Maximize productivity and profitability with our compliant, all-in-one lending platform

SecureLEND, our cloud-based, loan origination platform, is designed to grow your lending capabilities without adding staff.

With a modern interface, automated capabilities, and built-in compliance standards, SecureLEND attracts new customers and small businesses with a simplified application process and enables your bank to complete activities such as credit retrievals, underwriting, and documentation in one platform.

With SecureLEND, you can expect to:

Delight Your Customers

Enable your customers to conveniently apply for loans directly from your website, enhancing their experience and increasing engagement.

Build Efficient Closing Procedures

Offer flexible in-house or remote closings with e-signature capabilities, complete with a secure audit trail.

Manage Approvals in One Place

Have the option to send letters for approvals and declines automatically, and create counteroffers as needed.

Automate Data Collection

Get set up for success with automated HMDA, HOEPA, HPML, and other HUD data collection for required reporting.

Meet Compliance Standards

Ensure compliance with regulatory standards by maintaining consistent underwriting practices, reducing the risk of compliance-related issues and penalties.

Drive Cost-Effective Growth

Minimize manual processing costs and cut delivery time with built-in automation capabilities, and increase revenue with cross-selling opportunities based on customer need.

Optimize Your Loan Origination Process From Start to Finish

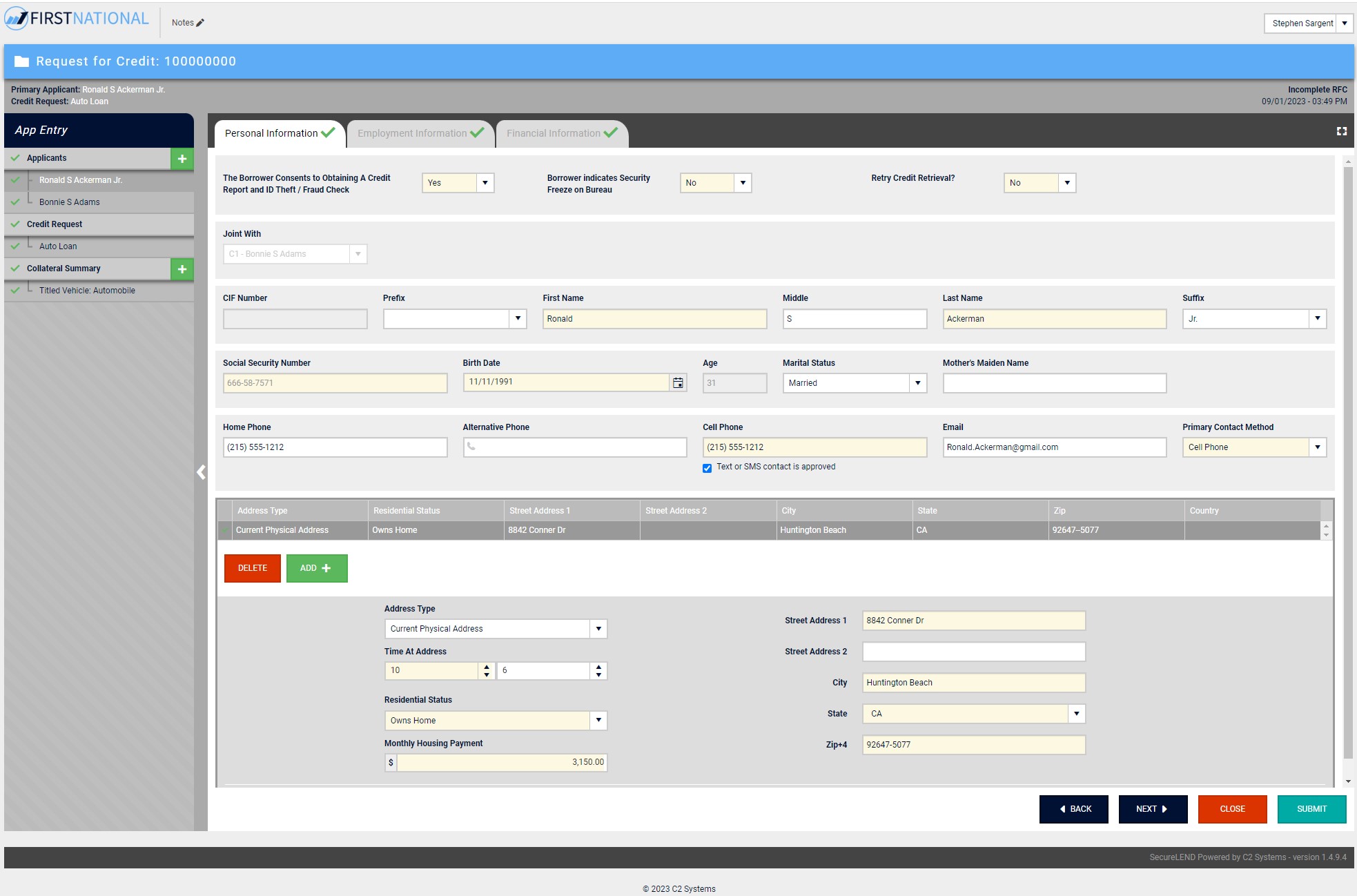

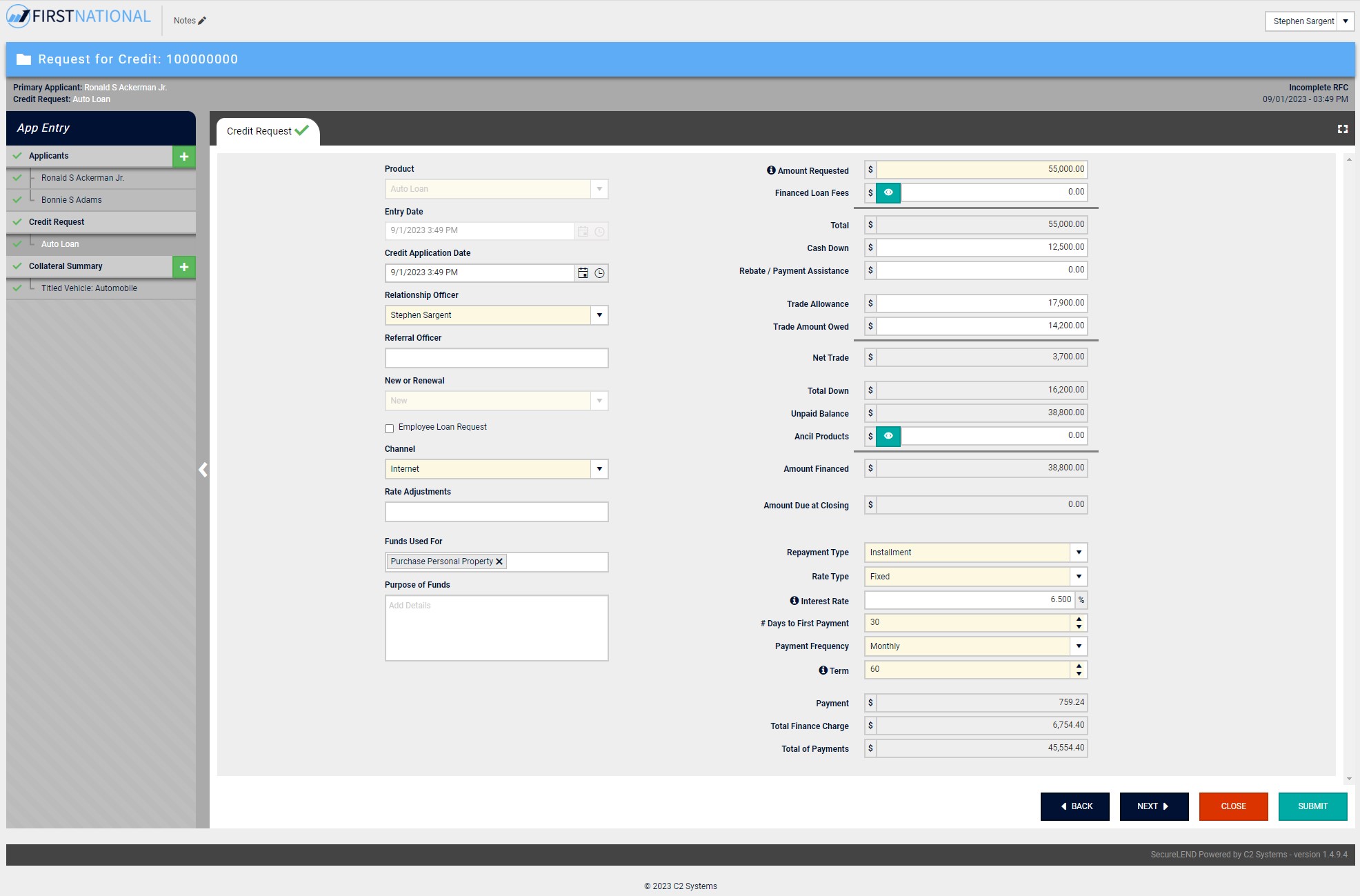

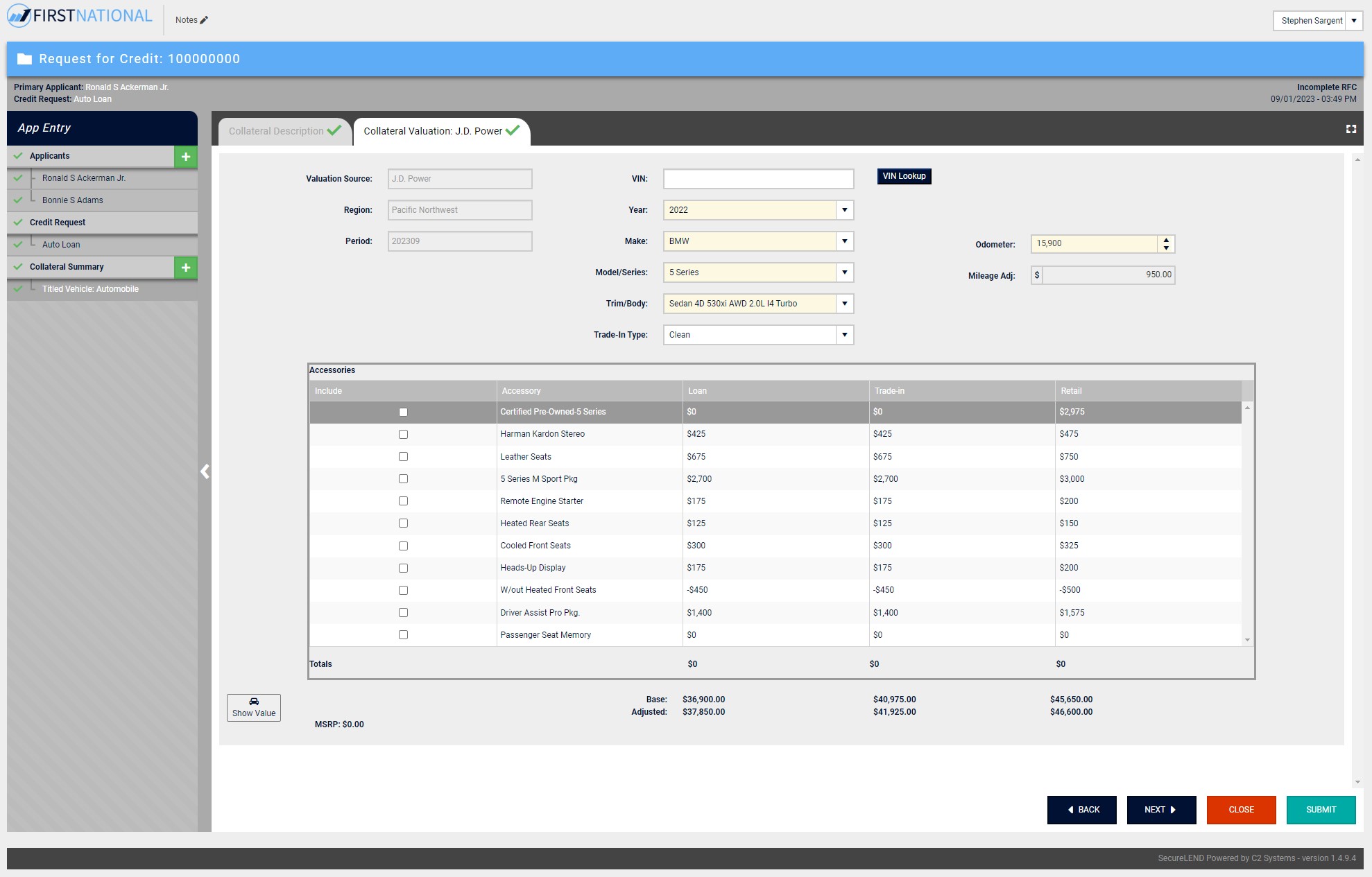

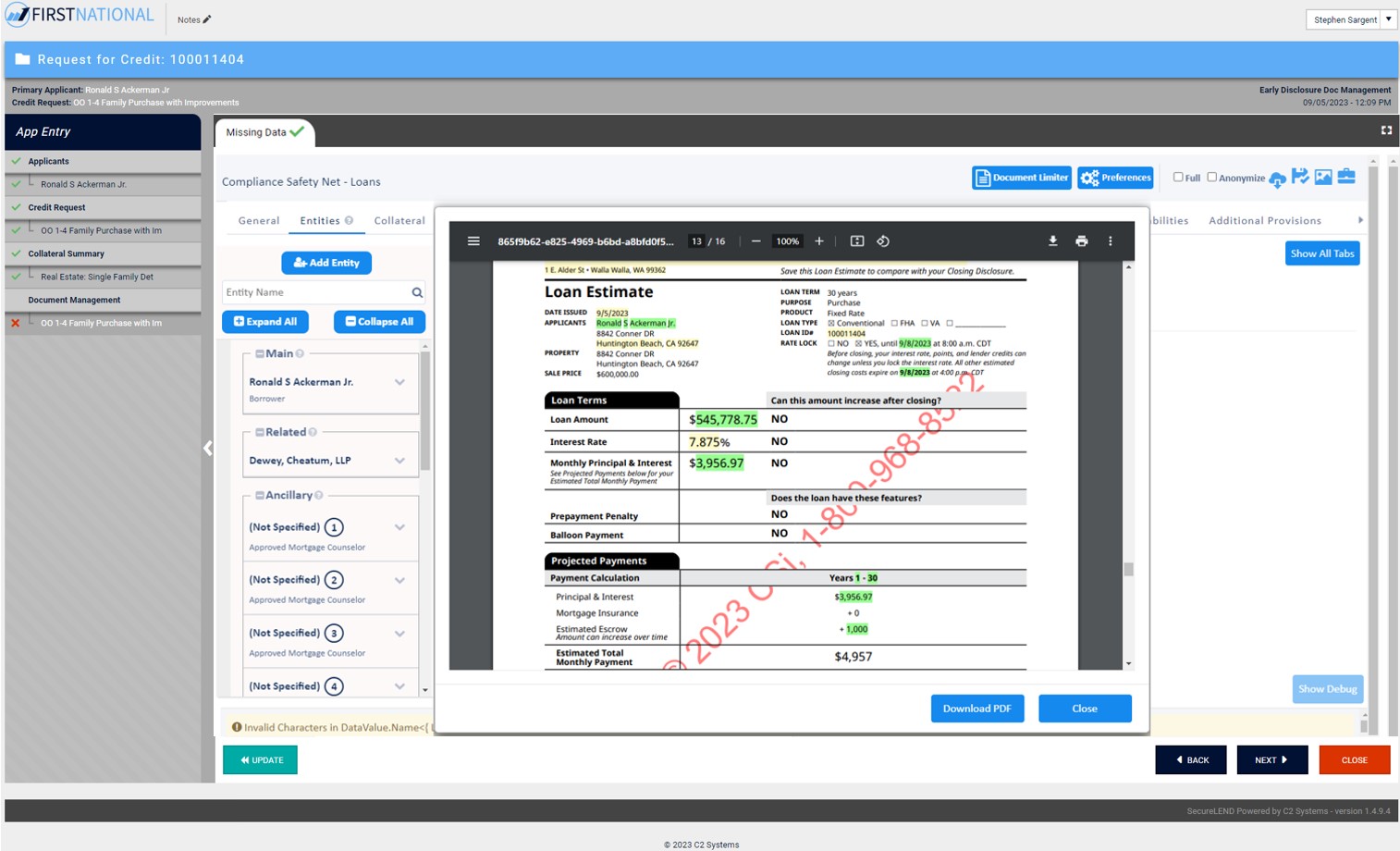

App Entry

Once a record is opened for app entry, SecureLEND provides the user with a collapsible navigation bar and roadmap for collecting details on the product being requested, the applicant’s personal, employment and financial information and collateral information.

Features include:

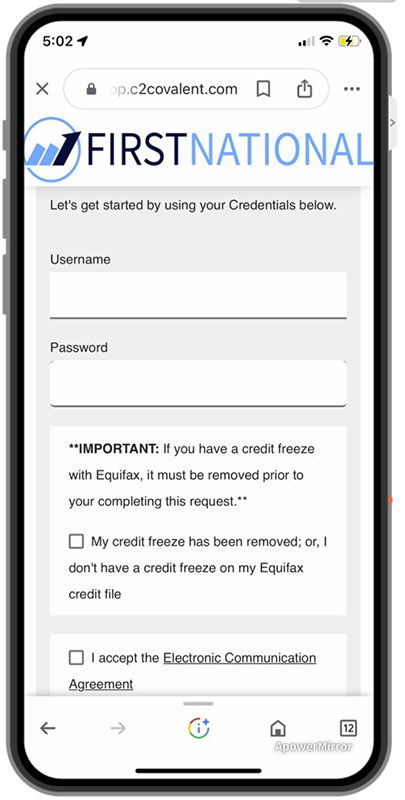

- Loan application entry available in-branch and online via desktop or mobile device.

- Customers can complete a loan application through the bank’s website.

- The ability to save an application and return later to complete (both by banker or customer).

- Access to all required information needed for loan application, including TRID.

Banker’s View

(In-Branch)

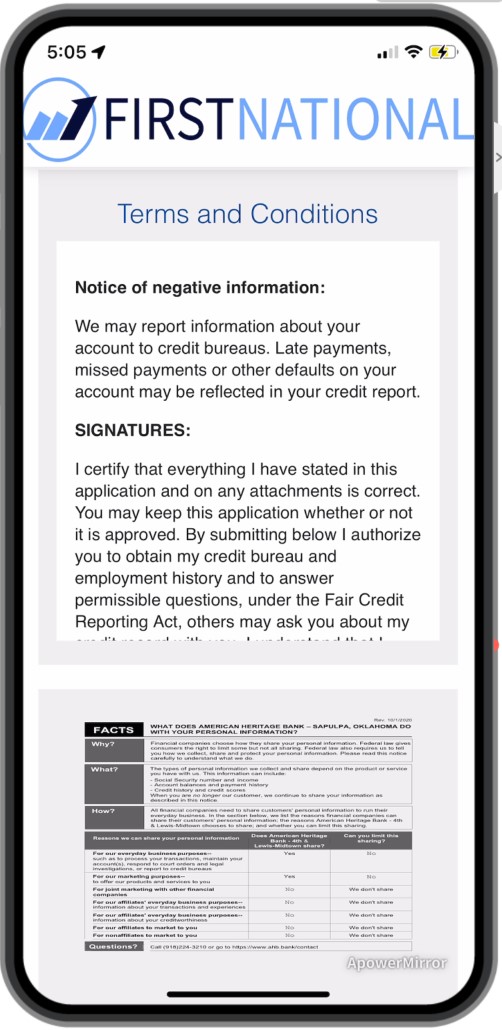

Customer View

(Mobile View)

