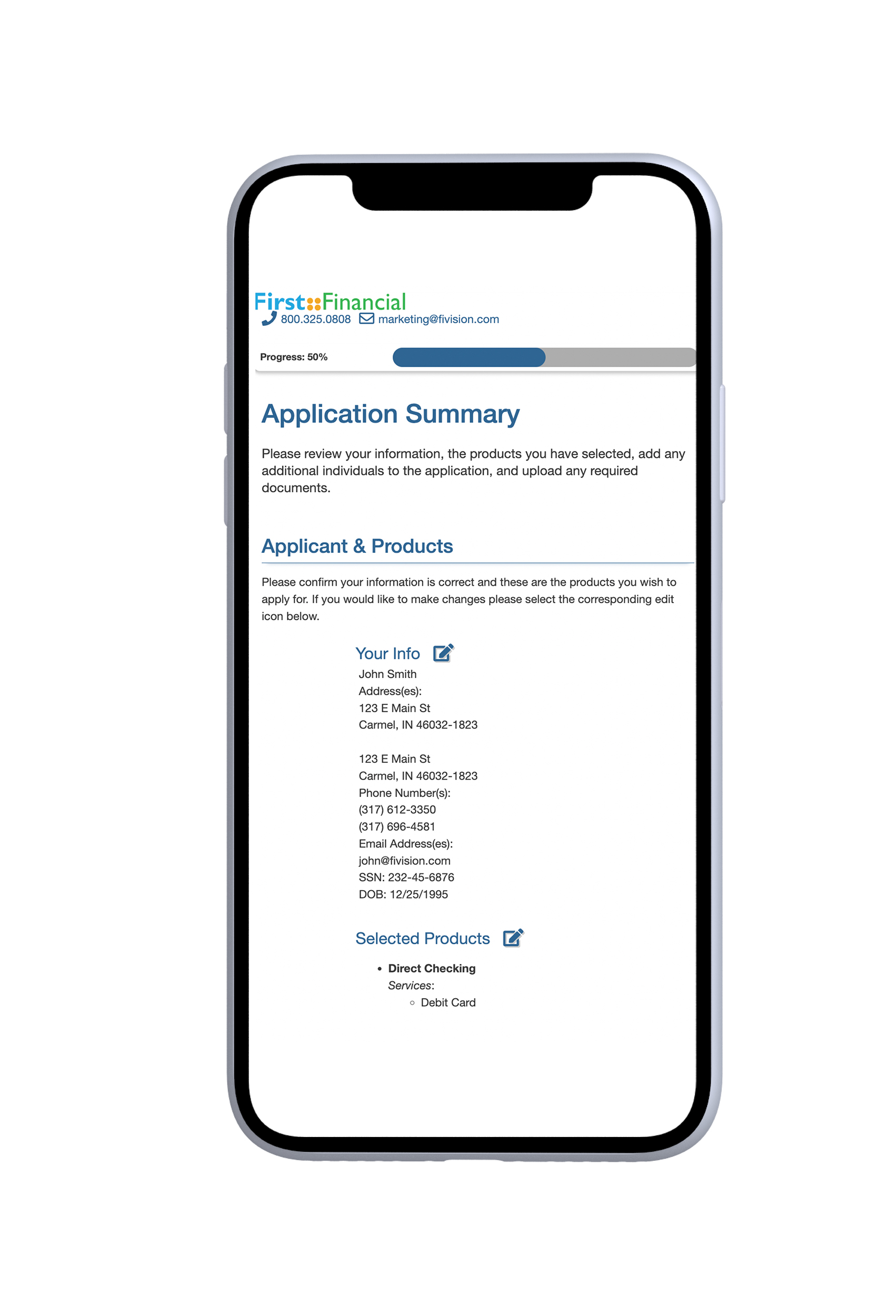

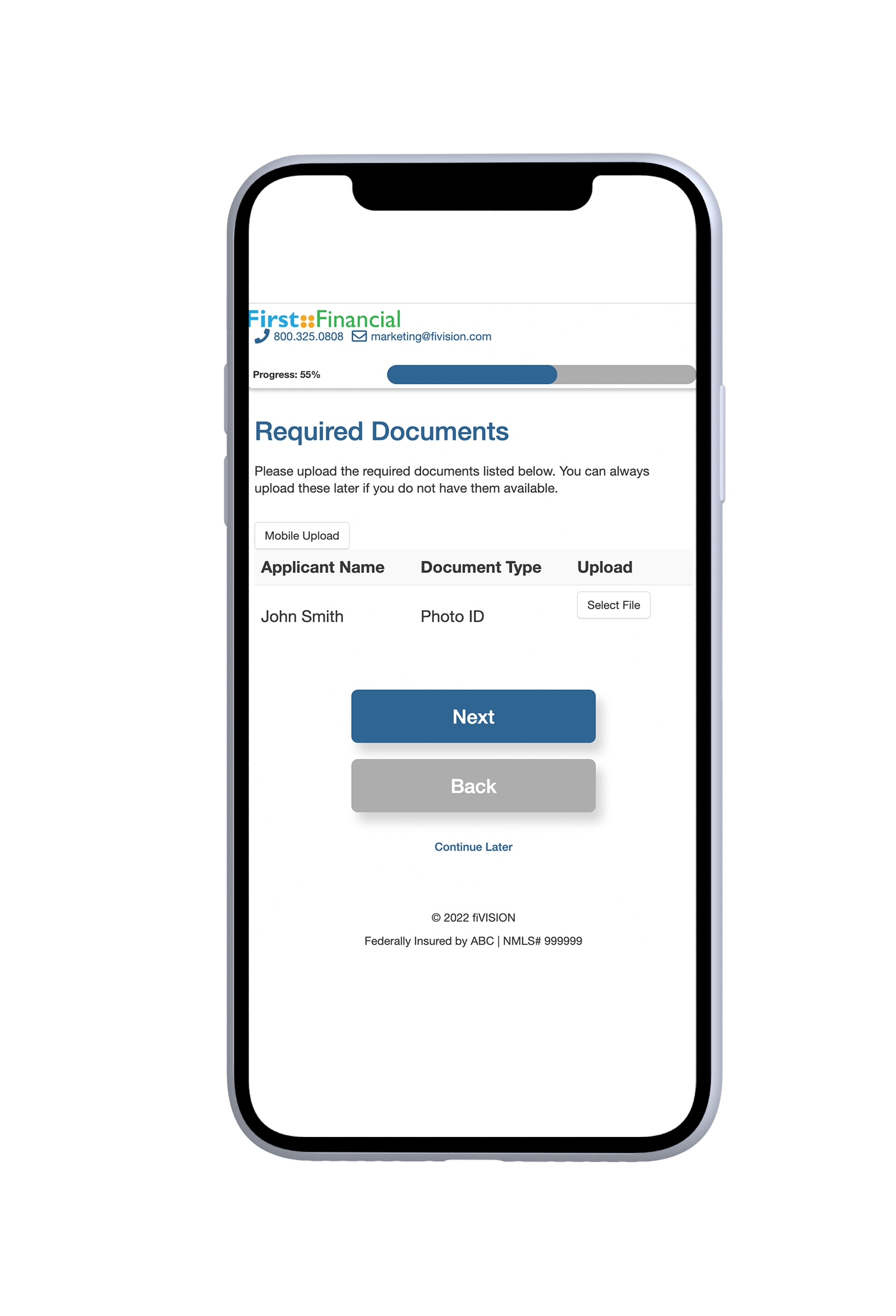

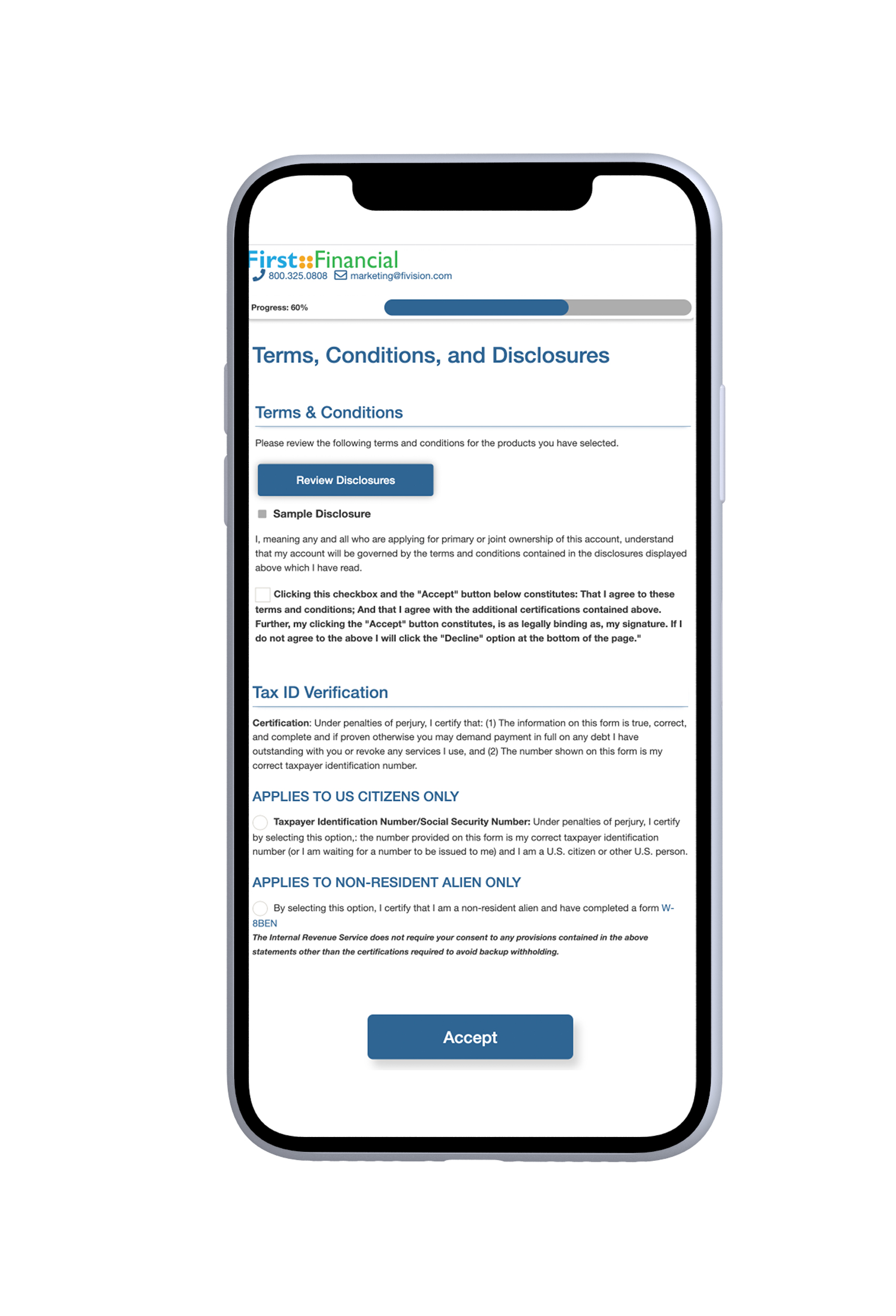

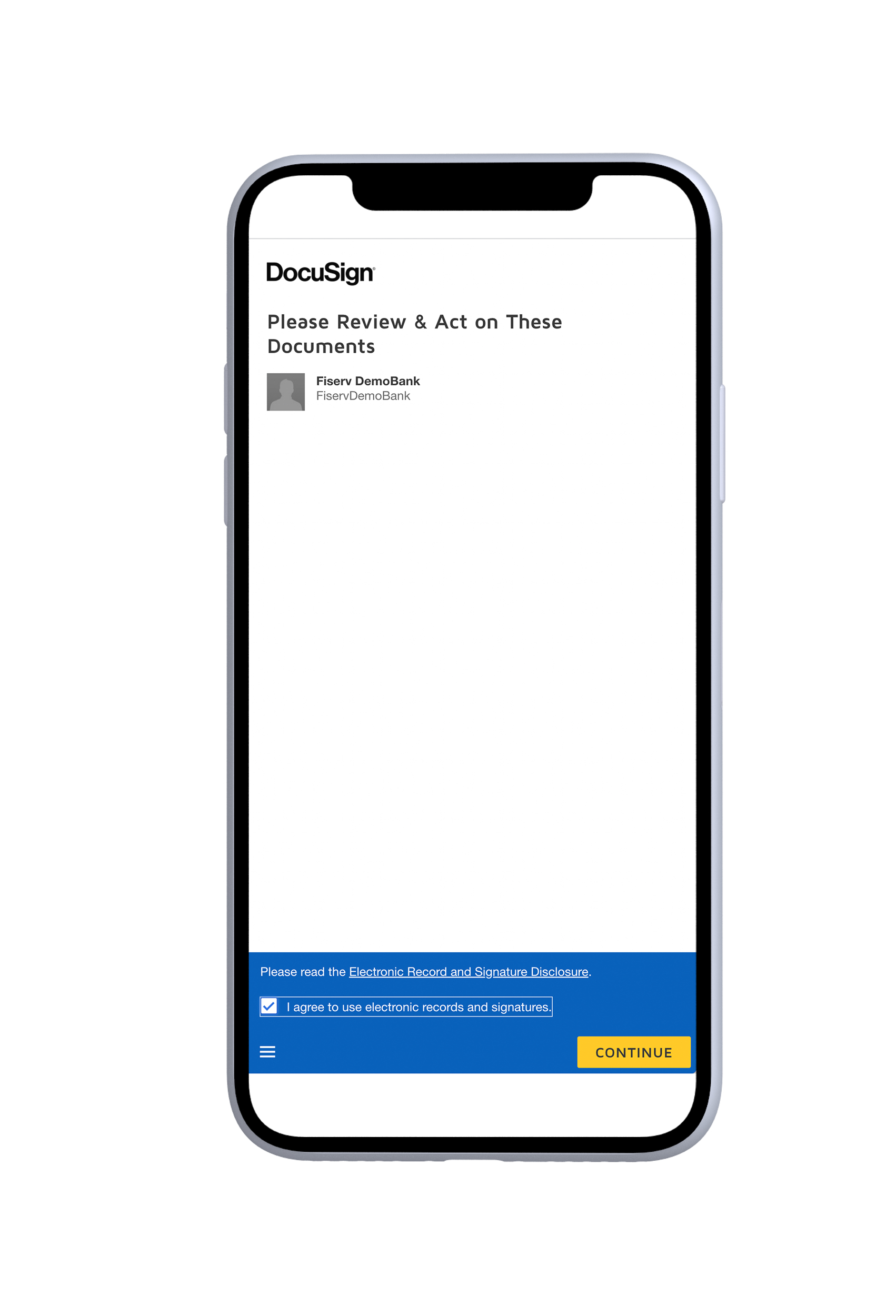

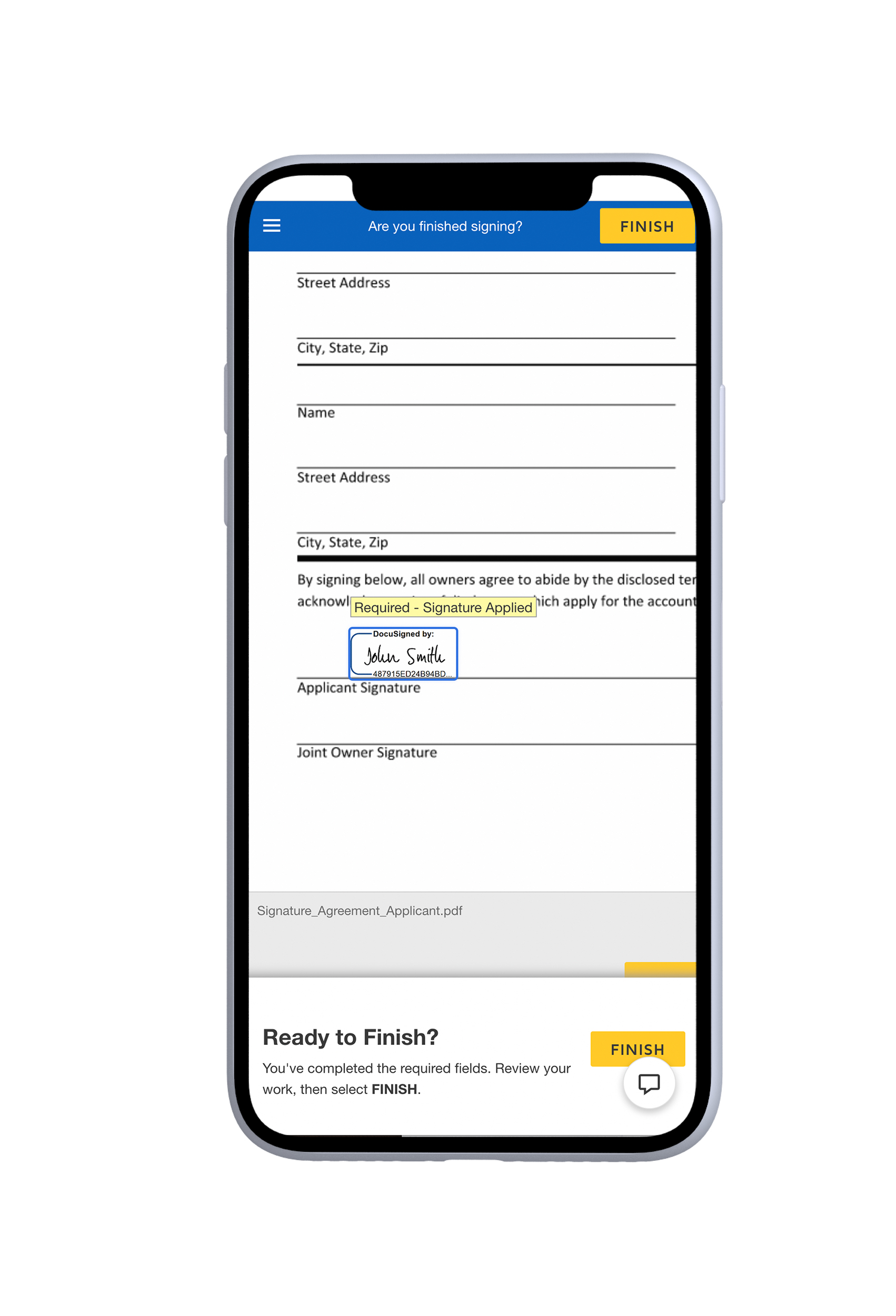

Whether your customers are visiting your bank in-branch or on its website, you’re able to offer them a superior application experience with SecureOPEN. Existing customers can add new accounts and new customers can enroll using one application that can be tailored to the messaging and flow desired by your bank. Online applications can be entered at any time from any device, including desktop, laptop, tablet, or smartphone.

Click each screenshot to zoom in.