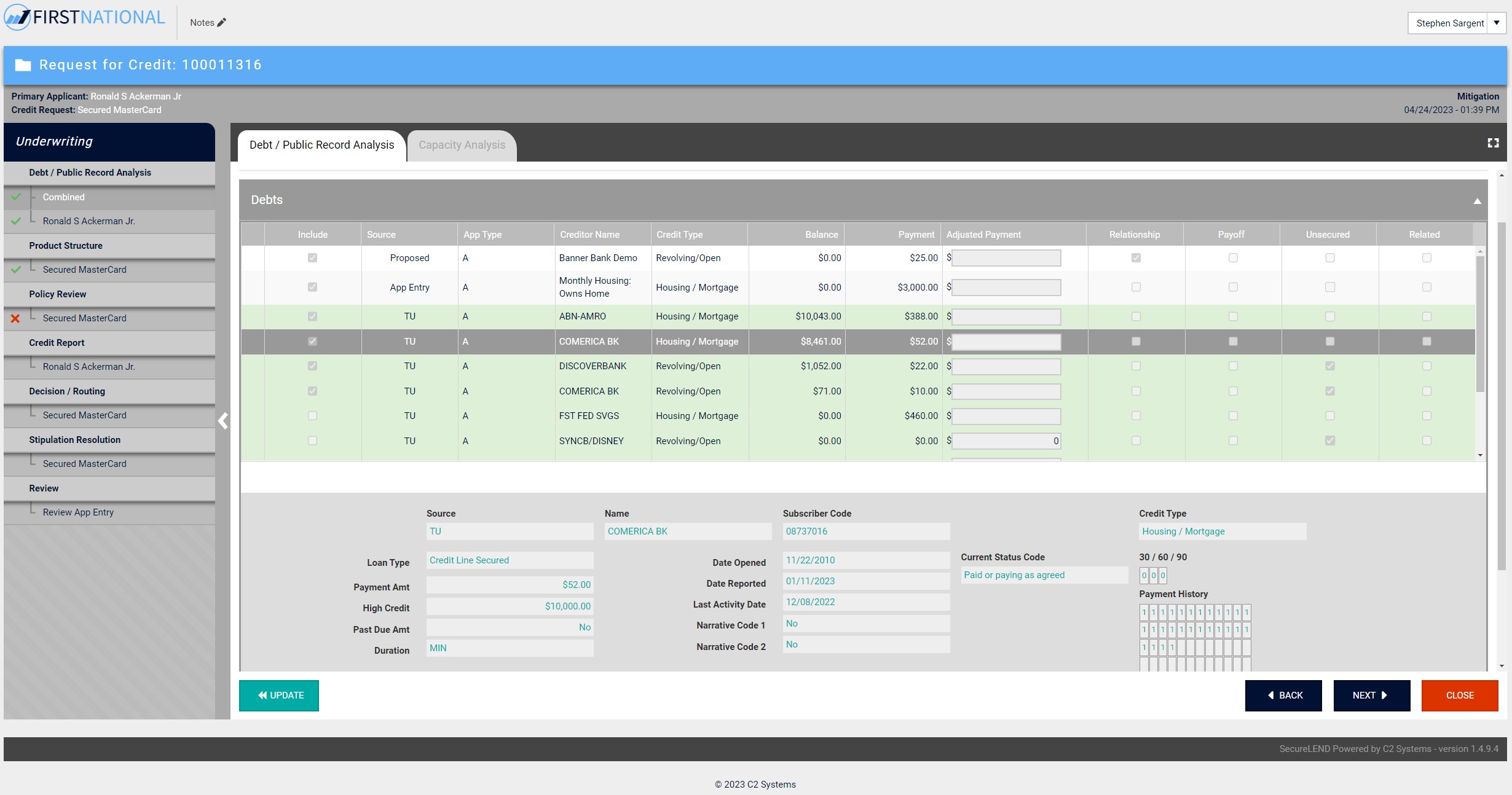

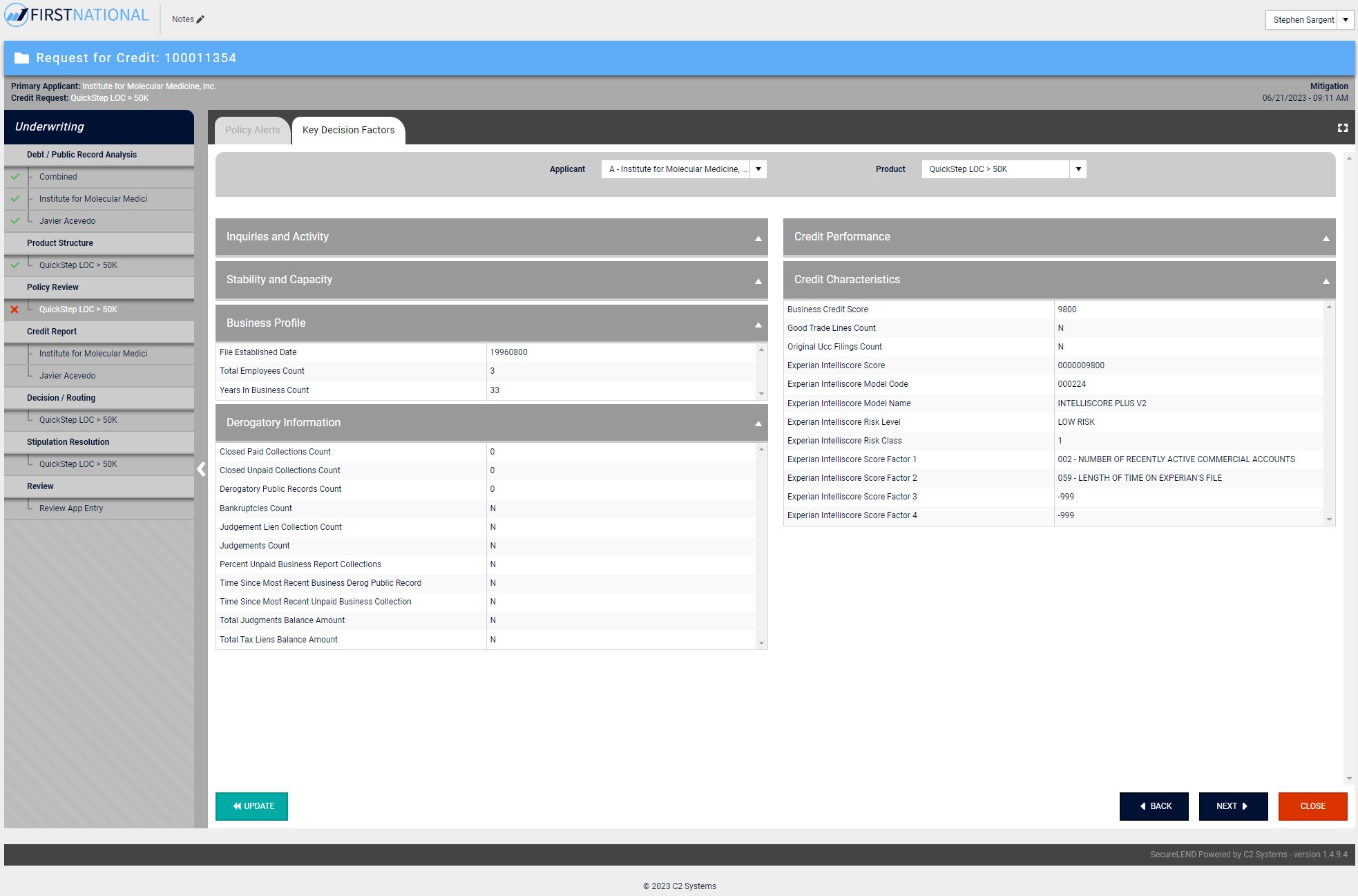

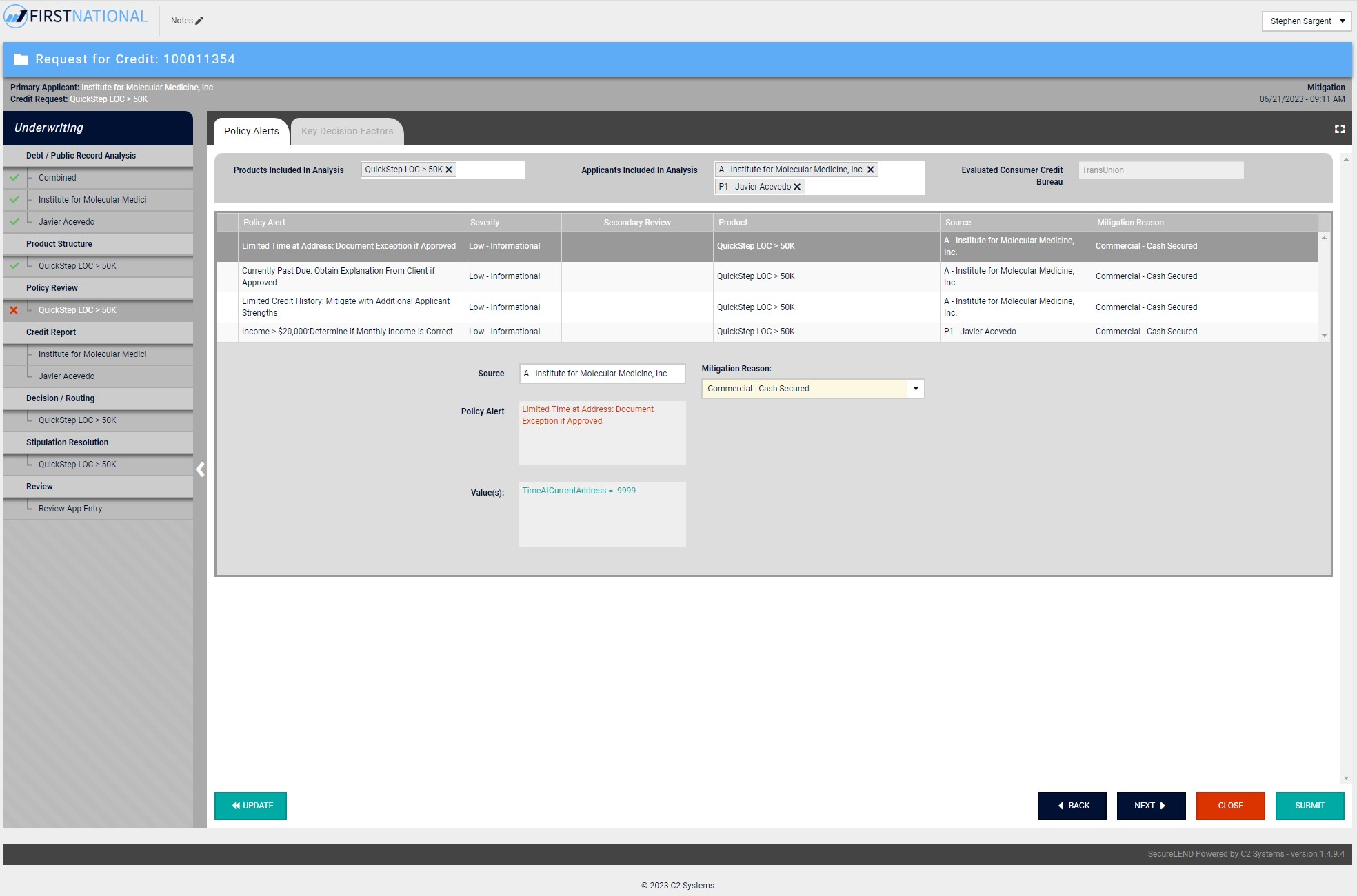

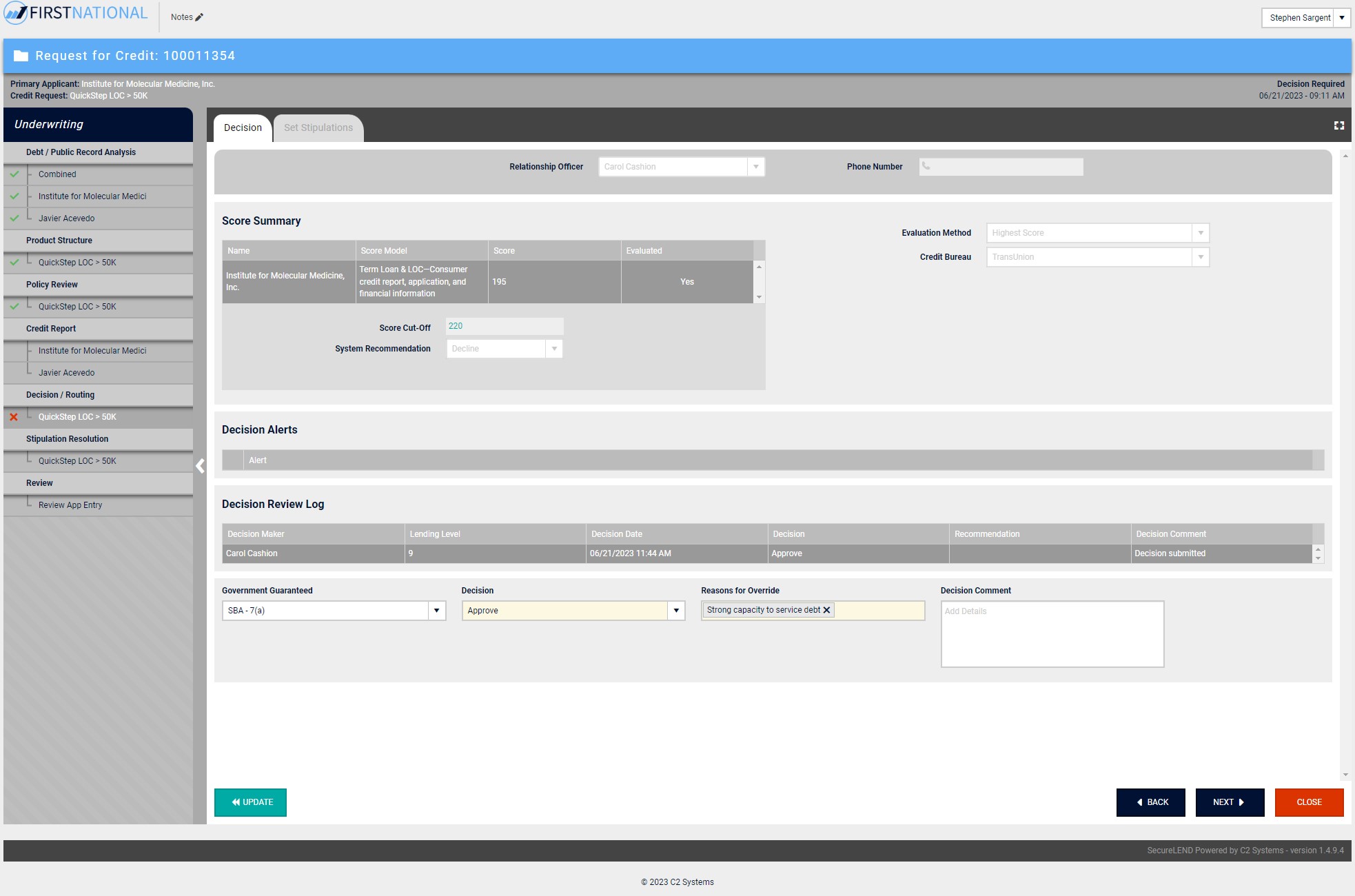

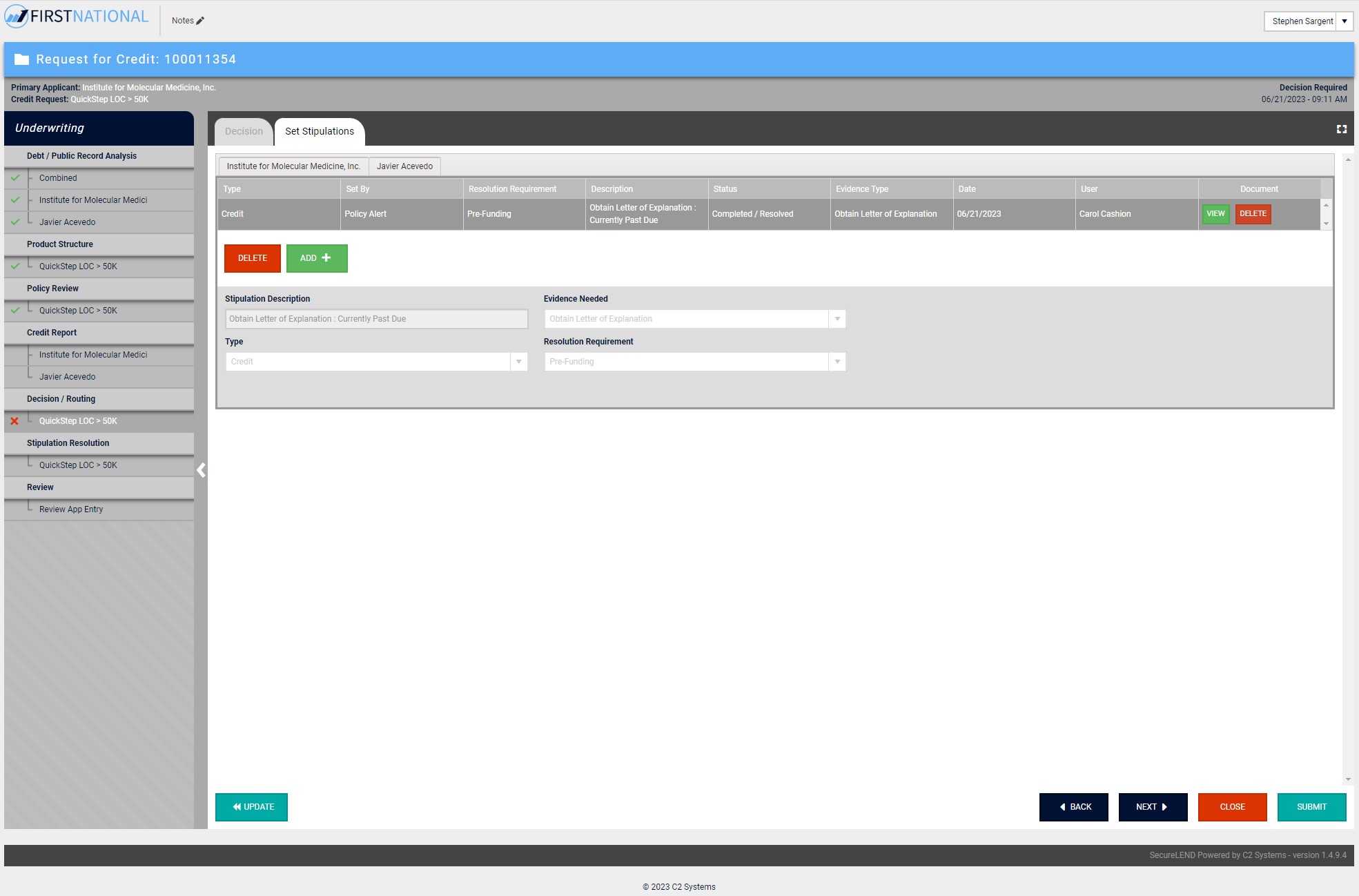

Underwriting

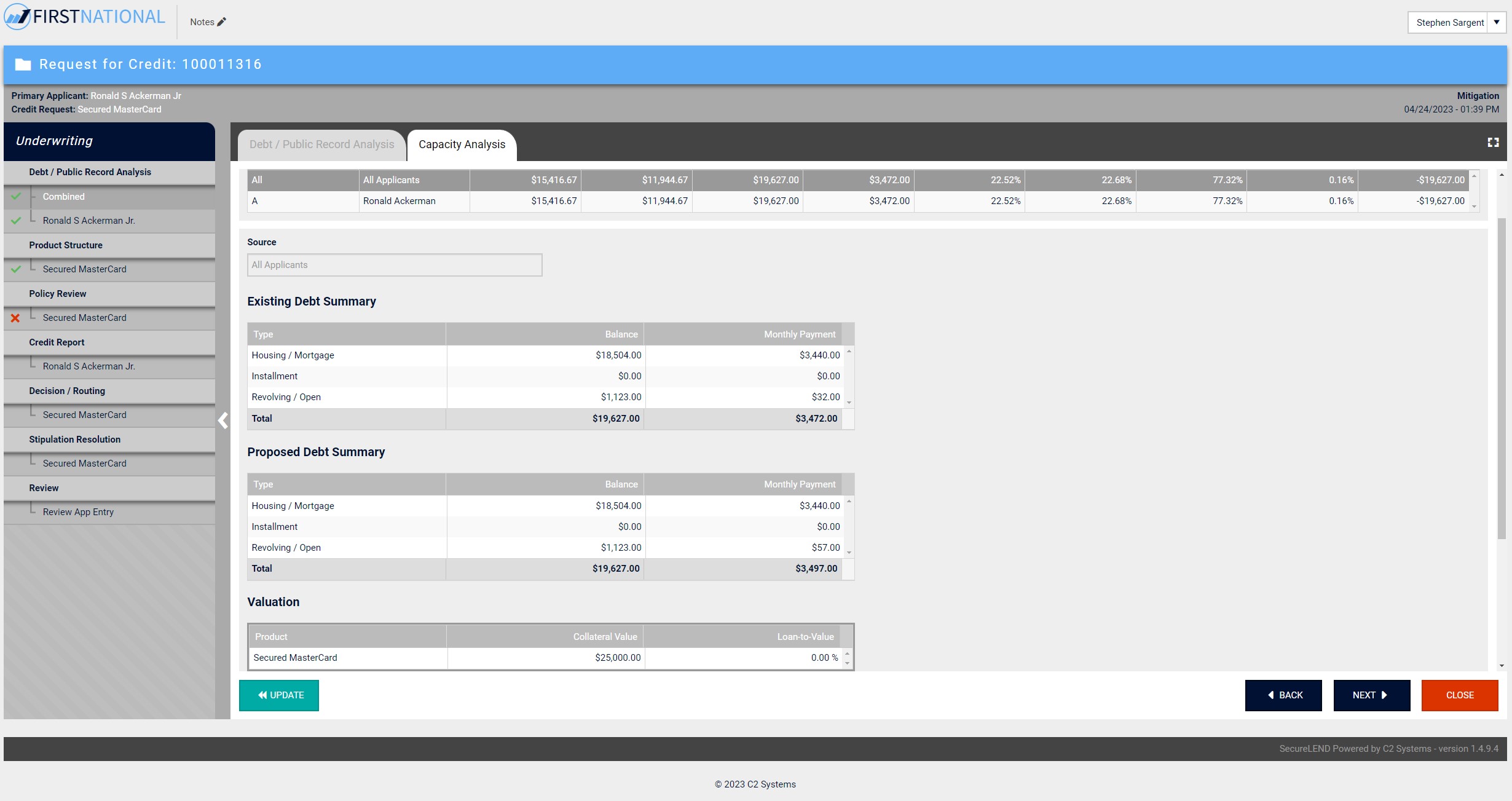

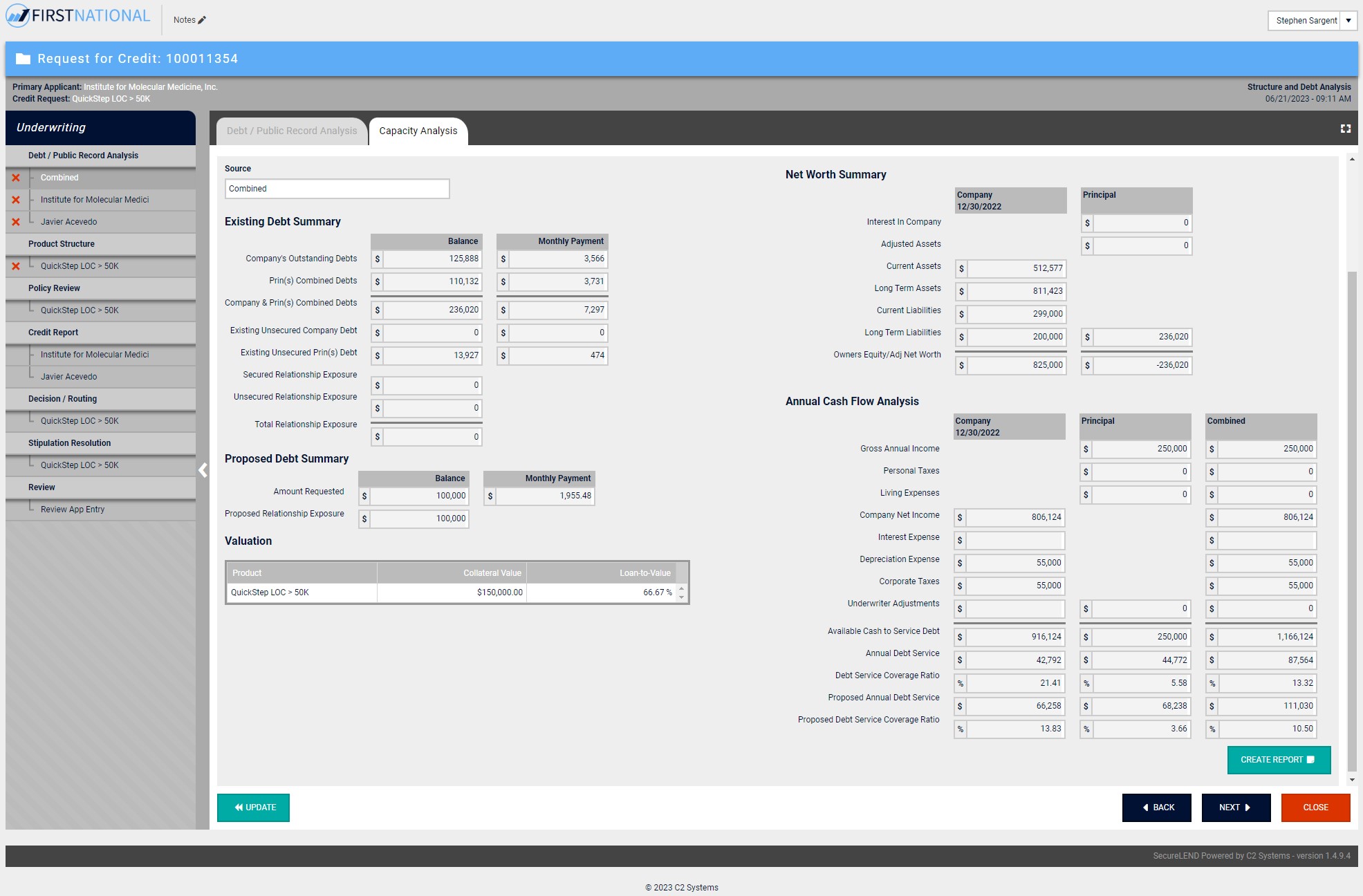

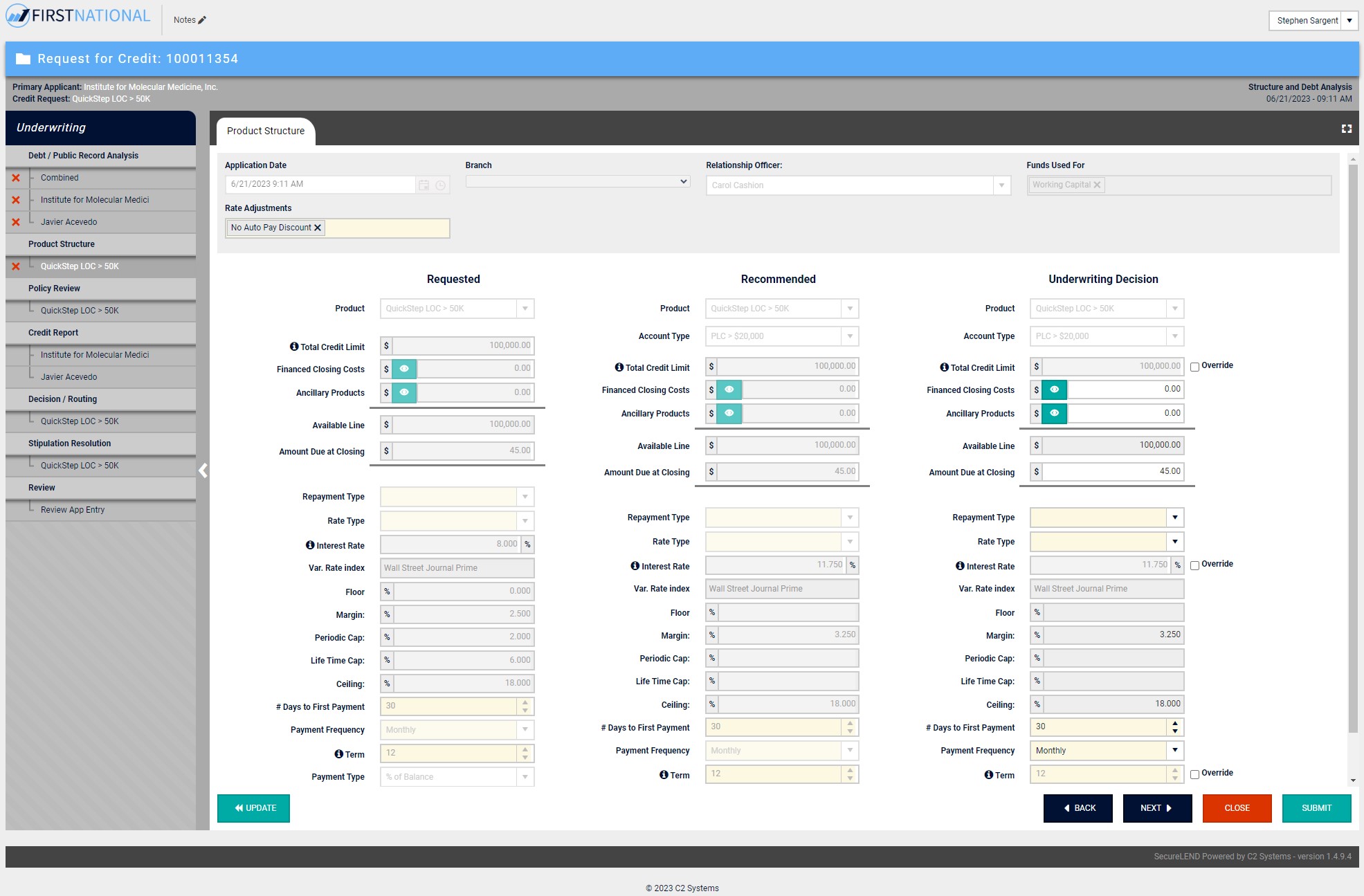

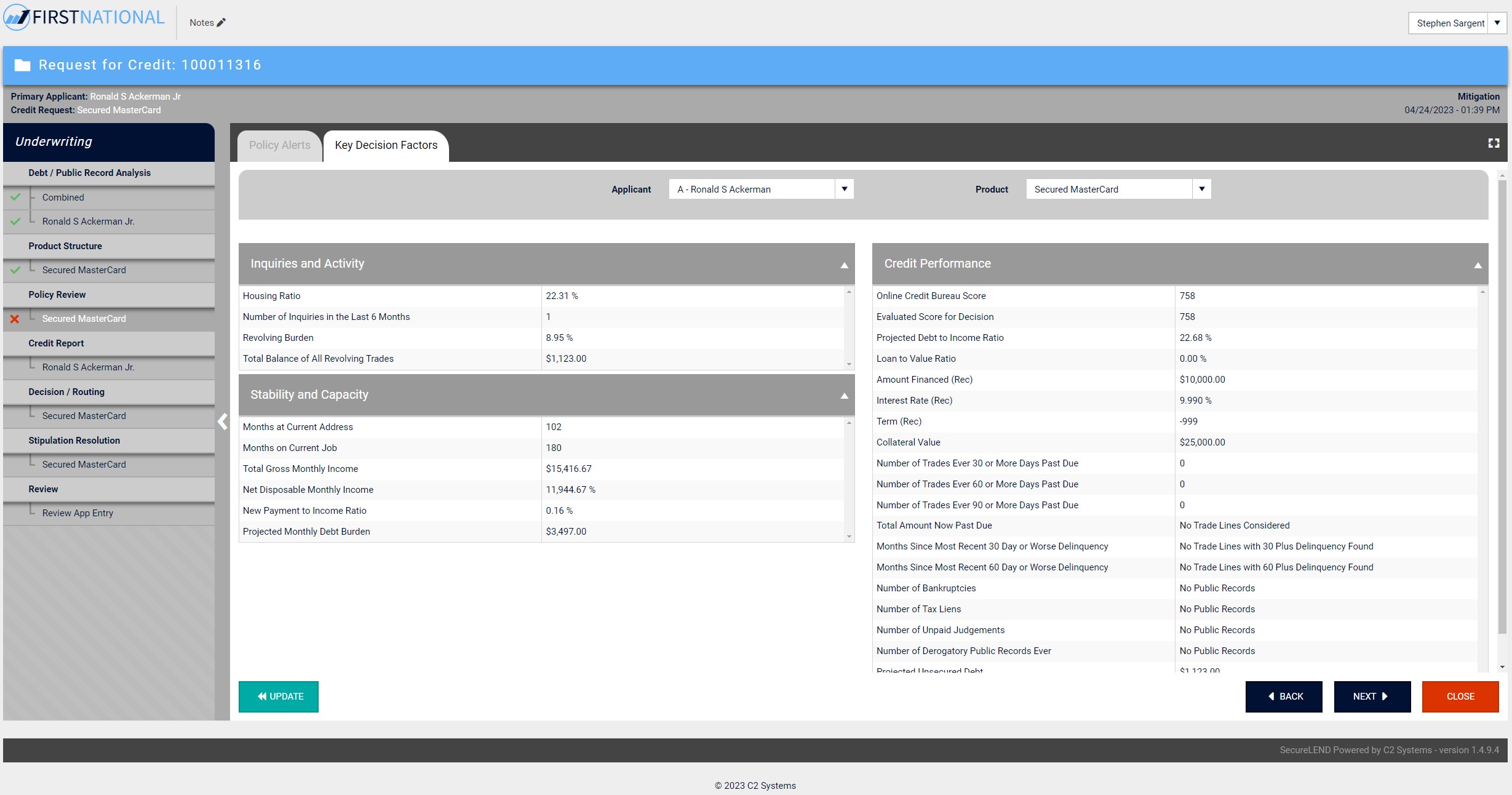

In underwriting, you’re able to configure all lending policies product by product. SecureLEND provides you with a set of tools for intelligent decision making, so you can get through underwriting as quickly as possible.

- Debt/Public Record Analysis

- Capacity Analysis

- Product Structure (commercial)

- Key Decision Factors

- Policy Alerts (commercial)

- Credit Decision (commercial)

- Stipulation Resolution (commercial)