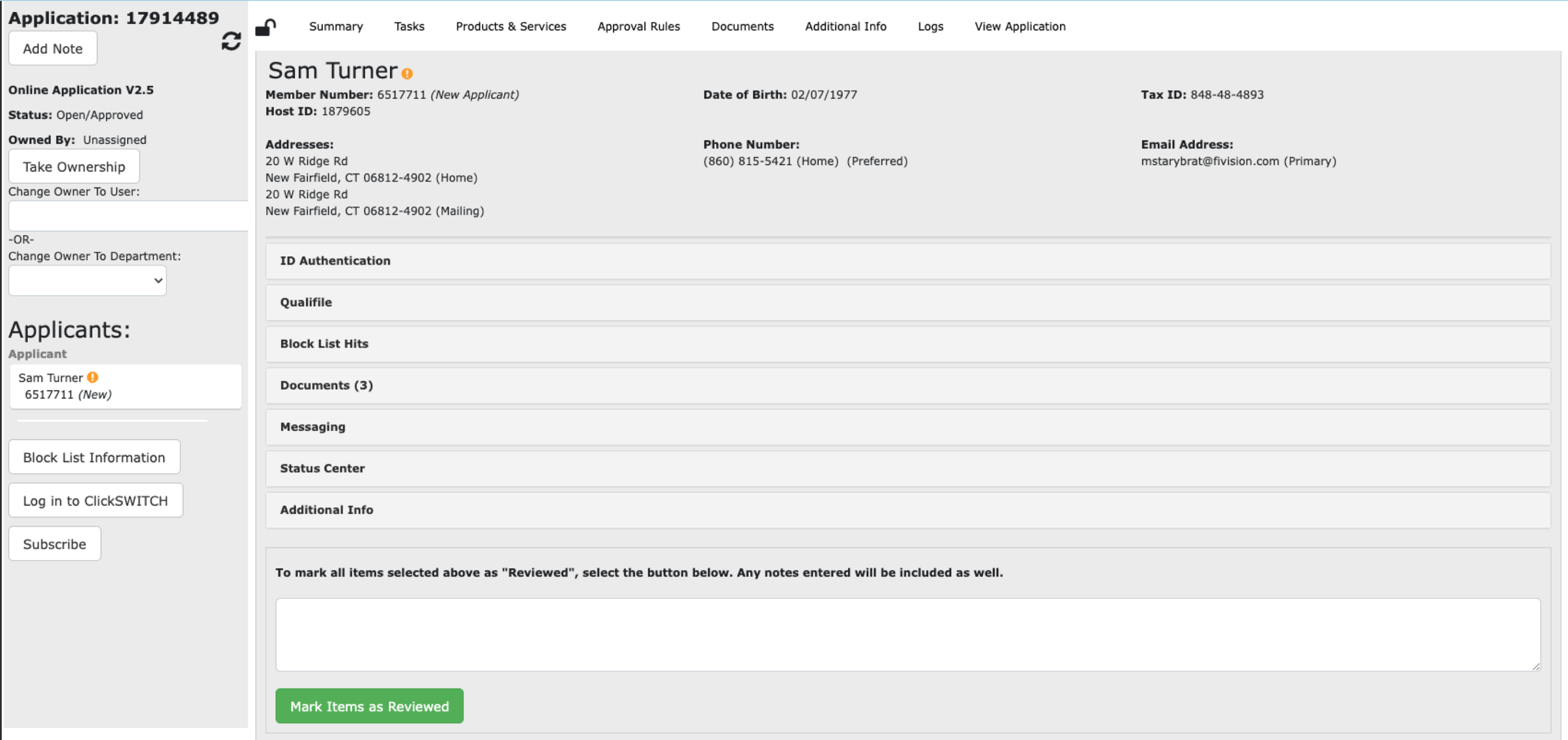

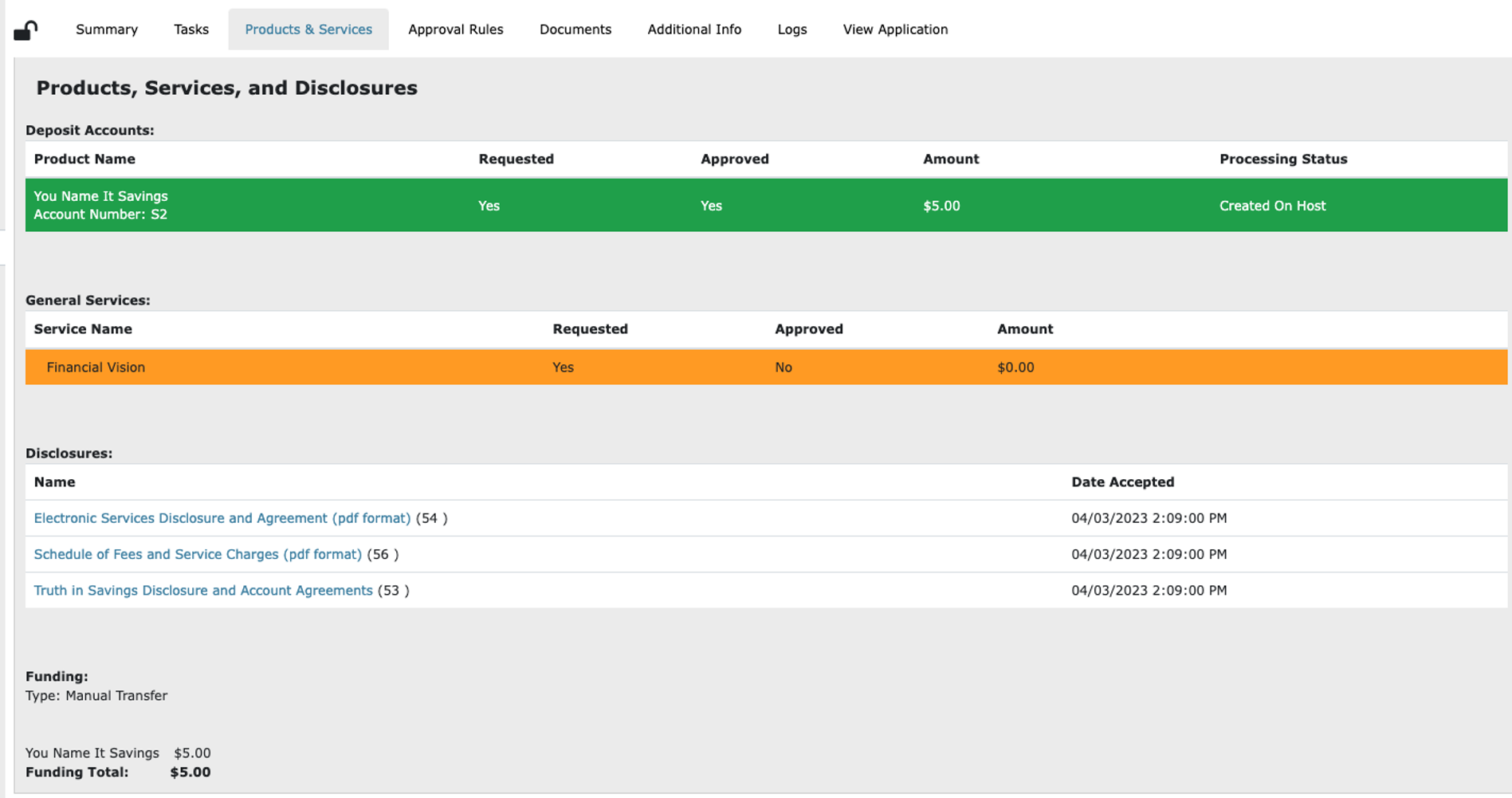

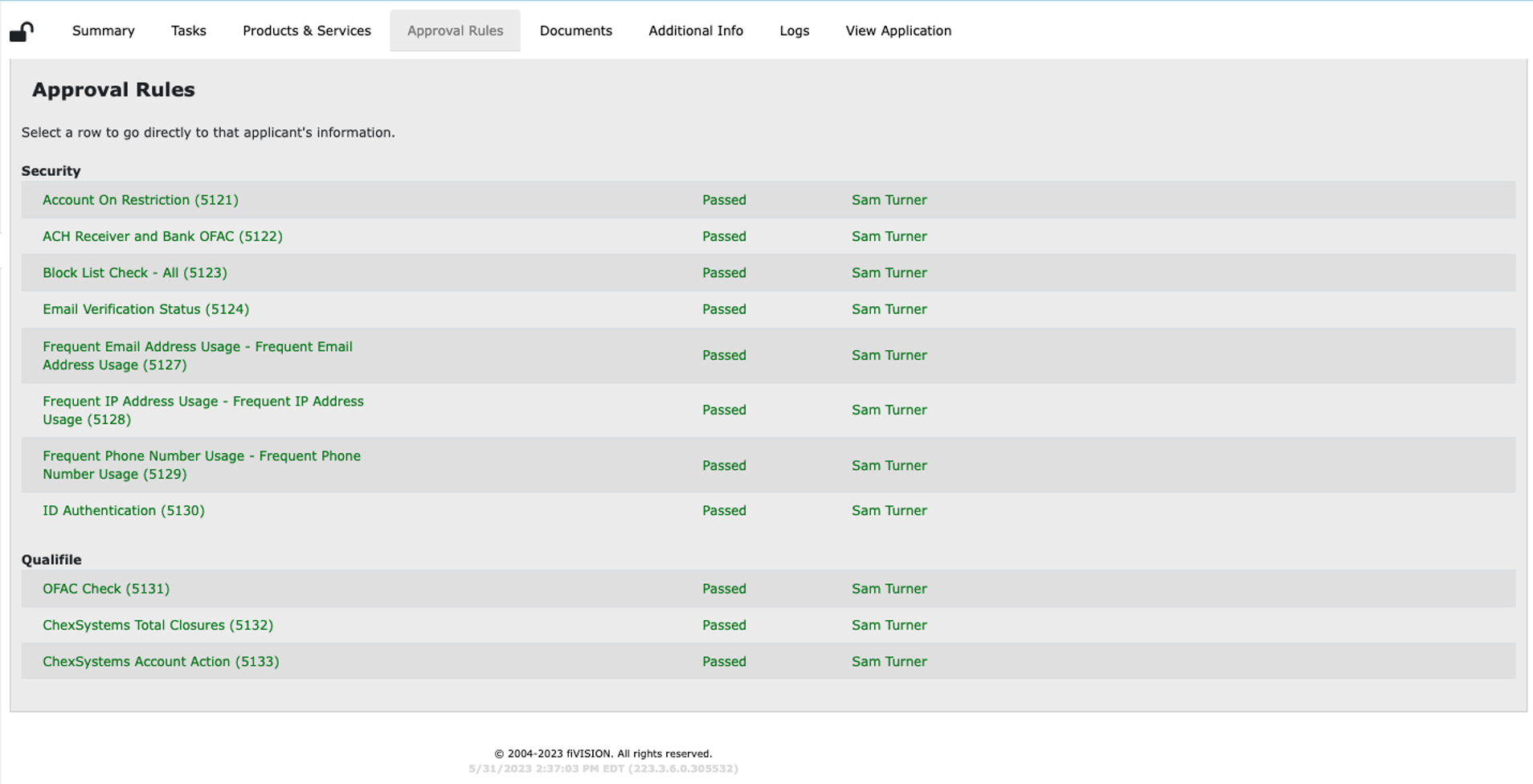

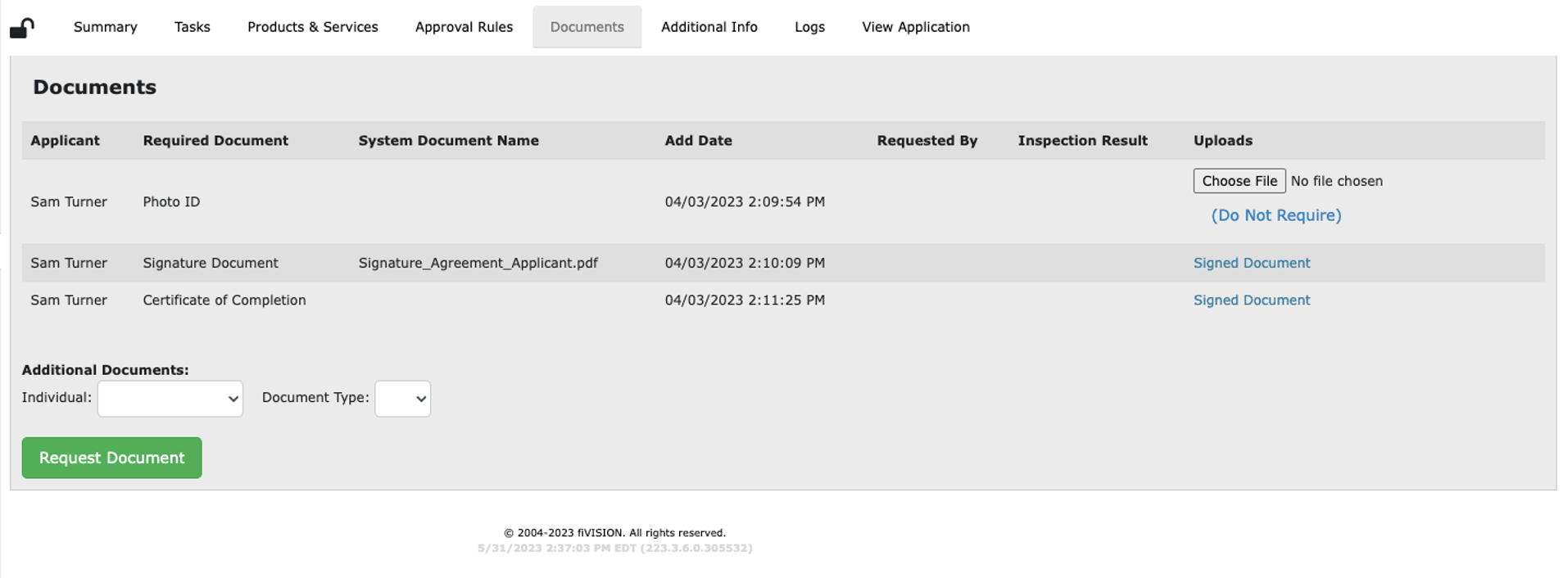

Manage New Accounts in One System

With SecureOPEN’s management console, your bank can process applications more easily and maintain compliance.

Its built-in automation capabilities and integrated decision engine eliminate manual and complex tasks, and help you complete key items on time with less human error. Furthermore, your bank can set up approval rules for each of your workflows and products, so you can seamlessly verify and authenticate customers.

- Enable authorized users with unique credentials and system privileges.

- Store and access applications on a real-time basis for review and processing.

- Pull Qualifile® – ChexSystems® from FIS, credit reports from Experian, Equifax, and TransUnion, along with OFAC and ID Verification from LexisNexis.

- Configure reports on a wide array of dynamic system data.