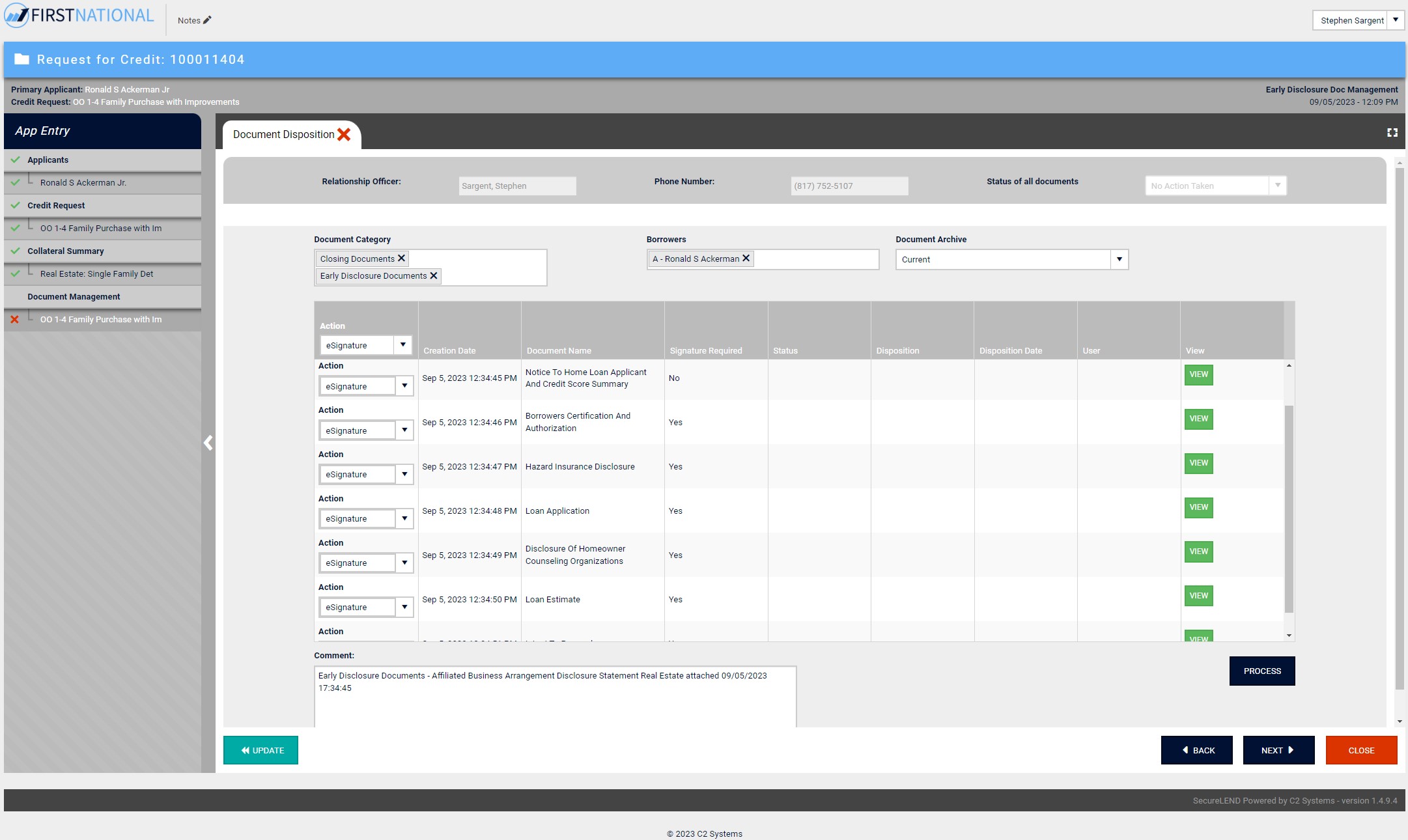

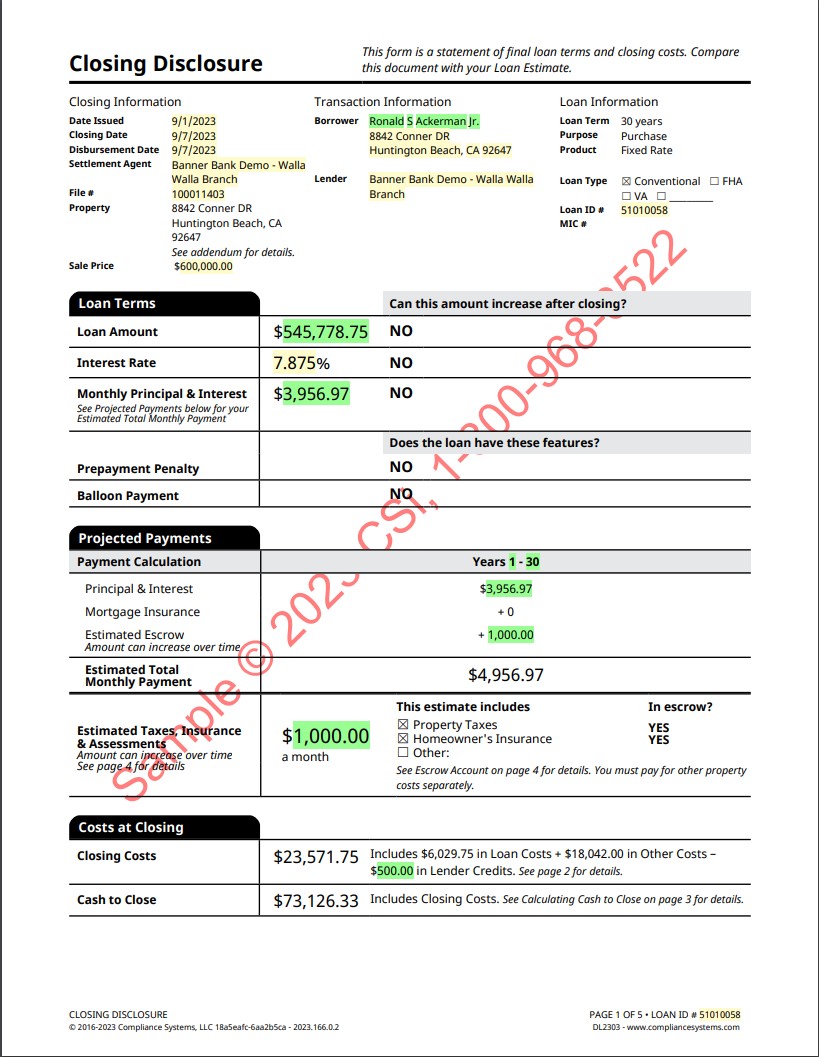

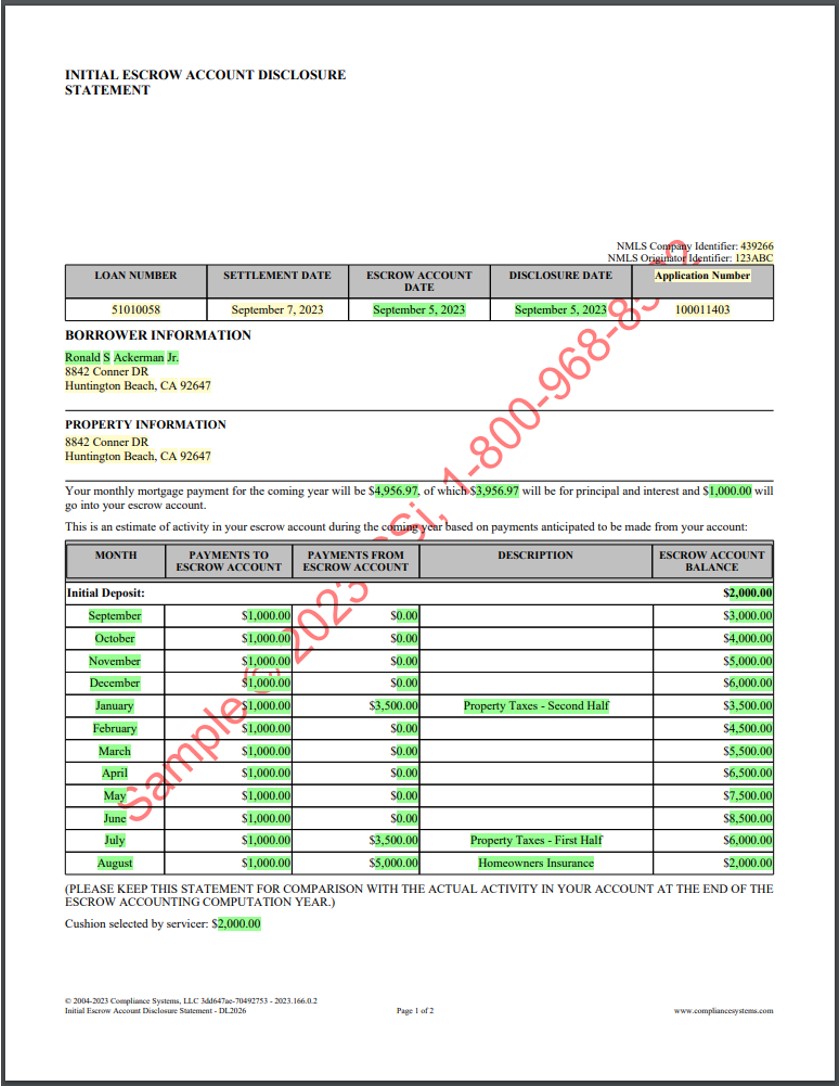

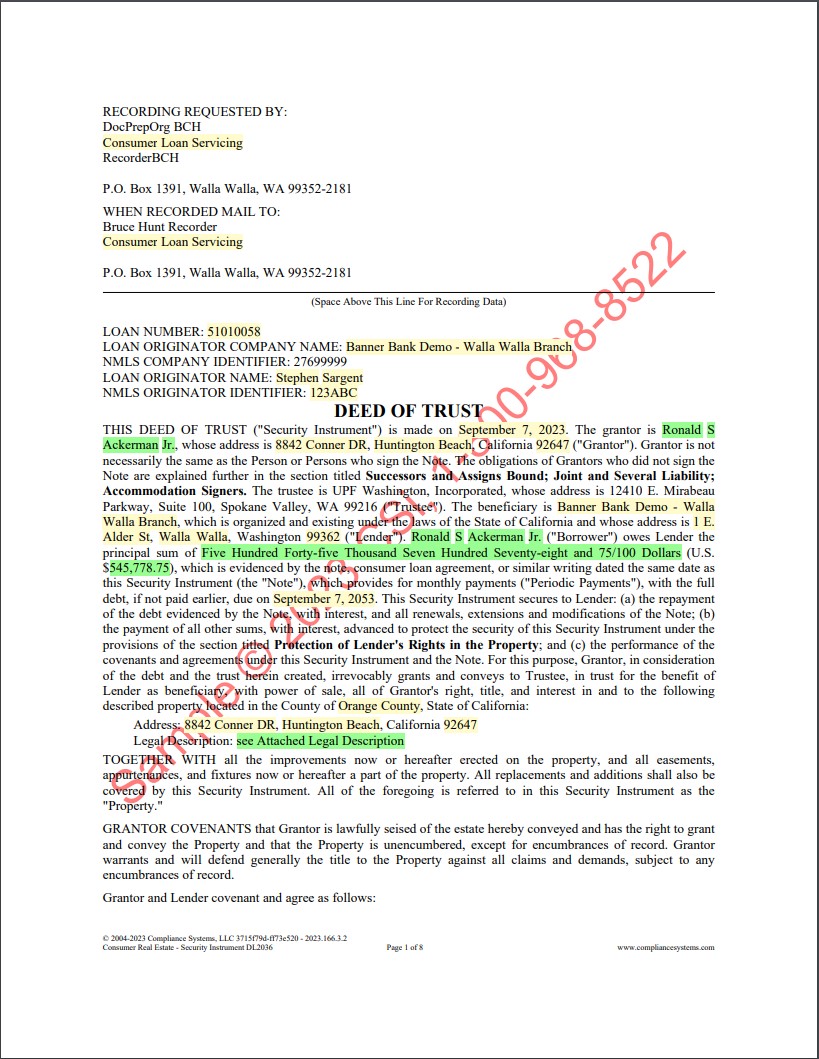

Document Preparation

With SecureLEND’s TruStage integration, you’re able to dynamically generate the necessary compliant documentation required for both early disclosure and closing doc packages, without ever leaving the platform.

Features include:

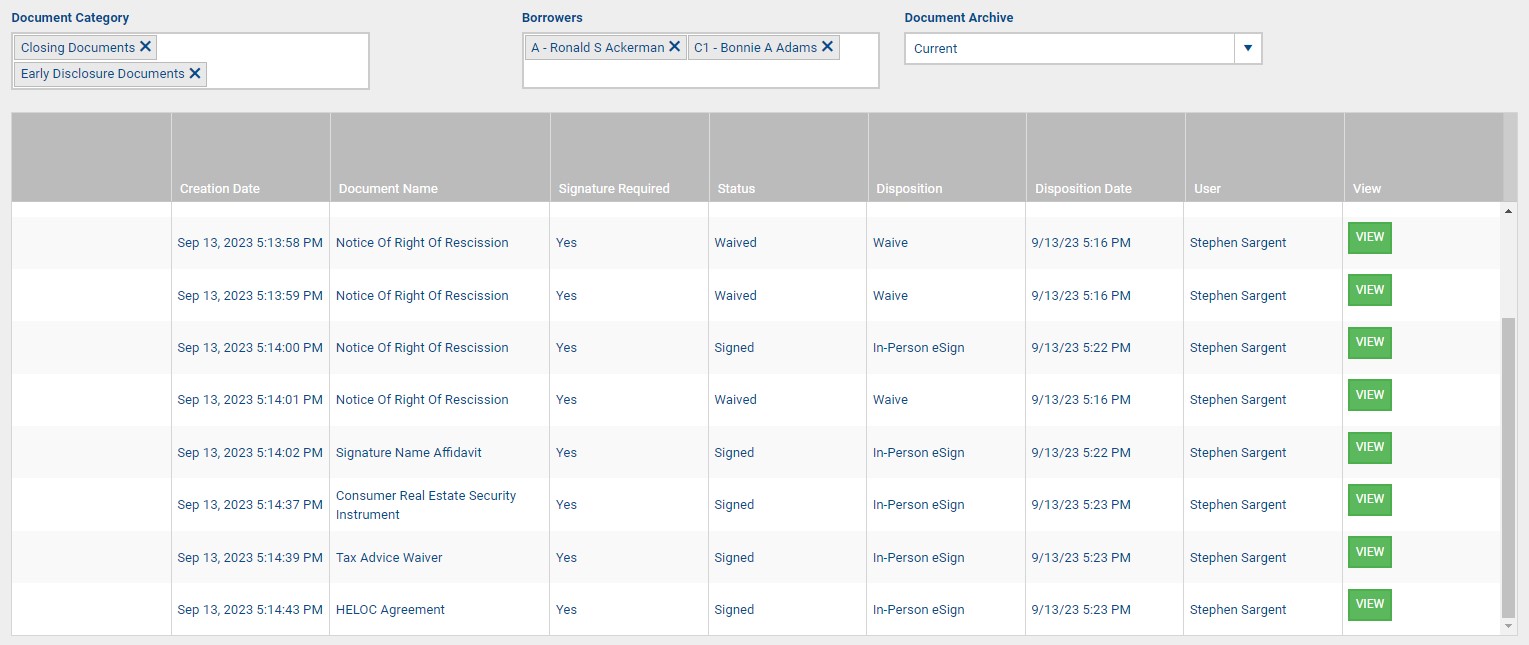

- Managing all documentation in one place

- Retrieving complete and compliant closing documents

- Viewing and printing documents on desktop, tablet, or mobile device

- The option to waive document inclusion from the closing package

- The option to send out documents for e-signature

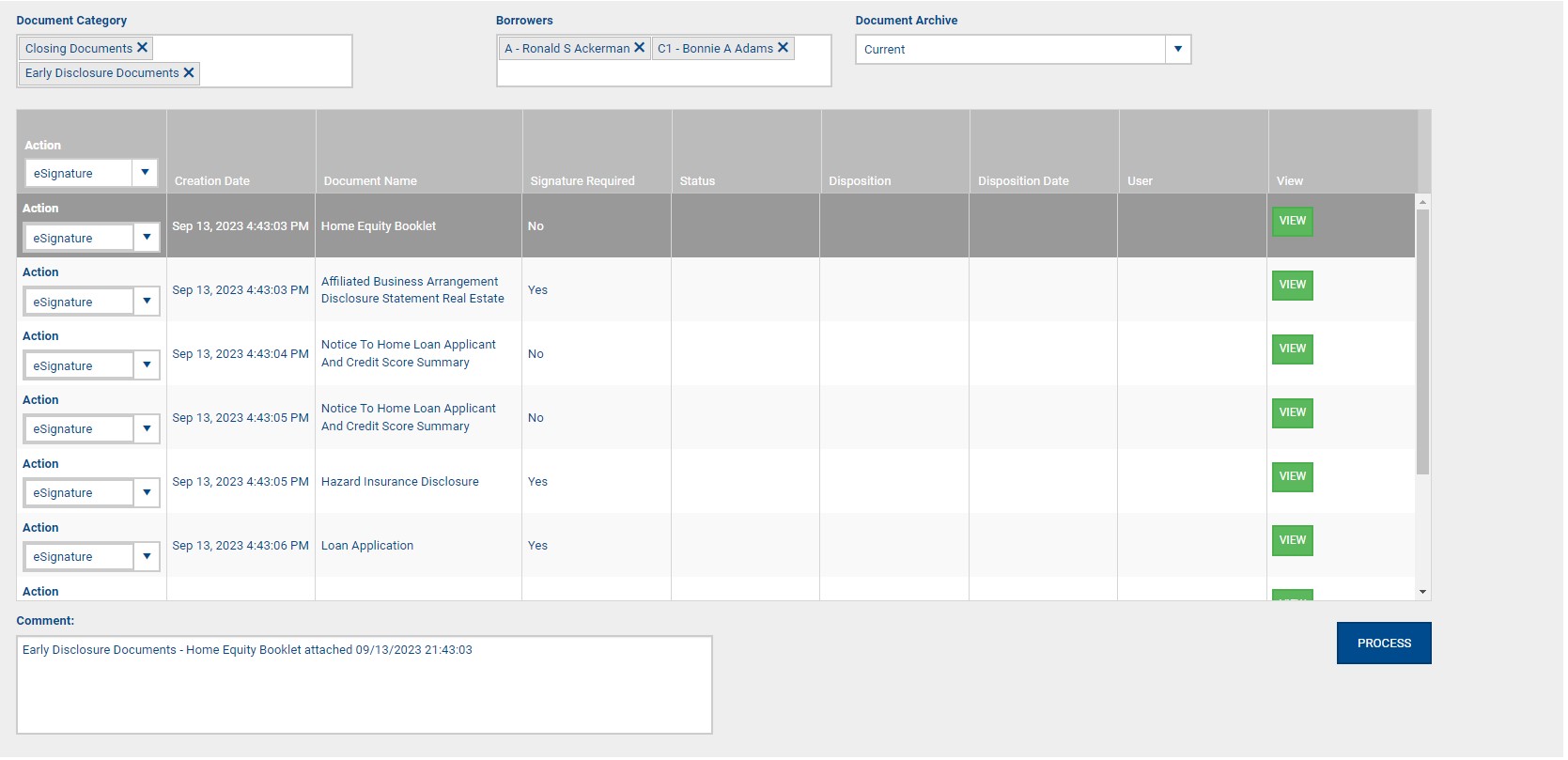

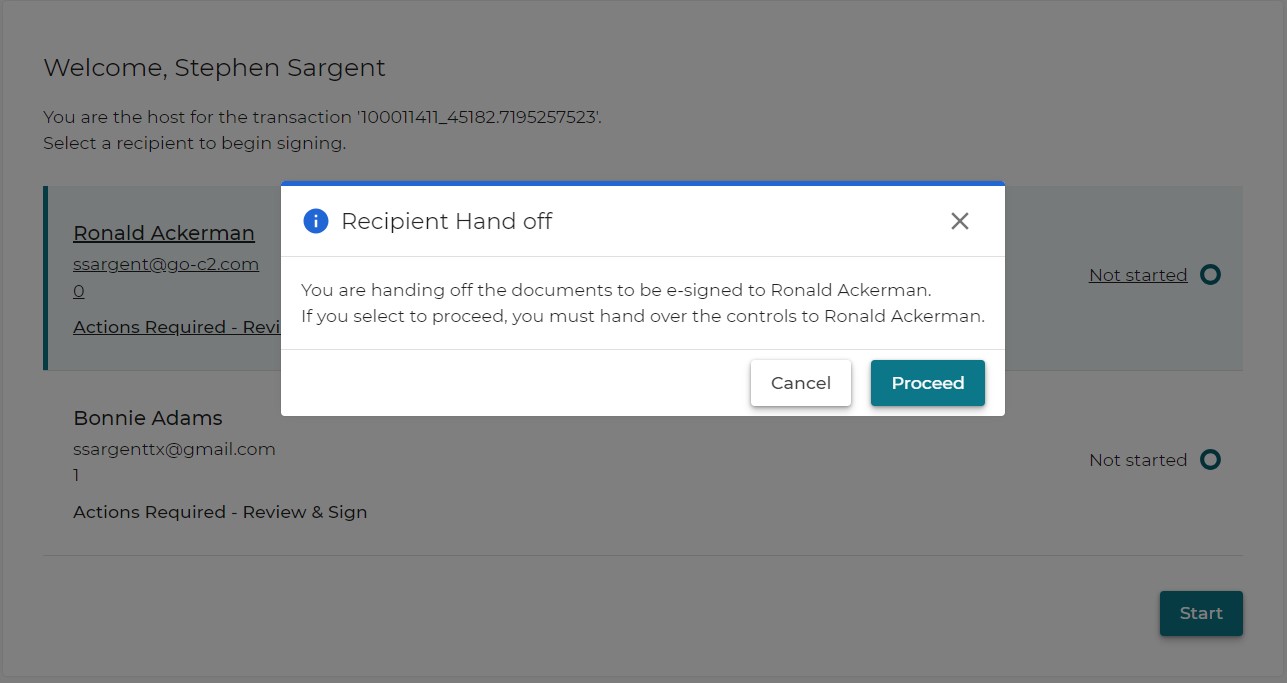

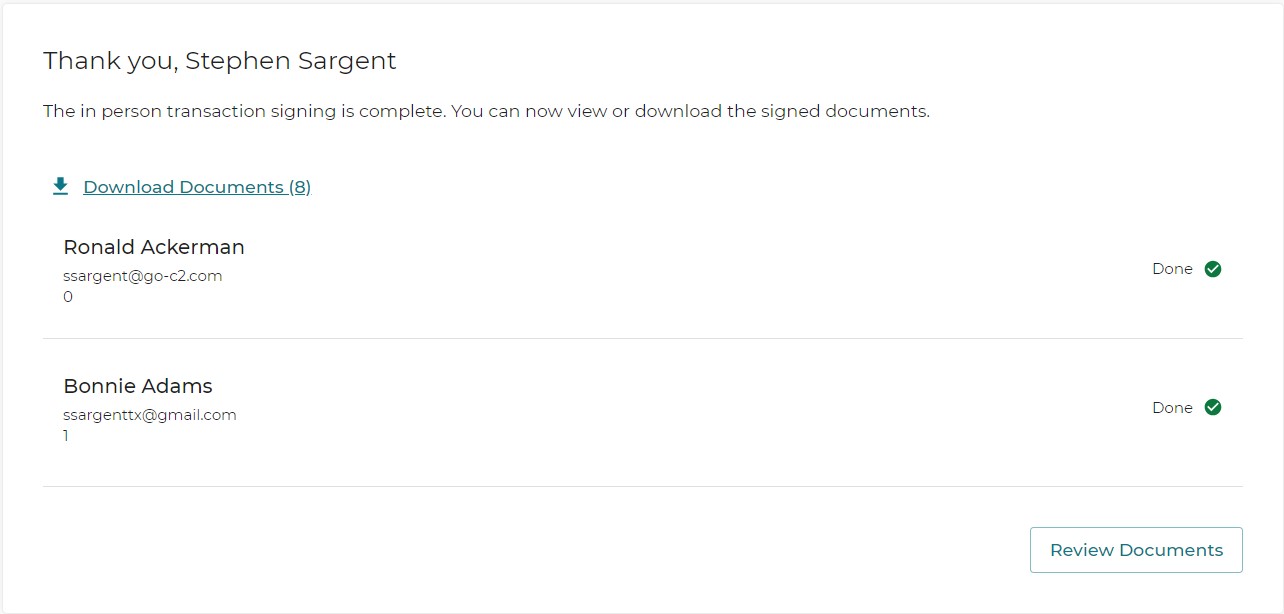

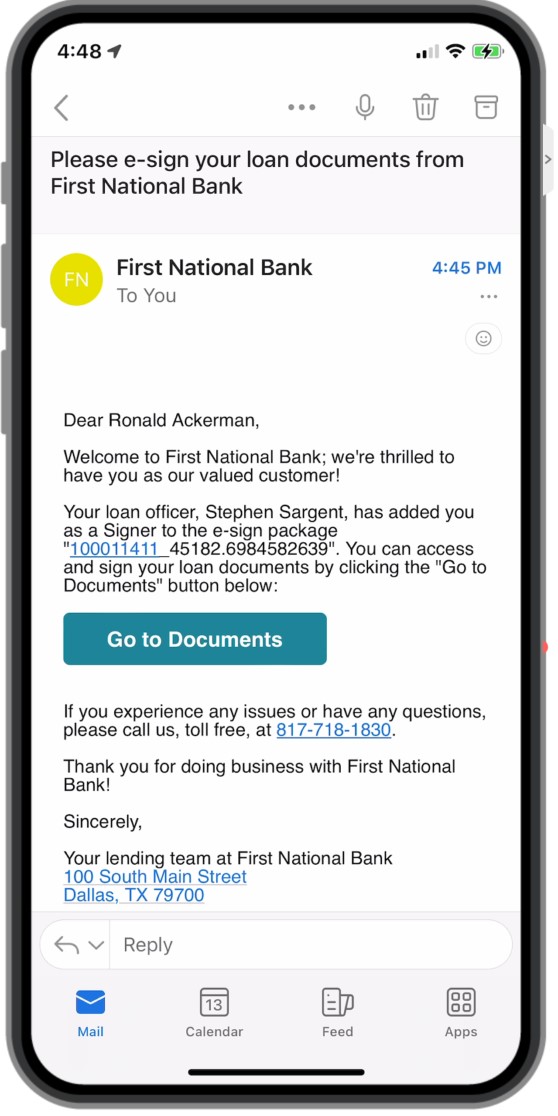

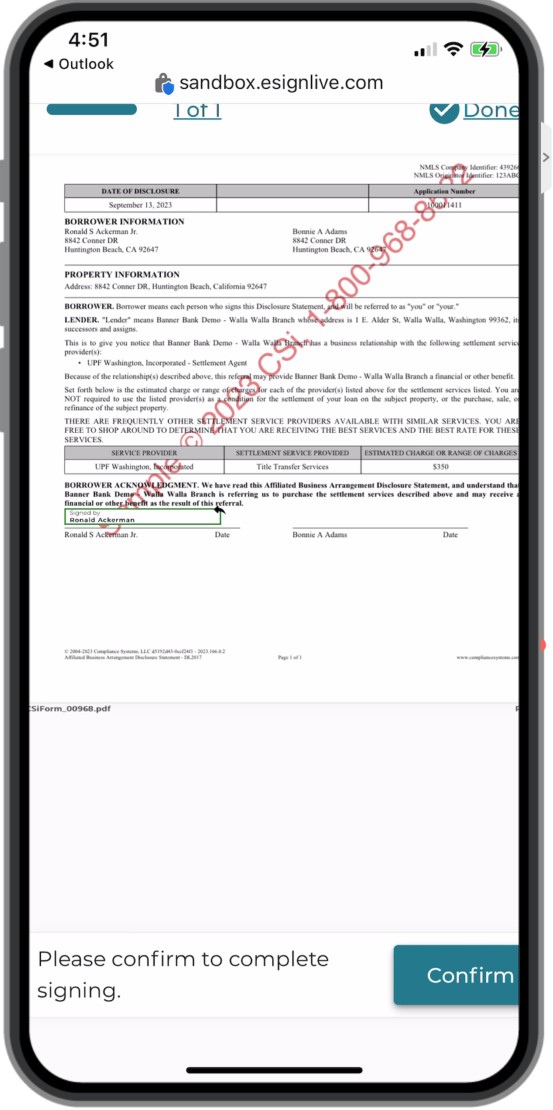

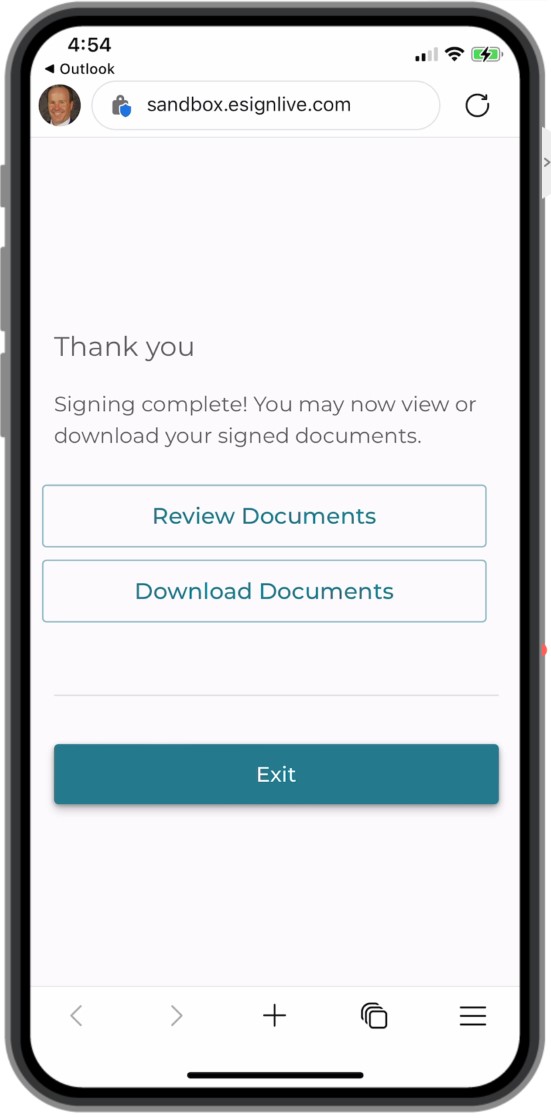

E-signature

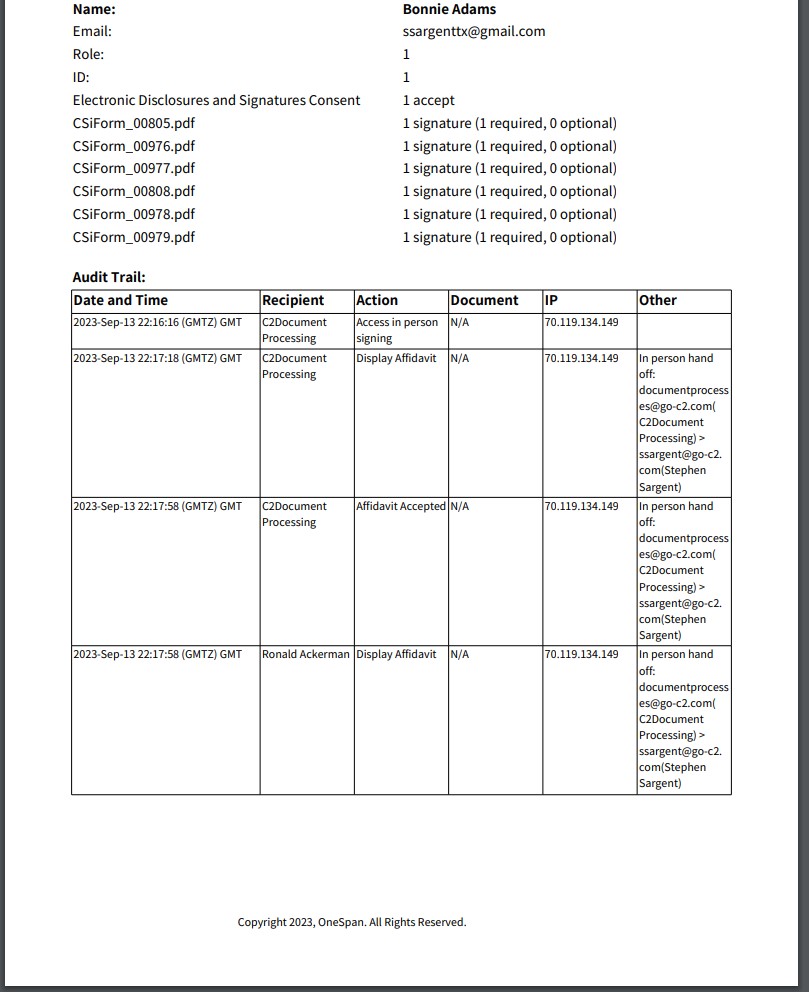

Bankers may use e-signature to keep track of all of documents that need a customer signature and finalize documentation in-branch or online. SecureLEND includes a dashboard where bankers can see all documents that their customer(s) need to complete and their completion status. They can also receive alerts when a customer has yet to sign the required documents.

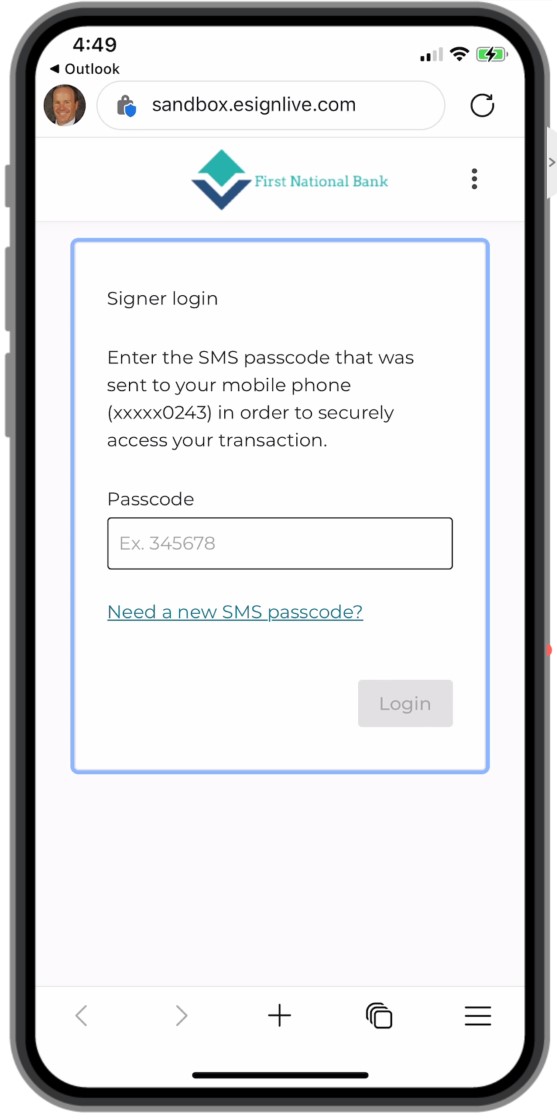

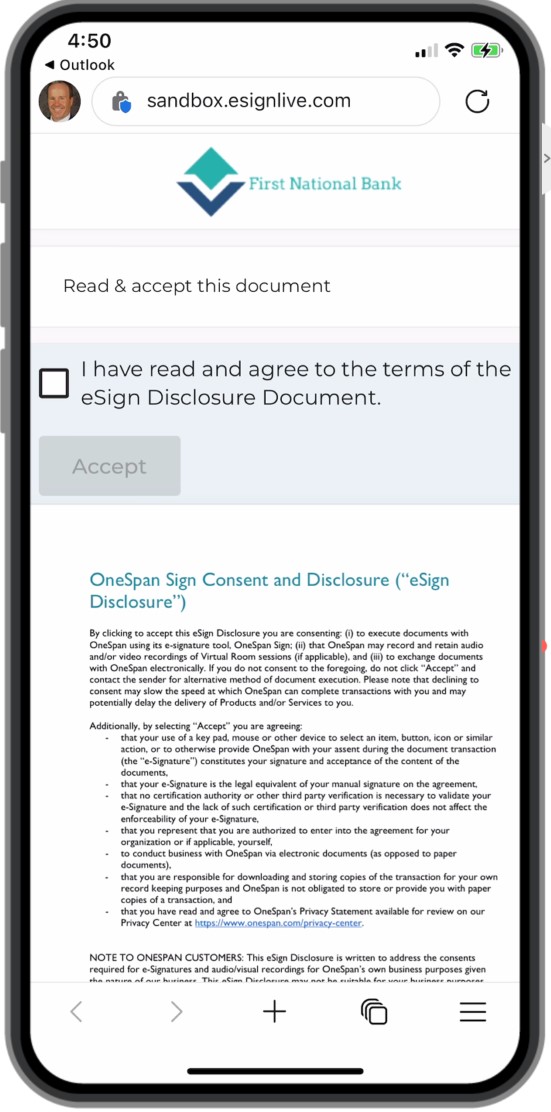

Customers receiving documents via email must authenticate their credentials and give consent before starting the e-signing process.

Features include:

- Using e-signature to manage and finalize customer documentation

- Staying compliant with e-signature audit documentation

- Presenting documents to your customers in-branch

- Sending documents to customers via encrypted email

Banker’s View

E-signature View

Plus! SecureLEND Is Integrated With Our i2Suite® Core Platform

SecureLEND is integrated with IBT Apps’ premier core platform, i2Suite, enabling bankers to create, update, and verify customer information while updating core in real-time. This not only boosts productivity, but it also minimizes human error, resulting in a more efficient, accurate, and reliable banking system. Moreover, this seamless core integration mitigates compliance risk, helping community banks meet and stay ahead of regulatory requirements and maintain a positive market reputation.

It’s Time to Simplify the Loan Process for Your Bank

Connect with us to discuss SecureLEND.