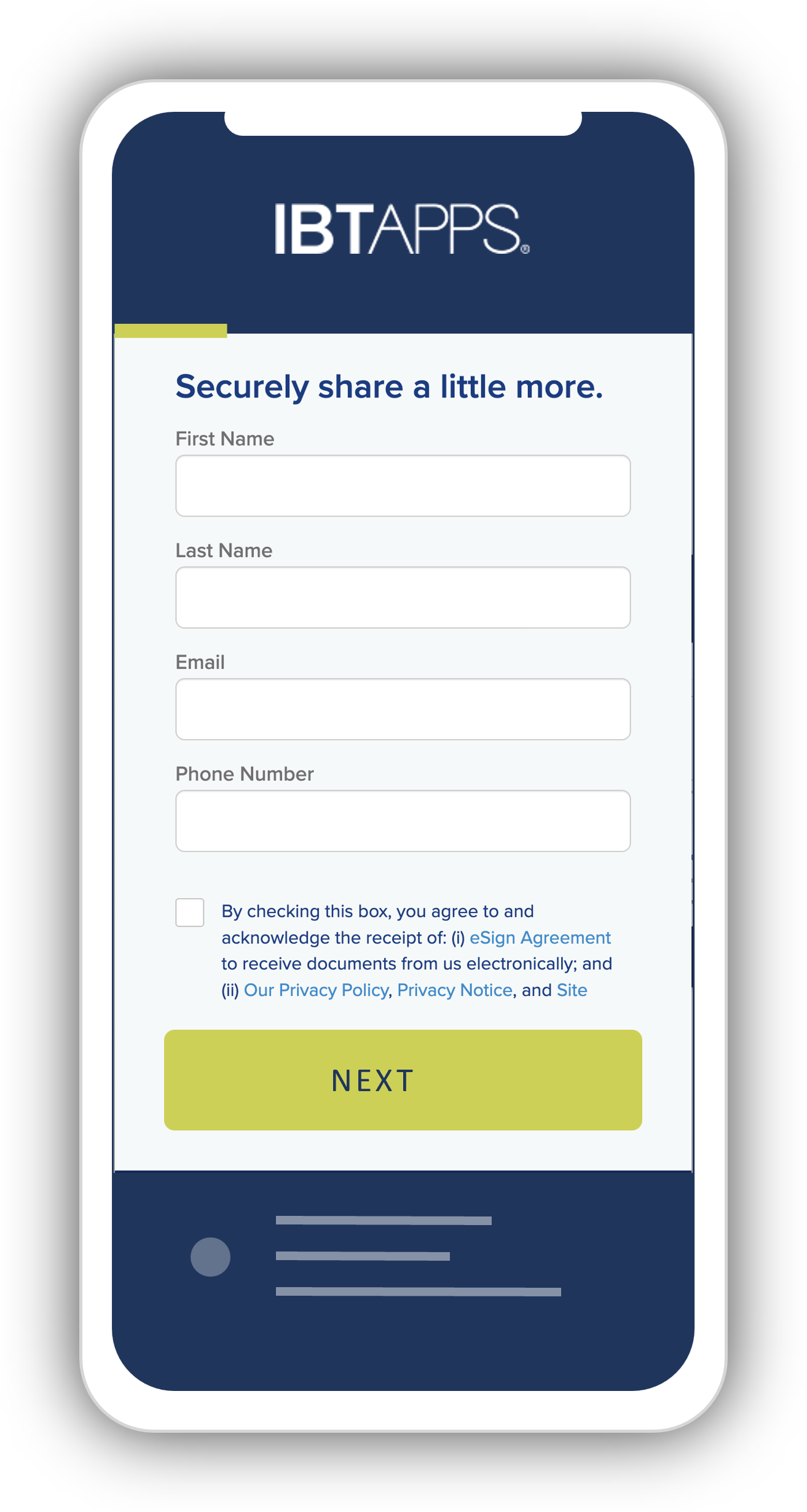

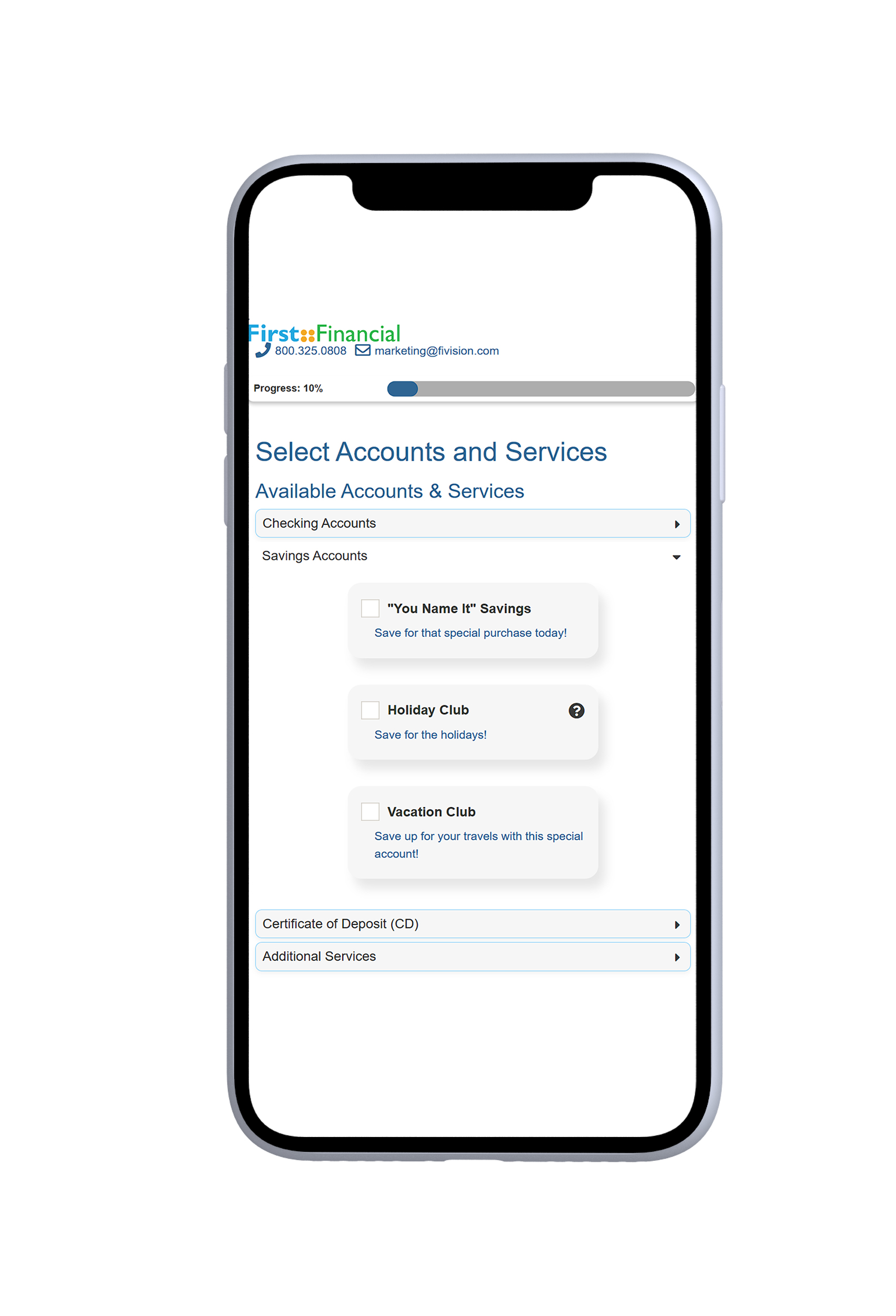

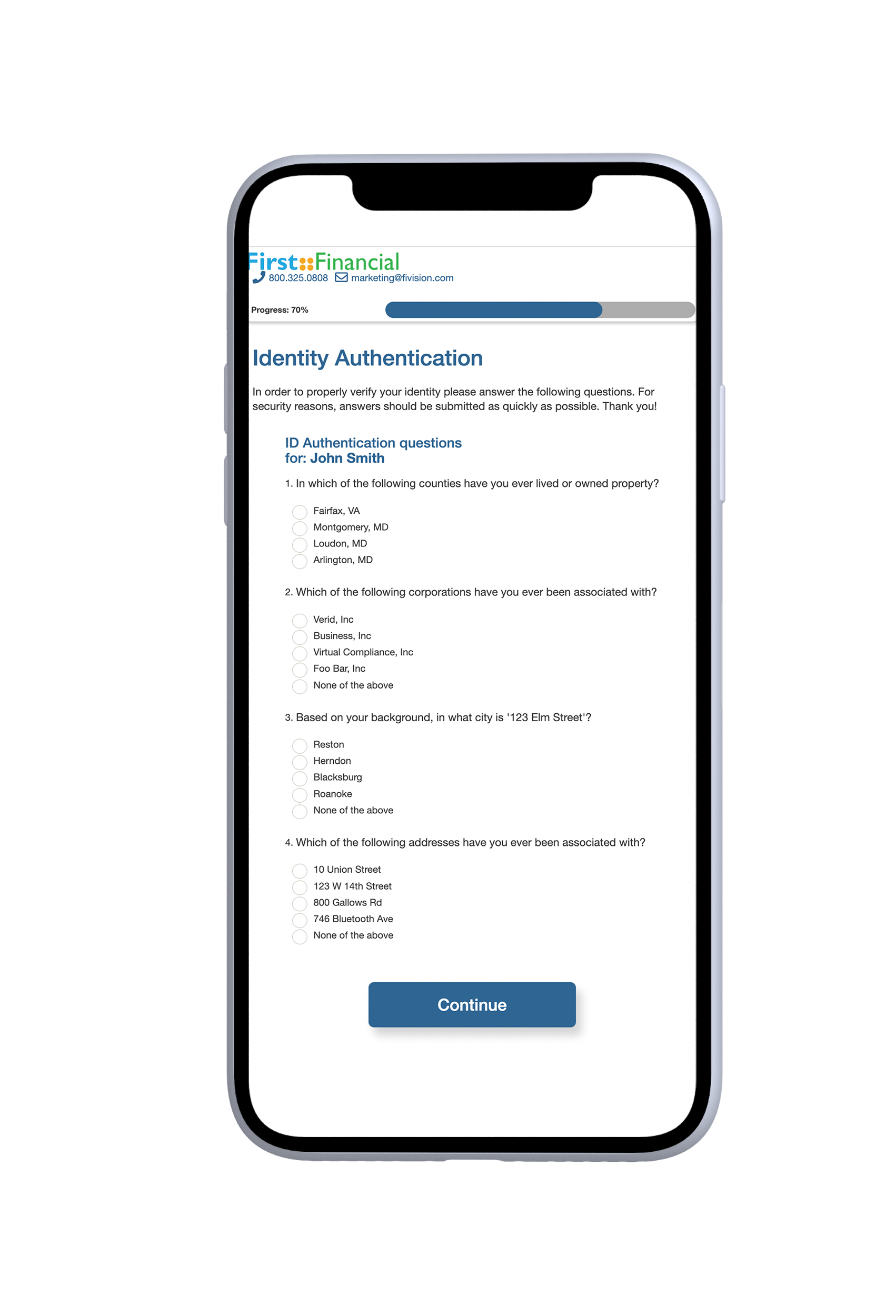

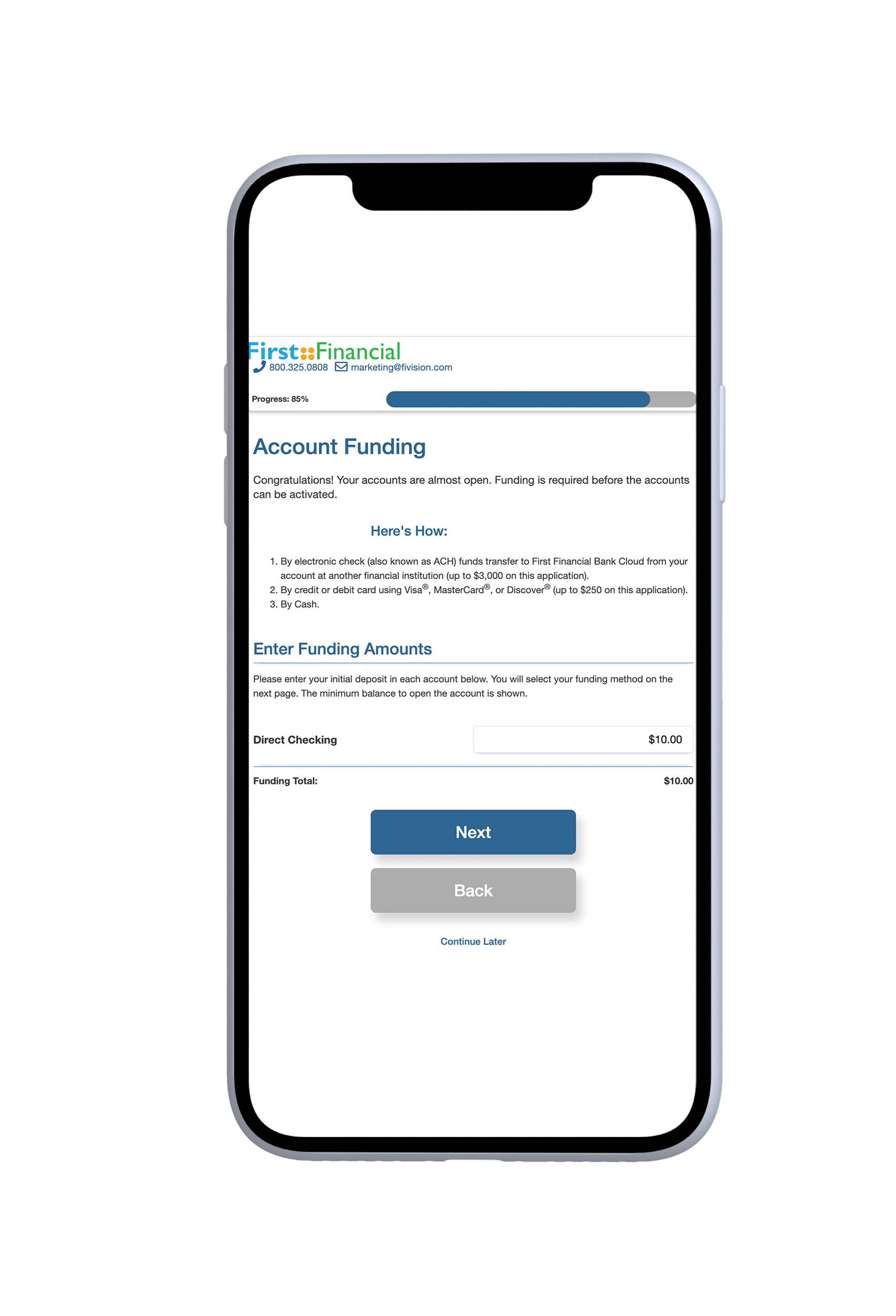

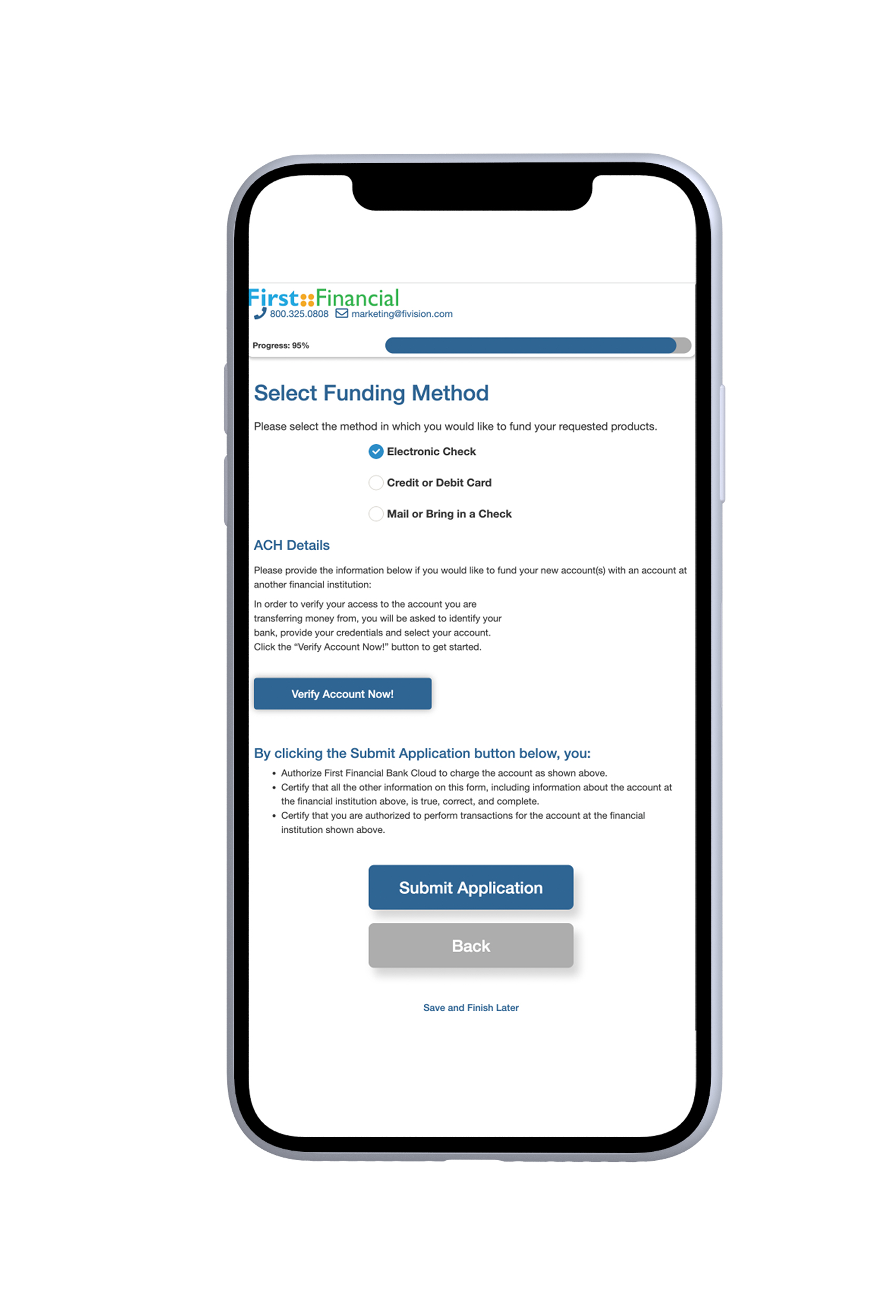

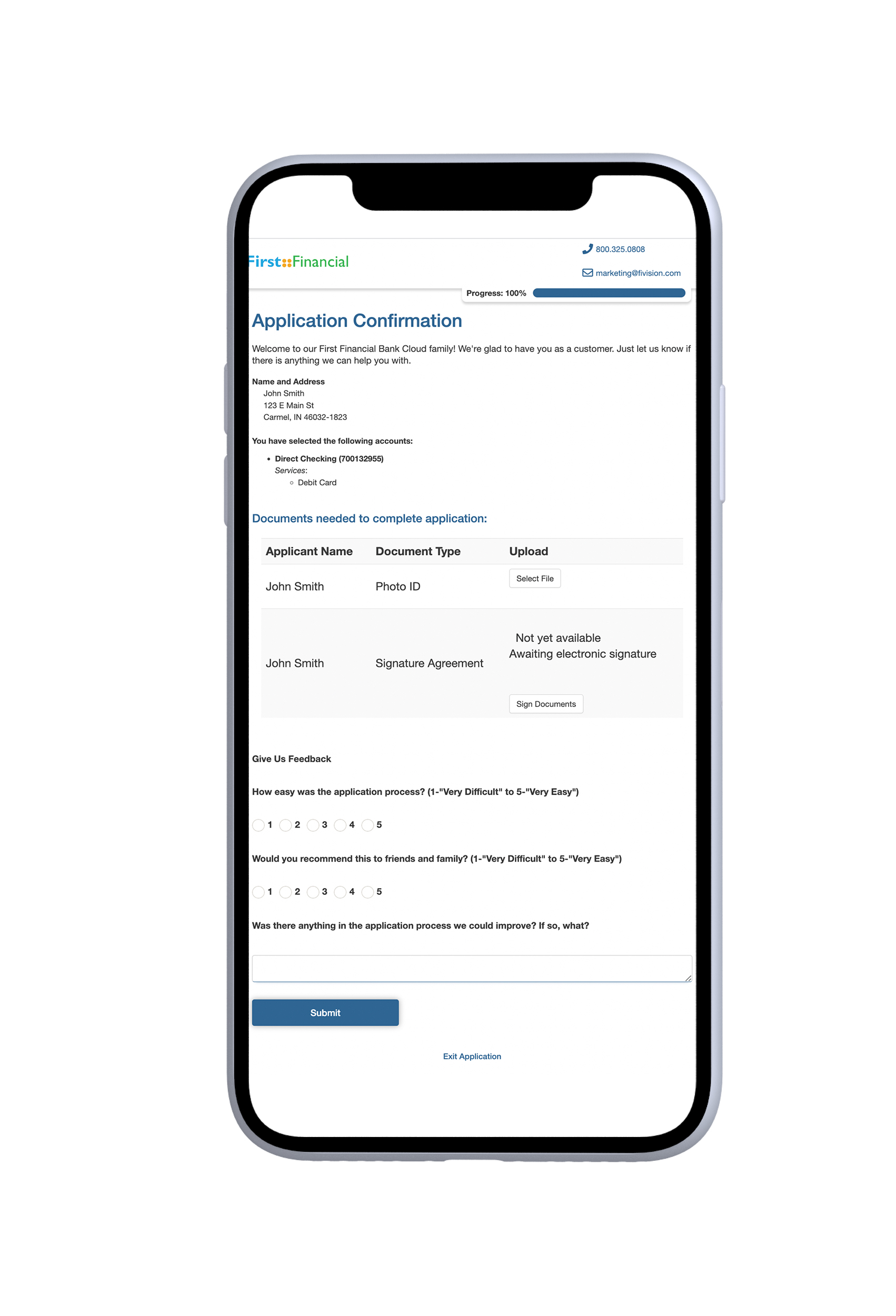

Offer Your Customers a Simplified Online Application

SecureOPEN gives your customers the freedom and convenience to apply for new accounts online without having to walk into a branch.

With an intuitive interface, diverse account and funding options, automated verifications and approvals, and e-signature tools, your customers can open personal accounts with ease.

- Give customers access to flexible funding options, while still maintaining control.

- Provide customers with the ability to check their application status or to save their applications to complete later.

- Use SecureOPEN’s secure messaging tool to communicate with customers.

- Take advantage of e-signature to send documents to your online customers.

Click each screenshot to zoom in.

Maintain Data Integrity When You Integrate SecureOPEN With

IBT Apps’ i2Suite Core Platform

SecureOPEN is integrated with IBT Apps’ premier core platform, i2Suite, enabling bankers to create, update, and verify customer information while updating core in real time. This not only boosts productivity, but it also minimizes human error, resulting in a more efficient, accurate, and reliable banking system. Moreover, this seamless core integration mitigates compliance risk, helping community banks meet and stay ahead of regulatory requirements and maintain a positive market reputation.

It’s Time to Simplify the Account Opening Process for Your Bank

Connect with us to discuss SecureOPEN.